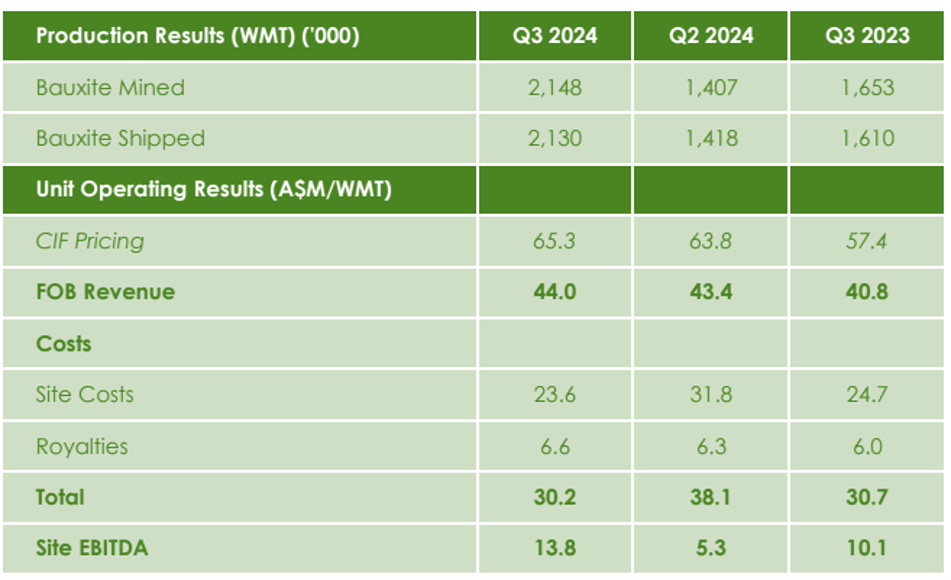

Metro Mining Limited has reported a standout third-quarter operational update for 2024, marking a record-breaking period for the company's bauxite production. The company achieved quarterly shipments of 2.13 million wet metric tonnes (WMT), a substantial 50 per cent increase over Q2 2024 and a 32 per cent rise compared to Q3 2023. This brings Metro's total output for the calendar year to 3.7 million WMT, setting the company on track to reach the lower end of its 6.0 to 6.4 million WMT guidance range, subject to weather conditions.

Key components of Metro's flow sheet, including mining, screening, the barge loading facility, and transhipping, are now operating above budgeted rates, boosting Metro's confidence in achieving a production rate of 7 million WMT per annum by 2025.

The company's production surge comes amid heightened tightness in the global bauxite market, with benchmark prices for both bauxite and alumina trending upwards by the close of the quarter. Metro recorded a 14 per cent year-on-year increase in average delivered prices and a modest 2.5 per cent rise over Q2 2024. These gains were slightly offset by contractual variances and demurrage costs from rapid production scaling, though Q4 is expected to yield even higher quarterly prices.

Q3 2024 marked the first full quarter of expanded operations, with Metro's new wobbler screening circuit and Offshore Floating Terminal (OFT) Ikamba achieving nameplate capacity. Strategic improvements in processes, team coordination, and efficiency resulted in monthly production and shipping records and a cumulative 10 per cent month-on-month increase in quarterly shipments. Metro's economies of scale are beginning to bear fruit, with site operating costs down to $23/WMT—26 per cent lower than Q2 2024. The site margin for EBITDA came in at $13.8/WMT, with some expansion-related costs still affecting the balance. However, Metro anticipates further cost reductions through continuous optimization.

Metro's robust operational performance translated to a net cash flow from operations of $29.3 million for the quarter. After repaying $11.7 million in debt, the company closed the period with a cash balance of $16.9 million.

Simon Wensley, CEO & MD of Metro Mining, said, “It is pleasing to see the expansion ramp up strongly during the quarter to reach target rates across the flow sheet, driving economies of scale and greatly improved margins. This reflects the hard work of the MMI and contractor teams. I expect to see the momentum continuing, and the recent tightening of the traded bauxite market will start to flow through this coming quarter and into 2025.”

