LME aluminium opened at US$2,305 per tonne in the previous trading day, with its high and low at US$2,331 per tonne and US$2,294 per tonne respectively before closing at US$2,326.5 per tonne, up US$17.5 per tonne or 0.76 per cent.

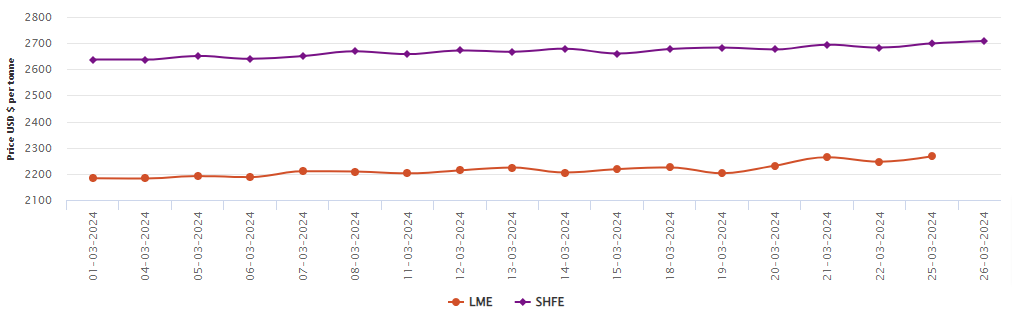

Aluminium prices surged to an 11-week high on Monday due to worries about a sluggish recovery in production in China's Yunnan province. This increase was further bolstered by a positive technical outlook. On Monday, March 25, both LME aluminium cash bid price and LME aluminium official settlement price hiked by US$21 per tonne or 0.93 per cent to settle at US$2,267 per tonne and US$2,267.50 per tonne.

As per the LME price graph, both 3-month bid price and 3-month offer price expanded by US$24 per tonne or 1.04 per cent to stand at US$2,318.50 per tonne and US$2,319 per tonne. December 25 bid price and December 25 offer price gained US$23 per tonne or 0.91 per cent to peg at US$2,523 per tonne.

LME aluminium opening stock came in at 559600 tonnes. Live warrants and Cancelled warrants closed at 340950 tonnes and 218650 tonnes. LME aluminium 3-month Asian Reference Price slumped by US$81.7 per tonne or 3.55 per cent to clock at US$2,203.25 per tonne.

SHFE aluminium price

On Monday, March 26, the SHFE aluminium price has ascended by US$9 per tonne or 0.33 per cent to reach US$2,708 per tonne. Overnight, the most-traded SHFE 2405 aluminium contract opened at RMB 19,490 per tonne, with its lowest and highest at RMB 19,485 per tonne and RMB 19,625 per tonne before closing at RMB 19,590 per tonne, up RMB 135 per tonne or 0.69 per cent.

Responses