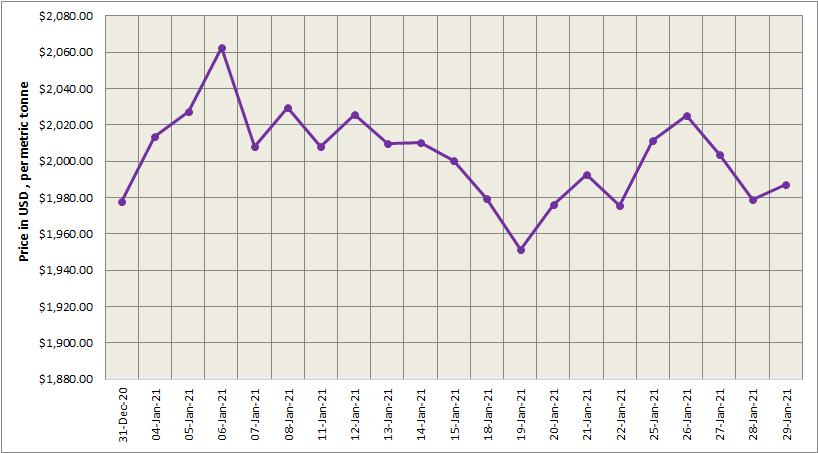

Three-month LME aluminium ended 0.23 per cent lower at US$ 1,977 per tonne last Friday, January 29, with open interest increasing 1,937 lots to 741,000 lots, and is likely to trade between US$ 1,990-2,050 per tonne today.

LME aluminium cash (bid) price and LME official settlement price climbed by US$ 8 per tonne to stand at US$ 1987 per tonne on Friday, January 29, following a downfall from US$ 2003.50 per tonne to US$ 1987 per tonne on January 28. 3-months bid price and 3-months offer price stood at US$ 1987.50 per tonne, up by US$ 9 per tonne from US$ 1978.50 per tonne. Dec 21 bid price and Dec 21 offer price hovered around US$ 2061 per tonne, growing by US$ 6.5 per tonne.

The LME aluminium opening stock increased to 1431050 tonnes from 1424175 tonnes. Live Warrants totalled 1179500 tonnes, while Cancelled Warrants at 251550 tonnes.

LME aluminium 3-months Asian Reference Price came in at US$ 1995.35 per tonne.

SHFE Aluminium Price Trend

Benchmark aluminium price for SHFE jumped to stand at US$ 2352 per tonne on Monday, February 1, marking the second consecutive day of hike.

The most-liquid SHFE 2103 aluminium contract finished the day 1.32 per cent higher at RMB 15,005 per tonne. Open interest fell 8 lots to 164,633 lots. Short-term impact of spot on futures will be monitored. It is estimated that the contract will fluctuate between RMB 14,930-15,030 per tonne tonight.

The most-active SHFE 2103 aluminium contract ended 1.54 per cent higher at RMB 15,160 per tonne last Friday night, with open interest increasing 7,237 lots to 172,000 lots, and is expected to move between RMB 14,800-15,200 per tonne today, while spot premiums will be seen at RMB 10-60 per tonne.

Responses