Bauxite market

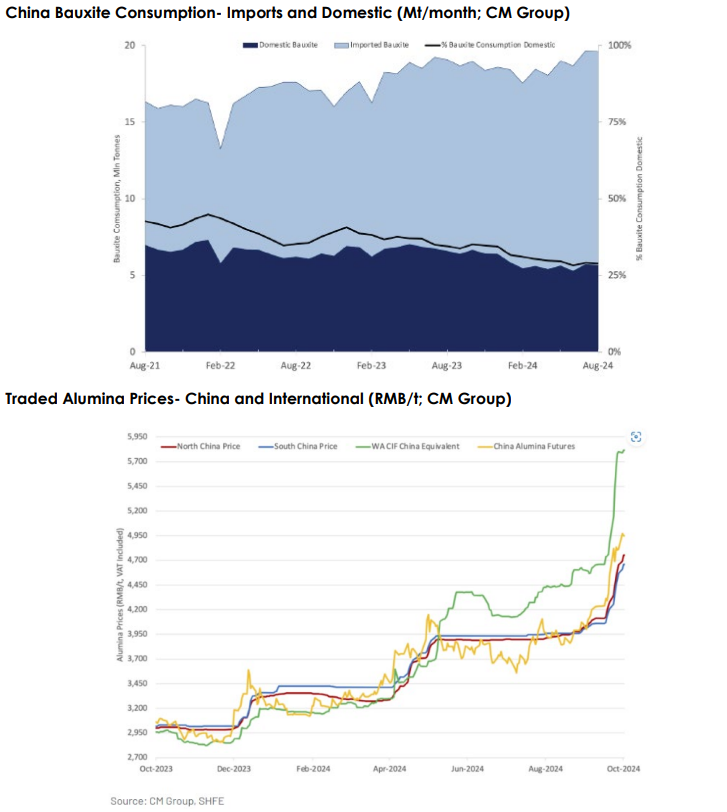

Bauxite imports to China were 142 million tonnes (MT) in CY 2023, a record and 13 per cent above CY 2022. In Q3 2024, demand from alumina production and, thus, traded bauxite continued to be strong, with YTD imports in September up 12.7 per cent over 2023. Alumina prices started to rise strongly again towards the end of the quarter and are now at almost record levels.

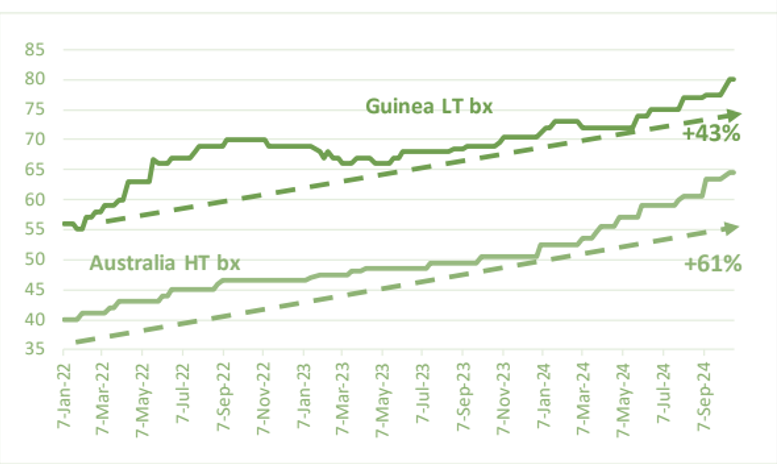

This is having a positive effect on the bauxite market pricing. The most recent spot market pricing (CM Group) shows the continued firming price for Guinea bauxite at US$80 /DMT, up 43 per cent since January 2022, and prices for Australian high-temperature (HT) bauxite at US$65 /DMT, up 61 per cent over the same period, with the most substantial rise in the last six months.

Traded Bauxite Prices (US$/DMT CIF China: CM Group)

Metro’s average delivered prices have risen approximately 14% from Q3 2023 and 2.5 per cent from Q2 2024. Headline quarterly contract prices experienced a reasonable translation of the spot price rises and were up approximately 8 per cent vs Q2 2024. This was offset by:

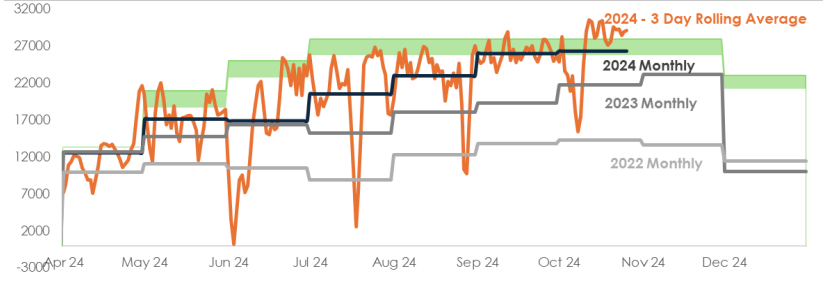

Spot prices rose again towards the end of Q3, as shown in the above graph, and we expect a good proportion of the spot price to translate into quarterly negotiated contracts. Also notable is that MMI shipped a Capesize cargo to EGA’s Al Taweelah refinery in Abu Dhabi in October.

