The US dollar rebounded against a basket of foreign currencies on Monday. LME base metals traded lower on Monday. LME Aluminium edged down 0.05% and SHFE aluminium sank 0.1%.

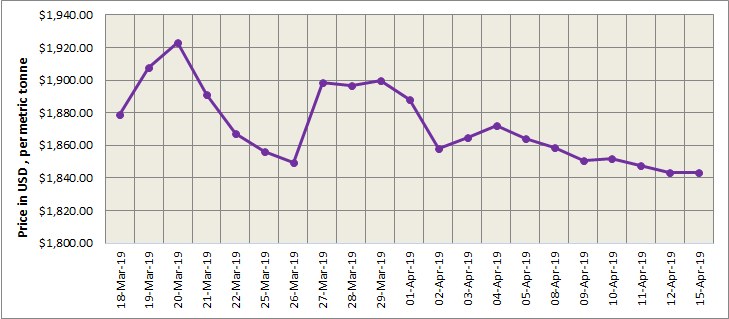

LME aluminium is in a consolidating phase without much fluctuation. LME cash settlement price remained flat from the previous trading day at US$ 1843.50 per tonne. Three-month LME aluminium fluctuated to close marginally lower at US$1,863 per tonne on Monday. In the face of the rebounding dollar, LME aluminium will have limited upward movement and is expected to trade between US$1,840-1,880 per tonne today.

{alcircleadd}

As on April 15, LME aluminium cash (bid) price stood at US$ 1843 per tonne, LME official settlement price stands at US$ 1843.50 per tonne; 3-months bid price stands at US$ 1859 per tonne, 3-months offer price is US$ 1860 per tonne; Dec 20 bid price stands at US$ 1987per tonne, and Dec 20 offer price stands at US$ 1992 per tonne.

The LME aluminium opening stock dropped to 1074450 tonnes. Live Warrants totalled at 682575 tonnes, and Cancelled Warrants were 391875 tonnes.

LME aluminium 3-months Asian Reference Price is hovering at US$ 1858 per tonne.

SME and SHFE Aluminium Price Trend

The benchmark aluminium price on Shanghai Metal Exchange dropped slightly to US$ 2064 per tonne today from US$ 2065 per tonne on April 15.

The most-traded SHFE May contract declined after it rose to a high of RMB13,910 per tonne yesterday and ended flat on the day at RMB13,835 per tonne. Recovering consumption extended declines in social inventories of primary aluminium by 14,000 tonnes from last Thursday as of Monday April 15. The most traded SHFE May contract then traded in a narrow range and closed 0.1% lower at RMB13,840 per tonne overnight. It is expected to trade at RMB13,800-13,900 per tonne today. Spot discounts are seen at RMB 50-10 per tonne after the April contract expired.

Responses