The US dollar index slipped on Friday as the euro rose sharply. LME base metals traded higher across the board on Friday April 12. LME aluminium advanced about 0.3% and SHFE aluminium popped 0.1%.

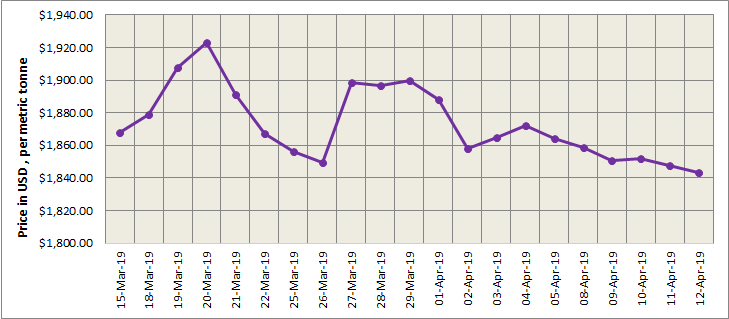

LME closed the week lower at 1843.50 per tonne on Friday. As the US dollar weakened, three-month LME aluminium rallied from a month-low of US$1,846 per tonne on Friday, and closed 0.3% higher at US$1,864 per tonne. The trading level of LME aluminium remained below all moving averages. Weak fundamentals are likely to cap upside room in LME aluminium, which is expected to trade at US$1,850-1,880 per tonne today.

{alcircleadd}

As on April 12, LME aluminium cash (bid) price stood at US$ 1843 per tonne, LME official settlement price stands at US$ 1843.50 per tonne; 3-months bid price stands at US$ 1864 per tonne, 3-months offer price is US$ 1865 per tonne; Dec 20 bid price stands at US$ 1995 per tonne, and Dec 20 offer price stands at US$ 2000 per tonne.

The LME aluminium opening stock dropped to 1081975 tonnes. Live Warrants totalled at 692650 tonnes, and Cancelled Warrants were 389325 tonnes.

LME aluminium 3-months Asian Reference Price is hovering at US$ 1862 per tonne.

SME and SHFE Aluminium Price Trend

After a period of flat run, the benchmark aluminium price on Shanghai Metal Exchange increased slightly to US$ 2065 per tonne today from US$ 2057 per tonne on April 12.

Chinalco’s bauxite train accident grew risk aversion among shorts and pulled up the most-liquid SHFE May contract to a high of RMB 13,855 per tonne in early trades yesterday and traded rangebound before it settled at RMB 13,840 per tonne. The most traded SHFE May contract traded in a tight range and closed 0.1% higher at RMB 13,850 per tonne on Friday night. It is expected to trade at RMB 13,800-13,900 per tonne today. Spot premiums are seen up to RMB 20 per tonne on the last trading day of the April contract.

Responses