Operational Performance

Production, Costs and Margins

Bauxite Hills mine operations

Q3 has been the ramp-up quarter following the successful commissioning of key expansion project assets in Q2, namely the Ikamba Offshore Floating Terminal, two additional 90m barges, an additional tug, as well as the commissioning of the new wobbler screening circuit.

Mining, screening, barge loading and transhipping increased output steadily, setting new records from July through August and September as each set of assets underwent an assessed process of ramp-up and optimisation. Nine road train consists were in operation by September, being serviced out of at least two mining locations. The new wobbler screening circuit was optimised and achieved 1,600 tonnes per hour (tph) nameplate throughput, enabled by the choke feeding with two new high-capacity Caterpillar 992 front-end loaders. Barge loading throughput was maximised with the use of both the wobbler screening circuit and the existing vibrating screen and is now regularly achieving above 1,700 tph.

The annual grade control program commenced mid-June and will continue until early December, adding an additional ~ 7 – 9Mt modelled ore for the 2025 season.

Marine operations

Over the quarter, Ikamba’s conveyor system maintained a steady 80 per cent operating capacity with loading rates, stabilizing at 1,800 tph by September and peaking at 2,500 tph during free-digging operations. This was a marked improvement from July’s average of 1,600 tph and peak of 2,100 tph.

In terms of operations improvements, a real-time monitoring system was introduced during the quarter. This incorporates an integrated 72-hour look-ahead schedule and overnight monitoring, enabling further optimisation of transhipping activities, particularly in response to managing unexpected logistical challenges. This has resulted in consistently higher transhipment volumes and fewer interruptions across operations.

Updated sailing protocols were adopted, particularly on ebb tides, to reduce the likelihood of barges becoming over-drafted at the barge loading facility. With these new protocols, barge movements were better synchronised with tidal schedules, improving cargo flow to the transhippers.

Daily meetings bring together production, the barge loading team (BLF), the marine team, and TSA to coordinate barge scheduling and optimise throughput, ensuring smooth and efficient operations.

As expected, Ikamba has demonstrated its capability to operate in an adverse sea state. During a weather event in July, the floating crane TSA Skardon ceased operations for four days, while Ikamba could return to loading operations after two days.

In September, a reduction in channel depth from 1.8 meters to 1.5 meters temporarily decreased cargo capacity and productivity. The marine team effectively managed this issue with a bed levelling campaign, completing the work in 15 days and restoring the channel depth to 1.8 metres. Notwithstanding the decreased under-keel clearance, daily and monthly shipping records were achieved at 32,617 WMT and 780,000 WMT, respectively.

Shipments: 2022, 2023, 2024 YTD (monthly and 3-day rolling average)

At the current progression rate, it is expected to meet the lower end of full-year shipment guidance of 6.0 to 6.4 million WMT, depending on weather interruptions as it approaches the wet season.

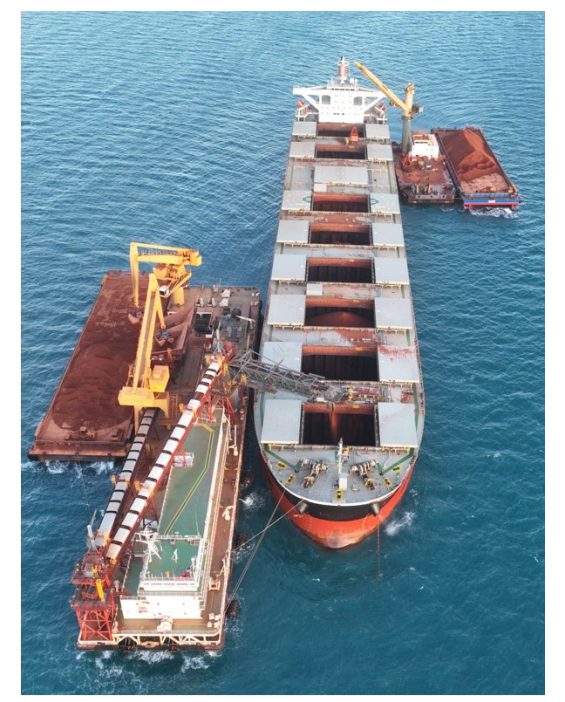

Image credit: Metro Mining

Information credit: Metro Mining Quarterly Activities Report July – September 2024

Responses