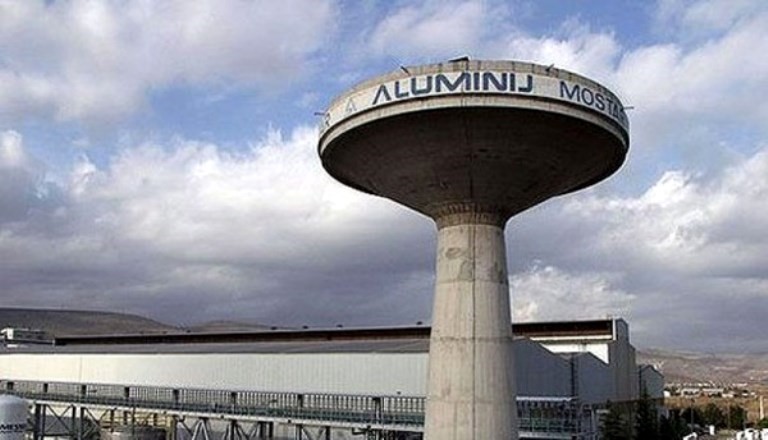

According to a company report, management at Aluminij Mostar, Bosnia's sole aluminium smelter has resigned after a potential investor submitted an inadequate buying offer for the smelter. The debt-ridden smelter was shut down in July because of high electricity and alumina prices.

A failure to find a strategic partner for the company, after miner and commodity trader Glencore and other investors backed out of a takeover deal led to the closure. Aluminij’s debt amounted to 380-million Bosnian marka (US$216.5-million), and the financial and tax police were investigating its operations.

In September, a consortium of Israeli and Chinese companies offered to invest in the smelter in exchange of subsidised electricity prices and government aid in delayed debt payment. The government refused to accept these conditions.

On Monday, the company's Supervisory Board said that new offer from the consortium of Israeli M.T Abraham Group and China Machinery Engineering Corporation (CMEC) and China Non-Ferrous Metal Industry’s Foreign Engineering & Construction did not work out in their favour.

The board accepted the resignations but said it would continue to work until a new team has been appointed and continue negotiations with the consortium to improve the offer. The board assured the management that all employees who will be declared redundant on December 31 or later should be paid severance payments.

Aluminij has paid severance payments to 600 of its 900-strong workforce while the remaining 300 are concerned about the outcome of possible privatisation.

Responses