The Australian mining and exploration company Metro Mining is gearing up to commence its 2025 production and shipping operations at the Bauxite Hills Mine and Marine Divisions in Queensland, with mobilisation to the site now underway.

Source: Metro Mining

Source: Metro Mining

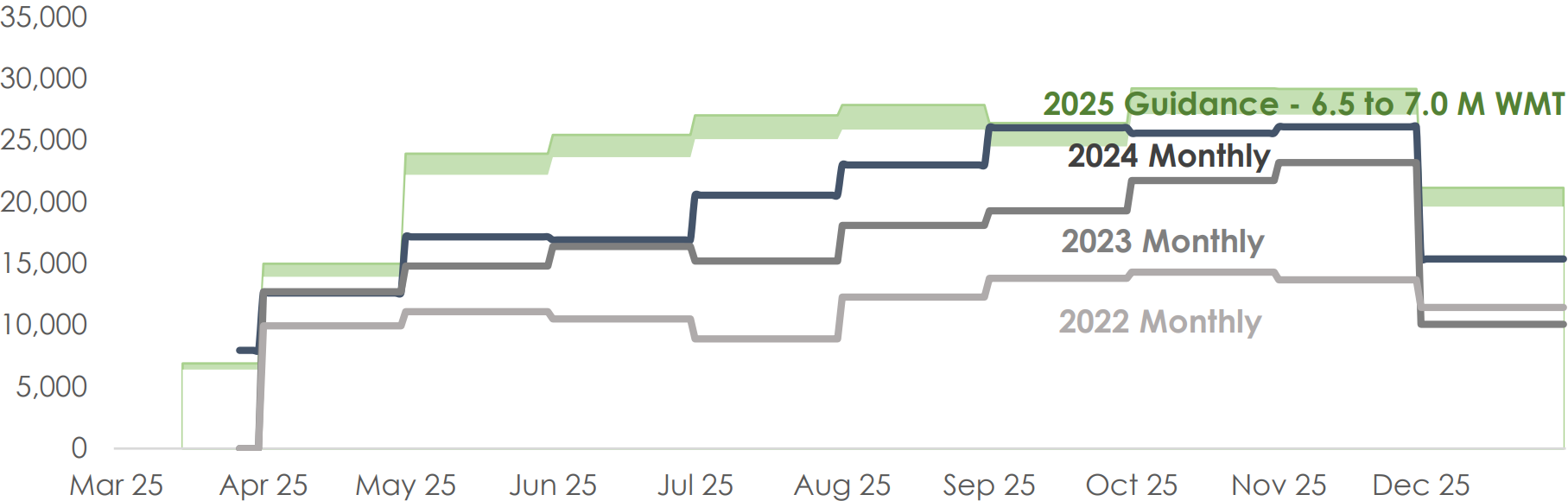

The company has set an ambitious target for the year, planning to ship between 6.5 and 7 million WMT of bauxite—building on its strong performance in 2024, when it recorded 5.7 million WMT, marking a notable 24 per cent increase over the previous year.

With a market capitalisation of $328.9 million, Metro is aiming to load its first vessel of the year by March 17, 2025. This early start has been made possible thanks to the company’s continued investment in operational efficiency, equipment upgrades, and the completion of its comprehensive annual maintenance program.

Key improvements include the installation of a new wobbler screening circuit and the implementation of Ikamba systems—both designed to better manage wet ore conditions and mitigate environmental risks. The maintenance program, which focused on ensuring the reliability of operations at higher output rates, was delivered on schedule and within its allocated $7 million budget.

These strategic enhancements position Metro to confidently meet its elevated shipping targets for 2025 while continuing to prioritise sustainability and operational resilience.

