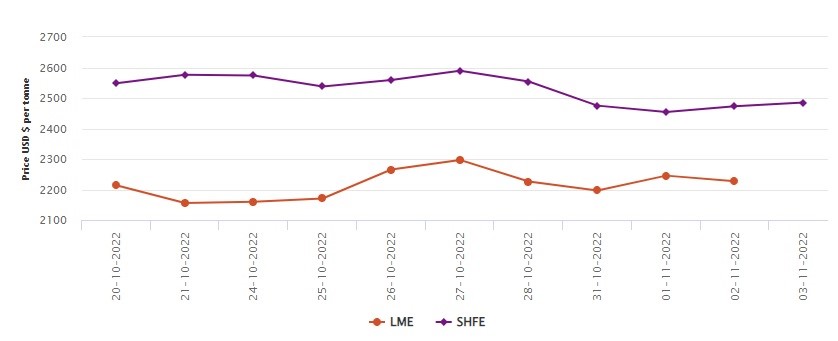

LME aluminium opened at US$2,252.50 per tonne on Wednesday, with its high and low at US$2,276.50 per tonne and US$2,233 per tonne, respectively, before closing at US$2,250 per tonne, a drop of US$7 per tonne or 0.31 per cent.

On November 2, Wednesday LME aluminium cash bid price plunged by US$18.50 per tonne or 0.82 per cent to halt at US$2,226.50 per tonne, and the LME aluminium official settlement price also shed the same percentage to rest at US$2,227 per tonne.

The 3-month bid price dived down by US$16 per tonne or 0.71 per cent to close at US$2,237.50 per tonne, and the 3-month offer price slumped by US$15.50 per tonne or 0.69 per cent to close at US$2,238.50 per tonne.

December 23 bid price and December 23 offer price both recorded an US$8 per tonne or 0.34 per cent fall, stopping at US$2,315 per tonne and US$2,320 per tonne.

LME aluminium opening stock plummeted by 2,925 tonnes or 0.5 per cent to settle at 581,050 tonnes from 583,975 tonnes recorded the previous day.

Live warrants totalled 329,175 tonnes, sliding down by 0.97 per cent or 3,225 tonnes.

Cancelled warrants read 251,875 tonnes, with a rise of 300 tonnes or 0.12 per cent.

LME aluminium 3-month Asian Reference Price came in at US$2,251.94 per tonne after gaining US$13.94 per tonne or 0.62 per cent.

SHFE aluminium price

But today, on November 3, the SHFE benchmark aluminium price has escalated by US$12 per tonne or 0.48 per cent to rest at US$2,485 per tonne.

The most-traded SHFE 2212 aluminium contract opened at RMB 17,860 per tonne overnight, with its low and high at RMB 17,820 per tonne and RMB 17,990 per tonne before closing at RMB 17,925 per tonne, up RMB 65 per tonne or 0.36 per cent.

The most-traded SHFE 2212 aluminium closed up 0.79 per cent or RMB 140 per tonne at RMB 17,860 per tonne, with open interest down 2,380 lots to 174,031 lots.

Responses