LME aluminium opened at US$2,219 per tonne last Friday, with its low and high at US$2,209 per tonne and US$2,265 per tonne, respectively, before closing at US$2,243 per tonne, up US$29 per tonne or 1.31 per cent.

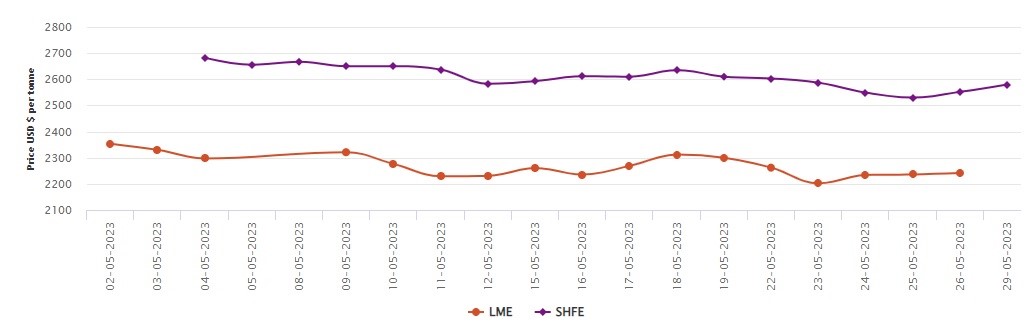

On May 26, Friday, the LME aluminium cash bid price and the LME aluminium official settlement price halted at US$2,241 per tonne and US$2,242 per tonne, rising by US$6 per tonne or 0.27 per cent. In May, the LME aluminium price index hovered around the average range of US$2,353 per tonne (May 2) and US$2,202 per tonne (May 23). On a year-on-year basis, the aluminium spot price has slumped by US$583.50 per tonne or 20.65 per cent from US$2,825.50 per tonne (May 26 2022) to US$2,242 per tonne last week.

The 3-month bid price, with an US$11.50 per tonne or 0.52 per cent hike, rested at US$2,237 per tonne, and the 3-month offer price jumped up by US$12 per tonne or 0.54 per cent, officially settling at US$2,238 per tonne.

December 24 bid price and December 24 offer price both have escalated by US$10 per tonne or 0.42 per cent to stop at US$2,400 per tonne and US$2,405 per tonne, respectively.

LME aluminium opening stock witnessed an addition of 0.75 per cent or 4,300 tonnes from May 25, officially closing at 579,775 tonnes.

Live warrants read 396,175 tonnes, with a slump of 2,025 tonnes or 0.51 per cent. Cancelled warrants halted at 183,600 tonnes after being boosted by 6,325 tonnes or 3.57 per cent.

The 3-month Asian Reference Price arrived at US$2,259.70 per tonne, with a gain of US$53.54 per tonne or 2.43 per cent.

In terms of the big picture, a simpler version of the US debt ceiling agreement was established. Furthermore, economic indicators such as US GDP and employment data in the first quarter suggest that the US economy has remained resilient, leading to overall positive market sentiment.

SHFE aluminium price

On May 29, today, SHFE aluminium price has earned US$28 per tonne or 1.1 per cent, officially closing at US$2,580 per tonne.

The low inventory of aluminium ingots, coupled with the unlikely chance of smelters in Yunnan resuming production anytime soon, will likely boost aluminium prices. However, subdued demand during the off-season will prevent aluminium prices from skyrocketing.

The most-traded SHFE 2307 aluminium contract opened at RMB 18,110 per tonne at last Friday’s night session, with its low and high at RMB 18,060 per tonne and RMB 18,180 per tonne before closing at RMB 18,155 per tonne, up RMB 295 per tonne or 1.65 per cent.

SHFE 2307 aluminium added RMB 595 per tonne or 3.38 per cent to RMB 18,185 per tonne. The open interest fell from 11,785 lots to 256,640 lots.

Responses