Aluminium prices on London Metal Exchanges stayed flat with a marginal dip as global manufacturing growth provided support. Manufacturing activity in China and Japan expanded in January resulting in raised output and increased employment supporting a strong recovery in the Asian market.

LME aluminium closed at US$2,224.50 per tonne on Wednesday, January 31, down from US$2,229 per tonne on Tuesday, January 30. Shanghai Metals Market (SMM) forecasts that LME aluminium may trade at US$2,195-2,220 per tonne on Thursday, February 1.

{alcircleadd}

As on January 31, LME official cash buyer aluminium price (Bid Price) stands at US$2,224 per tonne, cash seller & settlement aluminium price (Offer price) is US$2,224.50 per tonne, 3M Bid Price is US$2,221 per tonne, 3M Offer Price is US$2,222 per tonne, Dec1 Bid Price is US$2,272 per tonne, and Dec1 Offer Price stands at US$2,277 per tonne.

SME and SHFE Aluminium Price Trend

The benchmark aluminium price on Shanghai Metal Exchange has inched higher from US$2,252 per tonne on January 30 to US$2,254 per tonne on February 1.

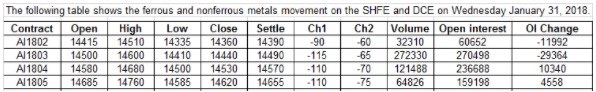

On Shanghai Futures Exchange, the most active aluminium contract dipped as investors squared their long positions. Bearish sentiment prevailed and aluminium-related stocks registered sharp fall. The movement of SHFE aluminium on January 31, as updated by SMM is as follows:

SMM analysis suggests that SHFE aluminium may trade within a lower range at RMB 14,280-14,420 per tonne on Thursday.

In the spot aluminium market, discounts are expected to move at RMB 130-90 per tonne.

Responses