The London Metal Exchange (LME) aluminium prices significantly surged on Wednesday, December 27, as trade resumed after the Christmas break. Three-month aluminium on the London Metal Exchange (LME) climbed 0.8 per cent to $2,345 per tonne in official open-outcry trading after reaching its highest since May 2 at US$2,382 per tonne.

Reason for the price hike

The increase in aluminium prices was attributed to purchases made by Commodity Trade Advisor (CTA) investment funds, which are influenced mainly by computer algorithms, according to a trader. Base metals prices hiked in London on Wednesday, boosted by increases in industrial profit in top metals user China. At the same time, aluminium hit an eight-month high due to technical buying and supply worries.

LME aluminium price

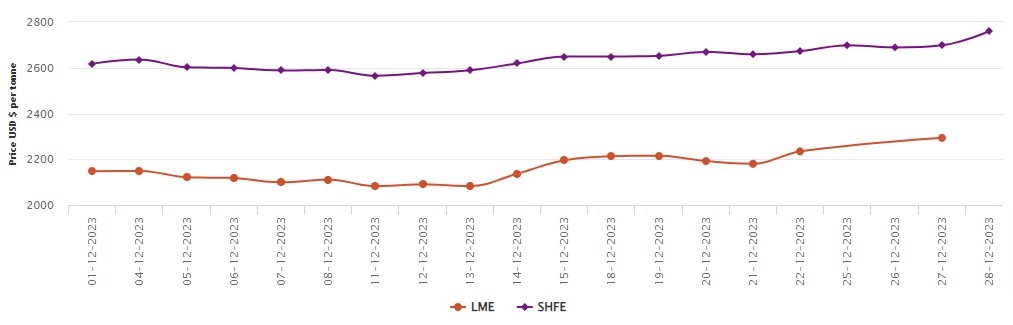

As per the LME aluminium price graph, both Cash bid price and official settlement price expanded by US$59 per tonne or 2.64 per cent to settle at US$2,293 per tonne and US$2,293.50 per tonne. LME aluminium 3-month bid price and 3-month offer price also witnessed an upswing of US$66 per tonne or 2.89 per cent to settle at US$2,345 per tonne and US$2,346 per tonne.

December 24 bid price and December 24 offer price heightened by US$62 per tonne or 2.58 per cent to score at US$2,457 per tonne and US$2,462 per tonne. LME aluminium opening stock came in at 523725 tonnes. Live warrants and Cancelled warrants closed at 328775 tonnes and 194950 tonnes.

LME aluminium 3-month Asian Reference Price hiked by US$54.33 per tonne or 2.39 per cent to peg at US$2,317.11 per tonne.

SHFE aluminium price

On Monday, December 28, the Shanghai Futures Exchange (SHFE) aluminium price expanded by US$62 per tonne or 2.29 per cent to reside at US$2,760 per tonne.

Responses