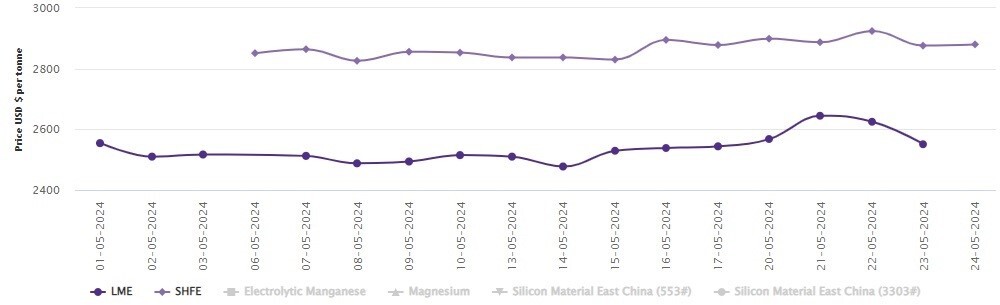

On the previous trading day, LME aluminium opened at US$2,638 per tonne, reached a high of US$2,645.5 per tonne, a low of US$2,586.5 per tonne, and closed at US2,614 per tonne, down US$26.5 per tonne, a decrease of 1 per cent.

On Thursday, May 23, both LME aluminium cash bid price and LME aluminium official settlement price decreased by US$74 per tonne or 2.82 per cent to settle at US$2,550 per tonne and US$2,551 per tonne, respectively. On a Week-on-Week scale, the LME aluminium price has grown by US$7 per tonne or 0.27 per cent from US$2,551 per tonne recorded on May 17.

3-month bid price and 3-month offer price slumped by US$70.50 per tonne or 2.64 per cent to halt at US$2,602 per tonne and US$2,602.50 per tonne.

The December 25 bid price and December 25 offer price also tumbled by US$52 per tonne or 1.87 per cent to anchor at US$2,720 per tonne and US$2,725 per tonne.

LME aluminium opening stock came in at 1127775 tonnes. Live warrants and Cancelled warrants stood at 653900 tonnes and 473875 tonnes. LME aluminium 3-month Asian Reference Price escalated by US$119.15 per tonne or 4.36 per cent to stop at US$2,615.97 per tonne.

SHFE aluminium price

Today, on May 24, the Shanghai Futures Exchange (SHFE) aluminium benchmark price has scored US$4 per tonne or 0.14 per cent to rest at US$2,880 per tonne. On a Week-on-Week scale, the SHFE aluminium price has soared by RMB 2 per tonne or 0.07 per cent from US$2,880 per tonne marked on May 17.

Overnight, the most-traded SHFE 2407 aluminium contract opened at RMB 20,770 per tonne, reached a high of RMB 20,960 per tonne, a low of RMB 20,770 per tonne, and closed at RMB 20,910 per tonne, up RMB 130 per tonne, an increase of 0.63 per cent.

Responses