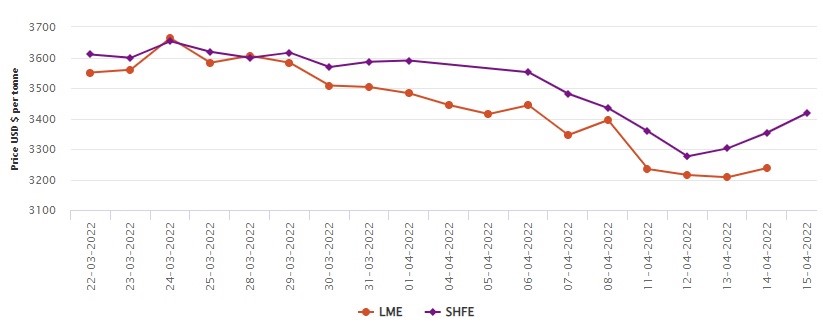

LME aluminium price moves up on graph to US$3237.5/t; SHFE gains 1.9% to stop at US$3418/t

LME aluminium opened at US$3,257 per tonne on Thursday and closed at US$3,299 per tonne, down US$42 per tonne or 1.29 per cent.

LME aluminium cash bid price stood at US$3,237 per tonne and LME aluminium official settlement price halted at US$3,237.50, gaining 1 per cent and 0.95 per cent respectively, if compared with the records of Wednesday.

3-month bid price of aluminium rose by US$27.50 per tonne or 0.85 per cent to rest at US$3,265 per tonne. 3-month offer price also faced the same percentage of hike to settle at US$3,266 per tonne.

According to Thursday’s LME official price chart, December 23 bid price stood at US$3,130 per tonne and December23 offer price at US$3,135, both witnessing an elevation of 0.32 per cent or US$10.

LME aluminium opening stock went low from 612,275 tonnes to 608,000 tonnes as recorded on 14th April. Live warrants totalled 391,550 tonnes recording a fall of 5,125 tonnes, while Cancelled warrants increased by 850 tonnes or 0.39 per cent to close at 216,450 tonnes.

The LME aluminium 3-month Asian Reference Price dropped by 0.85 per cent or US$27.88 to stop at US$3252.62 per tonne.

SHFE aluminium price

On Friday, 15th April, the benchmark aluminium price for SHFE has built up by US$64 per tonne or 1.9 per cent to stand at US$3,418 per tonne.

The most-traded SHFE 2205 aluminium contract opened at RMB 21,495 per tonne overnight and rose to RMB 21,765 per tonne before closing at RMB 21,730 per tonne, up RMB 370 per tonne or 1.73 per cent.

The most-traded SHFE 2205 aluminium closed up 1.42 per cent or RMB 300 per tonne to RMB 21,440 per tonne, with open interest down 10,208 lots to 167,560 lots.

This news is also available on our App 'AlCircle News' Android | iOS

.png/0/0)