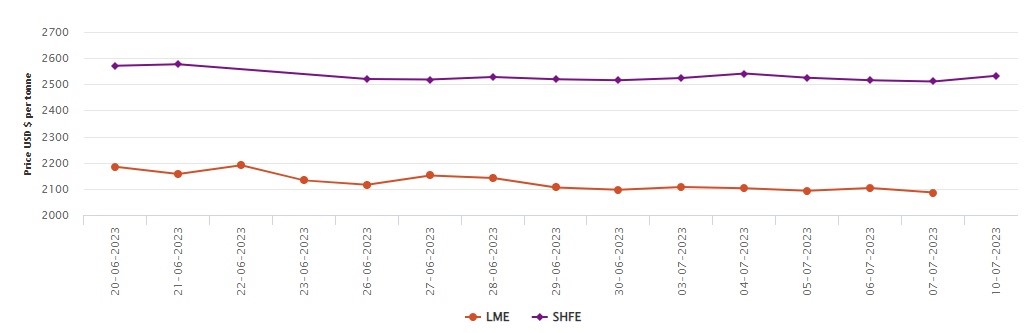

LME benchmark aluminium price descends by US$17.5/t; SHFE marks US$22/t growth

LME aluminium opened at US$2,134 per tonne last Friday, with its low and high at US$2,127 per tonne and US$2,151 per tonne respectively before closing at US$2,141 per tonne, up US$11 per tonne or 0.52 per cent.

On Friday, July 7, the LME aluminium cash bid price shed US$18 per tonne or 0.85 per cent to rest at US$2,085 per tonne, while the LME official settlement price clocked at US$2,086 per tonne, with a fall of US$17.50 per tonne or 0.83 per cent.

The 3-month bid price and the 3-month offer price plunged by US$19 per tonne or 0.88 per cent to close at US$2,130.50 per tonne and US$2,131 per tonne, respectively.

December 24 bid price and December 24 offer price both dropped US$20 per tonne or 0.86 per cent to officially stop at US$2,288 per tonne and US$2,293 per tonne.

LME aluminium opening stock decreased by 0.52 per cent or 2,800 tonnes, officially closing at 535,075 tonnes from 537,875 tonnes catalogued the day before.

Live warrants read 273,250 tonnes, with a spike of 1,000 tonnes or 0.37 per cent. Cancelled warrants stood at 261,825 tonnes, with 3,800 tonnes or a 1.43 per cent dive.

The 3-month Asian Reference Price closed at US$2,131.43 per tonne, falling by US$10.77 per tonne or 0.50 per cent.

SHFE aluminium price

Today, on July 7, the SHFE aluminium spot price has closed at US$2,533 per tonne, with a US$22 per tonne or 0.88 per cent hike.

The most-traded SHFE 2308 aluminium contract opened at RMB 17,880 per tonne last Friday’s night session, with its low and high at RMB 17,850 per tonne and RMB 17,950 per tonne before closing at RMB 17,940 per tonne. It rose by RMB 95 per tonne or 0.53 per cent.

SHFE 2307 aluminium added RMB 595 per tonne or 3.38 per cent to RMB 18,185 per tonne. The open interest fell 11,785 lots to 256,640 lots.

This news is also available on our App 'AlCircle News' Android | iOS