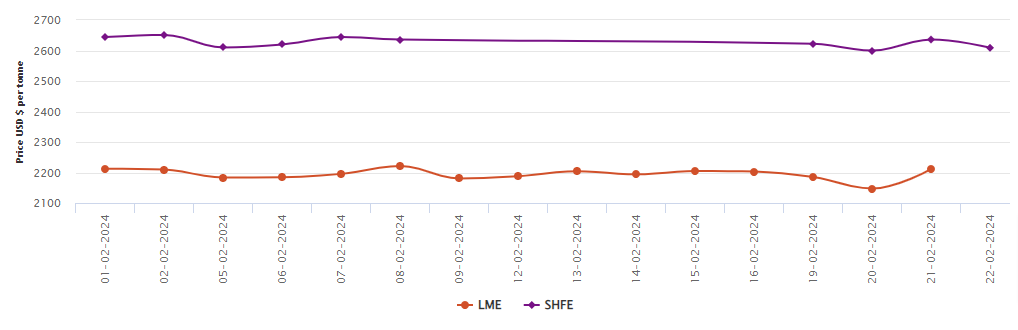

LME aluminium opened at US$2,227 per tonne on Wednesday, with its low and high at US$2,216 per tonne and US$2,269 per tonne respectively before closing at US$2,220.5 per tonne, up 1.23 per cent.

On Wednesday, February 21, both LME aluminium cash bid price and LME aluminium official settlement price moved northward. Prices surged amid speculation that a new round of US sanctions against Russia could target metal industries, potentially disrupting supply chains.

As per the data, both LME aluminium cash bid price and LME aluminium official settlement price surged by US$64 per tonne or 2.98 per cent to score at US$2,211 per tonne and US$2,211.50 per tonne.

3-month bid price and 3-month offer price skyrocketed by US$70 per tonne or 3.20 per cent and US$70.5 per tonne or 3.22 per cent to halt at US$2,253 per tonne and US$2,254 per tonne. On the same day, December 25 bid price and December 25 offer price hiked by US$63 per tonne to stop at US$2,463 per tonne and US$2,468 per tonne.

LME aluminium opening stock came in at 562125 tonnes. Live warrants and Cancelled warrants stood at 378025 tonnes and 184100 tonnes. LME aluminium 3-month Asian Reference Price gained US$62.24 per tonne or 2.84 per cent to halt at US$2,250.76 per tonne.

SHFE aluminium price

Today, on February 22, the SHFE aluminium price on the other hand declined by US$27 per tonne or 1.02 per cent to arrive at US$2,609 per tonne. Overnight, the most-traded SHFE 2404 aluminium contract opened at RMB 18,960 per tonne, with high and low at RMB 18,975 per tonne and RMB 18,805 per tonne before closing at RMB 18,825 per tonne, down 0.34 per cent.

Responses