LME aluminium opened at US$2,488 per tonne on Thursday and dropped to a low of US$2,460 per tonne, but then returned to US$2,500 per tonne and finally closed at US$2,507 per tonne, ending a six-day losing streak.

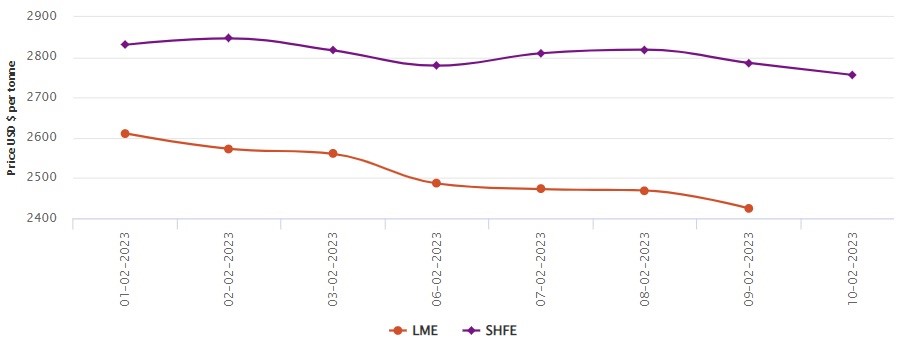

On Thursday, February 9, both LME aluminium cash bid price and LME aluminium official settlement price dropped by US$44.5 per tonne or 1.80 per cent to close at US$2,424 per tonne and US$2,424.50 per tonne.

The 3-month bid price and 3-month offer price slumped by US$42 per tonne or 1.67 per cent and US$41 per tonne or 1.63 per cent to peg at US$2,465 per tonne and US$2,467 per tonne.

December 24 bid price and December 24 offer price slipped by US$40 per tonne or 1.49 per cent to clock at US$2,638 per tonne and US$2,643 per tonne.

LME aluminium opening stock settled at 490550 tonnes. Live warrants and Cancelled warrants halted at 329300 tonnes and 161250 tonnes.

LME aluminium 3-month Asian Reference Price descended by US$44.01 per tonne or 1.73 per cent to come in at US$2,485.38 per tonne.

SHFE aluminium price

On February 10, the SHFE aluminium benchmark price decreased by US$30 per tonne or 1.07 per cent, stopping at US$2,756 per tonne.

The most-traded SHFE 2303 aluminium closed down 0.94 per cent or RMB 180 per tonne at RMB 18,930 per tonne, with open interest down 8,194 lots to 185,053 lots.

The most-traded SHFE 2303 aluminium contract opened at RMB 18,930 per tonne overnight and moved around RMB 19,000 per tonne, showing a cross-star pattern at the end of the session.

Responses