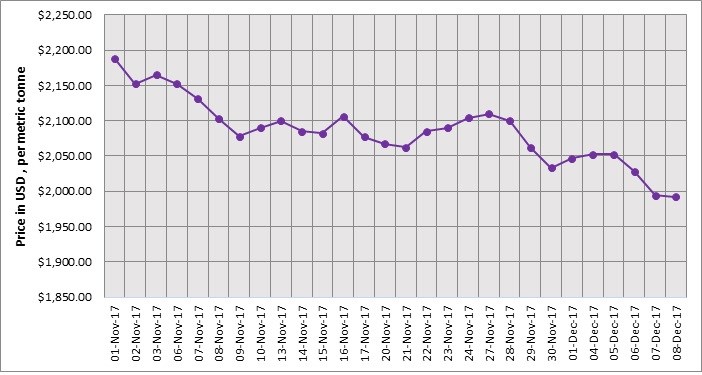

LME aluminium closed below US$2,000 per tonne mark last week indicating at an obvious stretch of short-term volatility. The light metal contract ended at US$1,992 per tonne on Friday, December 8, down from US$1,994 per tonne a day before.

Shanghai Metals Market holds a slightly different outlook though. According to SMM, LME aluminium will stop dropping temporarily today and rise slightly. It is likely to trade in the range of US$2,000-2,030 per tonne on Monday, December 11.

{alcircleadd}

As on December 8, LME official cash buyer aluminium price (Bid Price) stands at US$1,991.50 per tonne, cash seller & settlement aluminium price (Offer price) is US$1,992 per tonne, 3M Bid Price is US$2,011.50 per tonne, 3M Offer Price is US$2,012 per tonne, Dec1 Bid Price is US$2,060 per tonne, and Dec1 Offer Price is US$2,065 per tonne. LME aluminium Opening Stock or the LME aluminium inventory level stands at 1094525 tonnes, total Live Warrants is 867625 tonnes, and Cancelled Warrant is 226900 tonnes.

SME and SHFE Aluminium Price Trend

The benchmark aluminium price on Shanghai Metal Exchange has edged slightly higher at US$2,109 per tonne on December 11 from US$2,105 per tonne on December 8.

Aluminium has remained the first choice in the base metal complex for bears' capital in China market. It has been moving away from all moving averages and kept a weak tendency. This week, SHFE aluminium is expected to move in RMB 14,000-14,500 per tonne range. Spot premium will maintain at discount of RMB 110-70 per tonne on Monday, December 11.

Responses