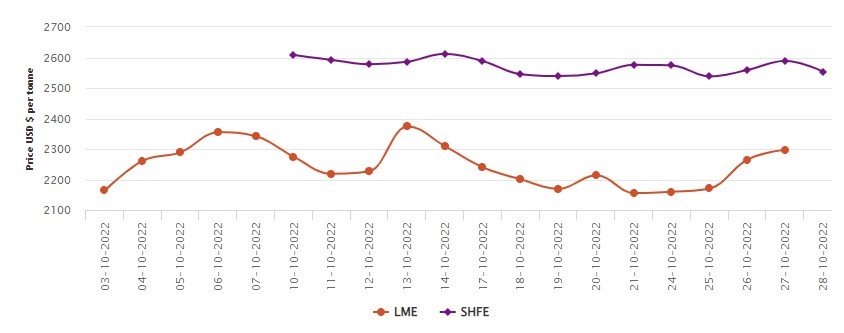

LME benchmark aluminium price slides up by US$31.54/t to US$2297/t; SHFE faces US$35/t slump

LME aluminium opened at US$2,333.5 per tonne on Thursday; with its high and low at US$2,341.5 per tonne and US$2,275 per tonne, respectively, before closing at US$2,291 per tonne, a drop of US$39 per tonne or 1.67 per cent.

On October 27, Thursday LME aluminium cash bid price augmented by US$31.50 per tonne or 1.39 per cent to halt at US$2,296.50 per tonne, and the LME aluminium official settlement price also escalated by the exact same percentage to rest at US$2,297 per tonne.

The 3-month bid price and 3-month offer price increased by US$40 per tonne or 1.77 per cent to close at US$2,300 per tonne and US$2,302 per tonne, respectively.

December 23 bid price and December 23 offer price recorded a US$43 per tonne or 1.84 per cent hike, stopping at US$2,375 per tonne and US$2,380 per tonne.

LME aluminium opening stock had a huge rise of 13,025 tonnes to settle at 587,100 tonnes from 574,075 tonnes recorded on Wednesday.

Live warrants totalled 349,175 tonnes, soaring up 3.97 per cent or 13,325 tonnes.

Cancelled warrants read 237,925 tonnes, with a slump of 300 tonnes or 0.12 per cent.

LME aluminium 3-month Asian Reference Price came in at US$2309.79 per tonne after gaining US$56.78 per tonne or 2.52 per cent.

SHFE aluminium price

But today, on October 28, the SHFE benchmark aluminium price has lost US$35 per tonne or 1.35 per cent to rest at US$2,554 per tonne.

Overnight, the most-traded SHFE 2211 aluminium contract opened at RMB 18,380 per tonne and rose RMB 18,465 per tonne before closing at RMB 18,345 per tonne, down RMB 73 per tonne or 0.4 per cent.

The most-traded SHFE 2211 aluminium closed down 0.43 per cent or RMB 80 per tonne to RMB 18,565 per tonne, with open interest down 26,615 lots to 85,111 lots.

This news is also available on our App 'AlCircle News' Android | iOS

.png/0/0)