The US dollar was roughly flat on Thursday as the market awaited the release of US gross domestic product data on Friday. The dollar index, which tracks the greenback against a basket of other currencies, rose 0.01% and finished at 97.39. LME base metals mostly increased and the SHFE complex rose across the board. LME aluminium gained 1.01% and SHFE aluminium grew 0.35%.

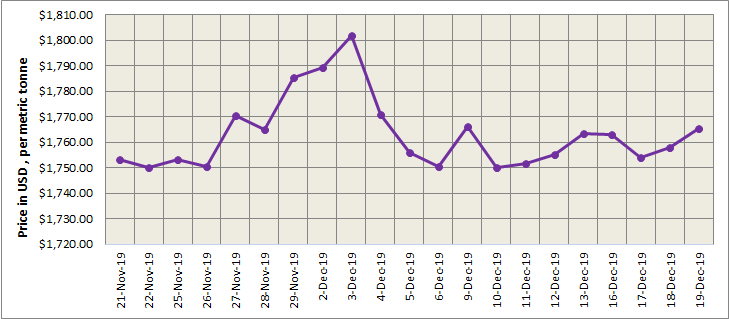

Three months LME aluminium got support from flat US dollar and its bullish SHFE counterpart and closed higher at US$ 1788 per tonne.

{alcircleadd}

As on December 19, Thursday, LME aluminium cash (bid) price stood at US$ 1765 per tonne, LME official settlement price stands at US$ 1765.50 per tonne; 3-months bid price stands at US$ 1786 per tonne, 3-months offer price is US$ 1788 per tonne; Dec 20 bid price stands at US$ 1845 per tonne, and Dec 20 offer price stands at US$ 1850 per tonne.

The LME aluminium opening stock increased again to 1487300 tonnes. Live Warrants totalled at 1341975 tonnes, and Cancelled Warrants were 145325 tonnes.

LME aluminium 3-months Asian Reference Price is hovering at US$ 1781 per tonne.

SHFE Aluminium Price Trend

Benchmark aluminium price for SHFE (Shanghai Future Exchange) increased to US$ 2041 per tonne on Friday, December 20, 2019.

SHFE aluminium rose 1% on the day, among the broad gains across nonferrous and ferrous complexes on signs of progress in resolving the spat between the US and China and latest stimulus from China’s central bank.

The most traded SHFE 2002 contract recovered from earlier losses and held onto overnight gains to finish the trading day 1% higher at RMB 14,200 per tonne, highs in three months. The decline in inventories is expected to continue into the end of the year. This, coupled with firm spot premiums, will remain supportive of nearby contracts. The SHFE 2002 contract is expected to move between RMB14,100-14,200 per tonne tonight.

Responses