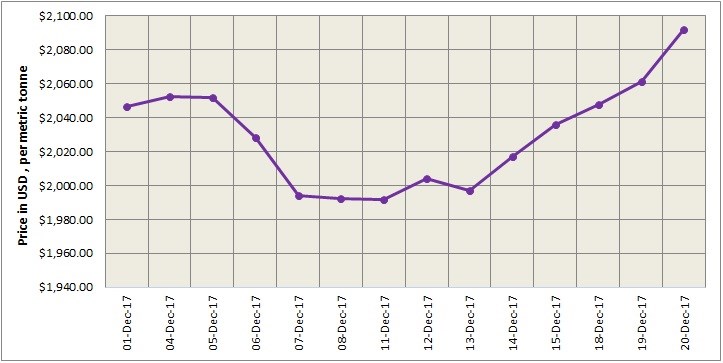

The uptrend in LME aluminium seems to be lacking momentum. With alumina prices declining in China domestic market (US$438 per tonne as on December 21 down from US$538 per tonne on November 21) the light metal contract is expected to rise but within a narrow range. Technical analysis suggests that LME aluminium will range at US$2,110-2,140 per tonne on Thirsday, December 21.

As on December 19, LME official cash buyer aluminium price (Bid Price) stands at US$2,091.50 per tonne, cash seller & settlement aluminium price (Offer price) is US$2,092 per tonne, 3M Bid Price is US$2,113 per tonne, 3M Offer Price is US$2,114 per tonne, Dec1 Bid Price is US$2,157 per tonne, and Dec1 Offer Price is US$2,162 per tonne. LME aluminium Opening Stock or the LME aluminium inventory level stands at 1107975 tonnes, total Live Warrants is 893250 tonnes, and Cancelled Warrant is 214725 tonnes.

SME and SHFE Aluminium Price Trend

The benchmark aluminium price on Shanghai Metal Exchange has inched up from US$2,171 per tonne on December 20 to US$2,174 per tonne on December 21.

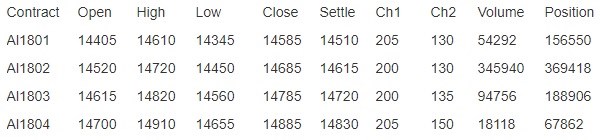

In China domestic market, aluminium contracts traded on Shanghai Futures Exchange rose overnight on news of alumina output cut due to shortage of natural gas. SHFE aluminium price movement on December 20 as updated by Shanghai Metals Market was as follows:

Alumina prices are unlikely to reverse their downtrend in the short term, which means a limited headroom for SHFE aluminium. However, SMM thinks alumina production will not be impacted largely due to natural gas shortage as most producers use coal gas for refining bauxite. So, in the medium term alumina prices will stabilise lifting aluminium prices further up.

The discounts on spot aluminium are likely to be at RMB 270-230 per tonne on December 21, SMM said.

Responses