LME aluminium price dives by 0.53% on Thursday, down 17.3% in twelve months; SHFE aluminium gains US$14/t

LME aluminium opened at US$2237 per tonne yesterday, with its high and low at US$2248 per tonne and US$2222 per tonne, respectively, before closing at US$2248 per tonne, up 0.11 per cent.

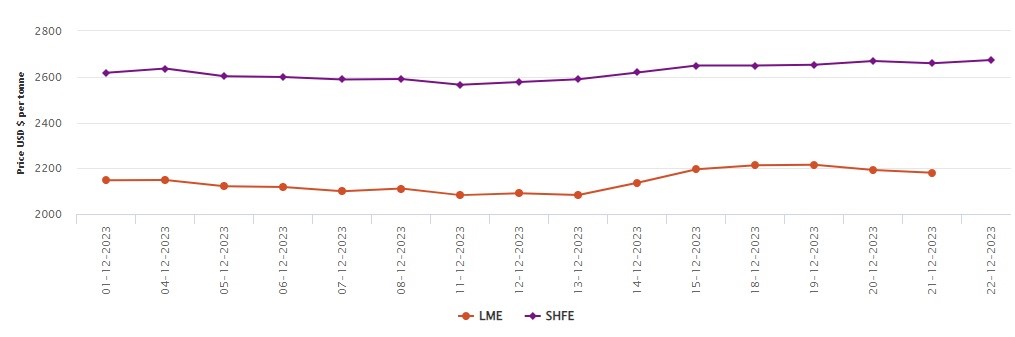

{alcircleadd}On December 21, the LME aluminium live price chart showed descending price trends. The LME aluminium cash bid price and the LME aluminium official price dampened by US$12.50 per tonne or 0.57 per cent and US$12 per tonne or 0.53 per cent to officially close at US$2,179 per tonne and US$2,180 per tonne.

The highest recorded hike of the year was on January 18, when the LME aluminium price stood at US$2,636 per tonne. In a matter of eight months, the aluminium price fell by 21.53 per cent to US$2,068.50 per tonne on August 21, the lowest recorded rate of the year. On December 11, the aluminium price marked a similar slumped rate of US$2,082.50 per tonne, projecting very little chance of recovery. On a 12-month scale, we can see a drop of 17.3 per cent.

December is the slowest month of the year in terms of world trade and economics due to the prevailing Christmas Holiday season. But this year, there was a serious geo-political crisis that resulted in sluggish market growth, taking its toll on the aluminium industry globally. Aluminium prices had to face a minor plunge due to oversupply and the subsequent overloading of LME warehouses. Moreover, China and Europe have narrowed their interest in aluminium consumption.

The London Metal Exchange graph flashed that the 3-month bid price and the 3-month offer price decreased by US$11 per tonne or 0.49 per cent and US$10.50 per tonne or 0.47 per cent, stopping at US$2,232 per tonne and US$2,233 per tonne, respectively.

The December 24 bid price and the December 24 offer price lowered down to US$2,348 per tonne and US$2,353 per tonne, losing US$12 per tonne or 0.51 per cent.

LME aluminium opening stock negated 1,650 tonnes or 0.32 per cent, officially resting at 508,150 tonnes. Live warrants stood at 285,350 tonnes, ascending by 1,975 tonnes or 0.7 per cent. Cancelled warrants halted at 222,800 tonnes, plunging by 3,625 tonnes or 1.6 per cent.

LME aluminium 3-month Asian Reference Price settled at US$2,247.45 per tonne, down US$26.96 per tonne or 1.18 per cent.

SHFE aluminium price

Today, on December 22, the Shanghai Futures Exchange (SHFE) aluminium price chart marked a spike of US$14 per tonne or 0.53 per cent to close at US$2,673 per tonne.

Overnight, the most-traded SHFE 2401 aluminium contract opened at RMB 18980 per tonne, with its low and high at RMB 18980 per tonne and RMB 19045 per tonne before closing at RMB 19025 per tonne, down RMB 10 per tonne or 0.05 per cent.

SHFE 2307 aluminium added RMB 595 per tonne or 3.38 per cent to RMB 18,185 per tonne. The open interest fell 11,785 lots to 256,640 lots.

This news is also available on our App 'AlCircle News' Android | iOS

.png/0/0)