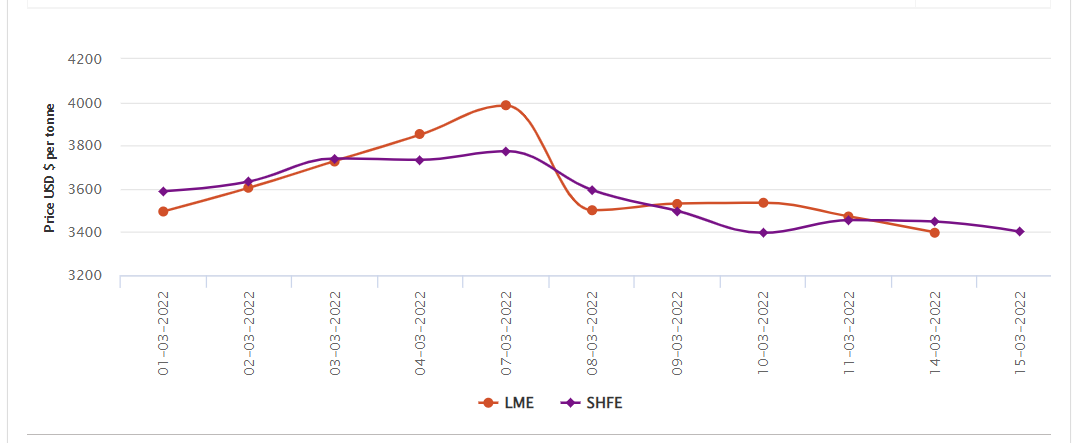

Three-month LME aluminium opened at US$3,497 per tonne on Monday, March 14, and closed at US$3,315 per tonne, down by US$165 per tonne or 4.74 per cent.

On Monday, March 14, LME aluminium prices continued to decline for the second day in a row, based on the anticipation of stock release in the market. On March 13, Hydro confirmed 4000 tonnes of Russian aluminium to arrive at its Karmøy facility. On the said date, LME aluminium cash bid price fell by US$72 per tonne or 2.07 per cent to stand at US$3,398 per tonne, while LME aluminium official settlement price decreased by US$73 per tonne or 2.10 per cent to settle at US$3,399 per tonne. 3-month bid price and 3-month offer price plunged by US$89.5 per tonne and US$89 per tonne to peg at US$3,410 per tonne US$3,411 per tonne, respectively. December 23 bid price and December 23 offer price also stood lower at US$3,205 per tonne and US$3,210 per tonne.

LME aluminium opening stock came in at 752850 tonnes. Live warrants decreased to 475175 tonnes, while Cancelled warrants grew to 277675 tonnes.

LME aluminium 3-month Asian Reference Price recorded no exception but a fall of US$41.2 per tonne to stand at US$3,459.50 per tonne.

SHFE aluminium price

On Tuesday, March 15, the benchmark aluminium price for SHFE has also registered a downfall for the second consecutive day by 1.36 per cent to US$3,401 per tonne.

The most-traded SHFE 2204 aluminium closed down 0.32 per cent or RMB 70 per tonne to come in at RMB 21,855 per tonne, with open interest down 10,568 lots to 150,311 lots.

Overnight, the most-traded SHFE 2204 aluminium contract opened at RMB 21,800 per tonne, with the highest and lowest prices at RMB 21,885 per tonne and RMB 21,655 per tonne before closing at RMB 21,730 per tonne, down RMB 175 per tonne or 0.8 per cent.

Responses