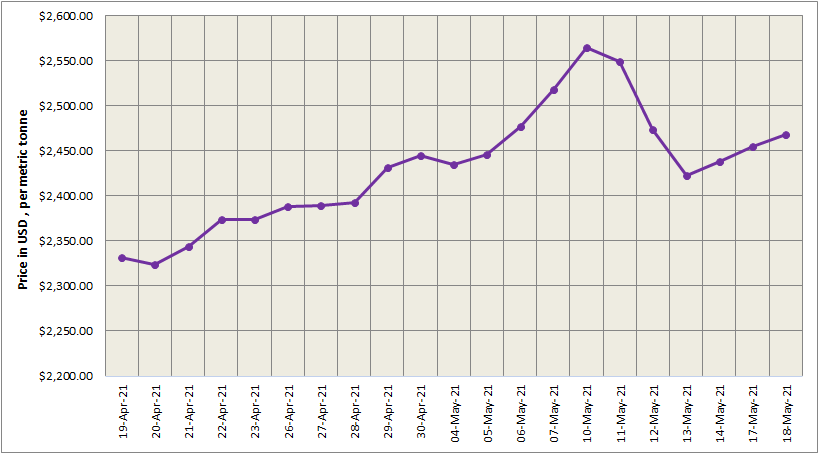

Three-month LME aluminium fell 1.22 per cent to close at US$ 2,466 per tonne on Tuesday, May 18. As the US dollar index continued to weaken in the near term, it is expected that LME aluminium will try to continue to repair the recent decline today. It is expected to trade between US$ 2,450-2,550 per tonne today.

LME aluminium cash (bid) price and LME official settlement price grew for the third day in a row by US$ 13 per tonne or 0.53 per cent to come in at US$ 2,468 per tonne on Tuesday, May 18. 3-months bid price and 3-months offer price increased by US$ 19.50 per tonne from US$ 2,479 per tonne to US$ 2,498.50 per tonne. Dec 22 bid price and Dec 22 offer price stood at US$ 2,486 per tonne on Tuesday compared to US$ 2,464.50 per tonne on Monday, May 17.

The LME aluminium opening stock decreased from 1768375 tonnes on May 17 to 1765525 tonnes on May 18. Live Warrants totalled 1221325 tonnes, while Cancelled Warrants stood at 544200 tonnes.

LME aluminium 3-months Asian Reference Price climbed US$ 27.17 per tonne to close at US$ 2,503.82 per tonne on May 18.

SHFE Aluminium Price Trend

Benchmark aluminium price for SHFE edge US$ 33 per tonne or 1.07 per cent lower on Wednesday, May 19, to stand at US$ 3,051 per tonne.

The most-active SHFE 2106 aluminium contract gained 0.46 per cent to close the day at RMB 19,715 per tonne, with open interest decreasing 19,908 lots to 151,000 lots.

The most-liquid SHFE 2107 aluminium contract fell 0.61 per cent to settle at RMB 19,545 per tonne on Tuesday night, and is likely to trade between RMB 19,500-19,800 per tonne today. It is expected that the contract will keep fluctuating at high today.

Responses