Chart: 2022, 2023, 2024 & 2025 Plan monthly shipments

Source: Metro Mining

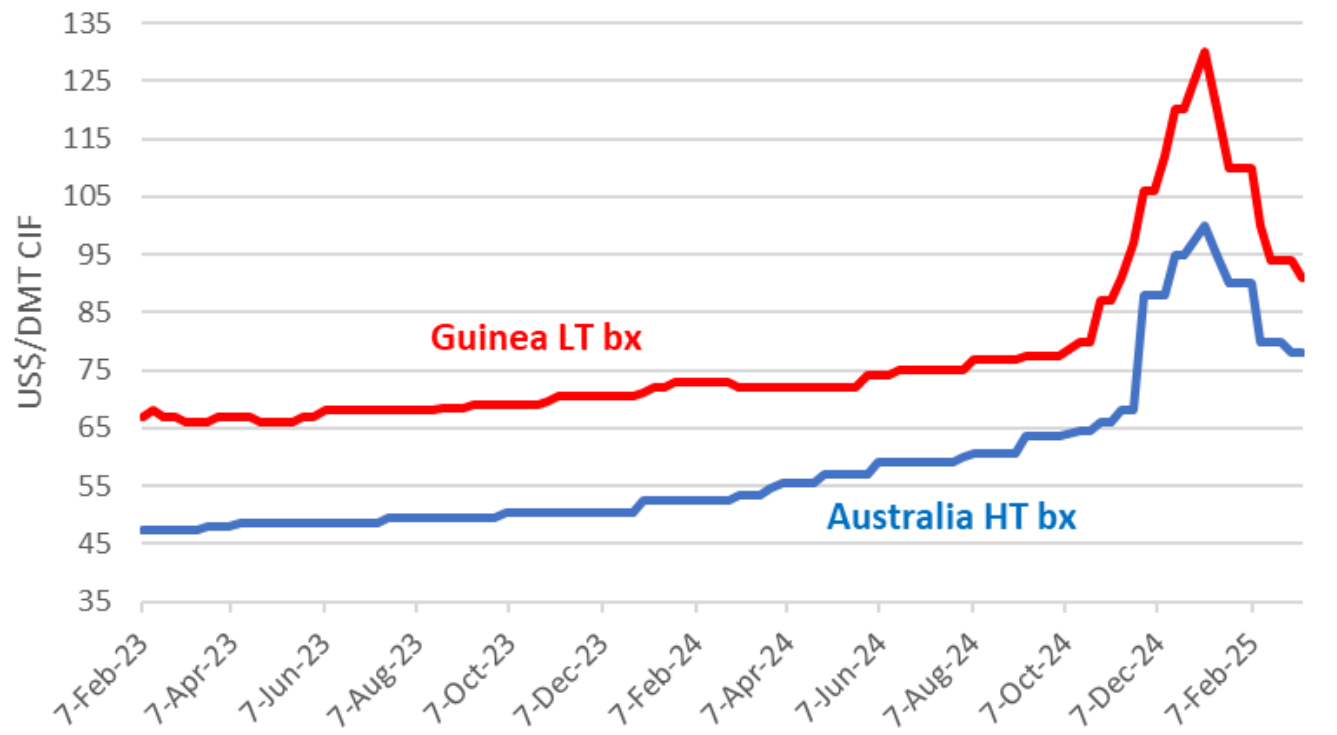

The traded bauxite market in the Asia Pacific region has experienced significant volatility over the past three to four months, largely driven by fluctuations in the alumina market. Alumina prices surged to record highs in December 2024 before undergoing a sharp correction. Despite this, bauxite demand continues to climb to unprecedented levels, supported by the commissioning of new Chinese coastal refinery capacities and the ongoing decline in China’s domestic bauxite supply.

While bauxite production in Guinea has increased, it remains unpredictable due to mine restrictions and the onset of the wet season. Nevertheless, bauxite prices, though off their recent peaks, have demonstrated resilience and relative stability over the past month. Prices remain strong compared to historical averages, which are 64per cent higher than January 2023. As of the latest update, the Australian high-temperature spot benchmark price is holding at US$78/DMT CIF China (source: CM Group).

Chart: Traded Bauxite Spot Price (US$/DMT CIF Chinese port: CM Group)

Source: Metro Mining

Metro has secured long-term contracts with high-quality off-takers for the majority of its products. Approximately 75 per cent of the projected volume for Q2 2025 is subject to quarterly pricing adjustments. Recent negotiations have resulted in a more than 25 per cent increase in FOB netback pricing for Q2.

Responses