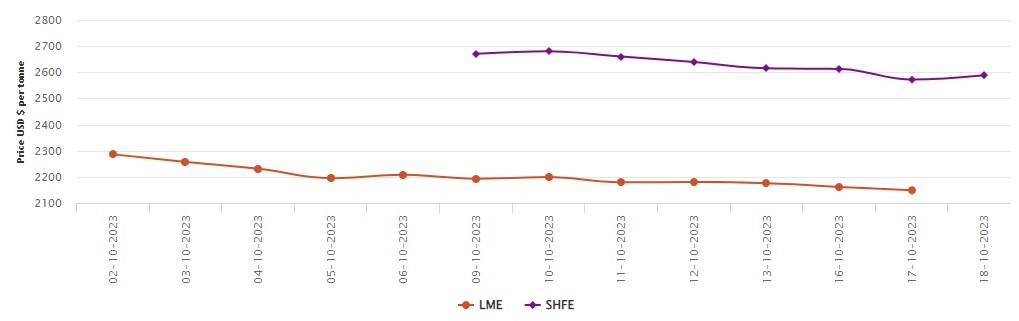

LME aluminium opened at US$2,183.5 per tonne on Tuesday, with its high and low at US$2,186 per tonne and US$2,158.5 per tonne, respectively, before closing at US$2,177 per tonne, a decrease of US$4 per tonne or 0.18 per cent.

On Tuesday, October 17, both LME aluminium cash bid price and LME aluminium official settlement price dropped by US$13 per tonne or 0.60 per cent to close at US$2,148 per tonne and US$2,148.50 per tonne.

As per the London Metal Exchange (LME) data, both 3-month bid price and 3-month offer price slipped by US$21 per tonne or 0.95 per cent to clock at US$ 2,170 per tonne and US$2,170.50 per tonne.

December 24 bid price and December 24 offer price fell by US$18 per tonne or 0.77 per cent to rest at US$2,297 per tonne and US$2,302 per tonne. LME aluminium opening stock closed at 484600 tonnes. Live warrants and Cancelled warrants settled at 193350 tonnes and 193350 tonnes.

LME aluminium 3-month Asian Reference Price also slipped by US$32.21 per tonne or 1.46 per cent to peg at US$2,171.50 per tonne.

SHFE aluminium price

On October 18, today, the Shanghai Futures Exchange (SHFE) aluminium price recorded a growth of US$17 per tonne or 0.66 per cent to reach US$2,589 per tonne.

Overnight, the most-traded SHFE 2311 aluminium contract opened at RMB 18,820 per tonne, with its lowest and highest at RMB 18,885 per tonne and RMB 18,790 per tonne before closing at RMB 18,880 per tonne, up RMB 100 per tonne or 0.53 per cent compared with the previous trading day.

Responses