The second-largest aluminium smelter in southeast Missouri is set to cut back its operations by January 28, leading to a situation where "most employees" will no longer be necessary, as reported by local news on January 24. The information is sourced from a letter issued by the plant management.

The reduction in operations at the New Madrid smelter in Missouri means that only four primary aluminium producers are active within the United States.

The Magnitude 7 Metals LLC letter stated, "Due to abnormally cold weather, our operations have been severely impaired to the point where they cannot be restored while running."

The letter also mentioned that Magnitude 7 plans to actively seek additional funding from potential investors to resume operations at the smelter in the coming years. The facility, with an annual capacity of 263,000 tonnes, located in New Madrid County, Missouri, was brought back into operation in mid-2018 following its acquisition from bankruptcy by Swiss-based ARG International AG. Matt Lucke, a former trader at Glencore, led the acquisition.

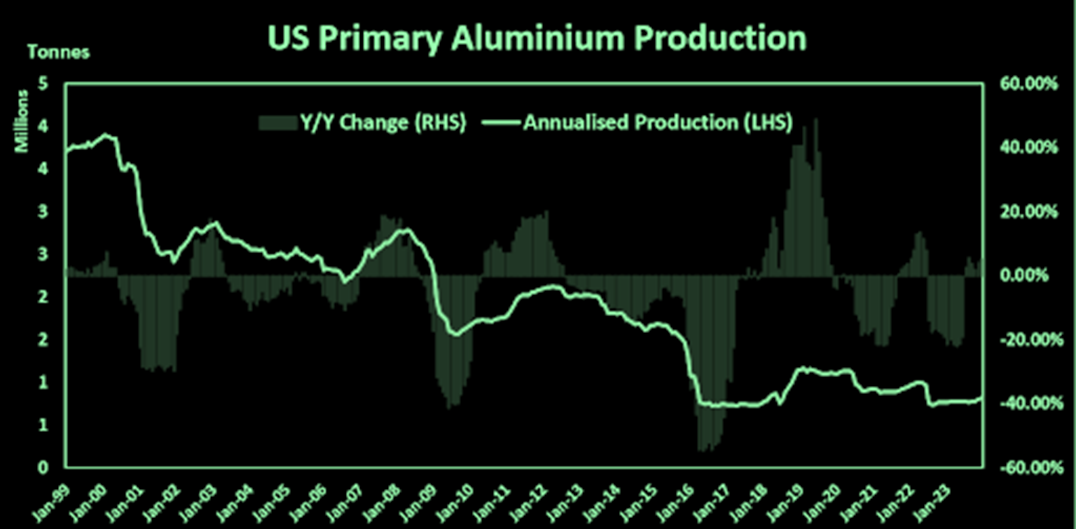

As the 21st century began, the nation proudly hosted 20 primary smelters, with all but one in active operation. However, this sector has faced severe setbacks due to a combination of soaring power prices—a crucial factor in the electrolysis production process—and the influx of high Chinese exports. New Madrid was a prime example of the Trump administration's strategy to combat this issue through import tariffs. Despite being rescued from bankruptcy and resuming operations shortly after the 10 per cent duties were implemented in 2018, the tariffs alone proved insufficient to ensure its survival.

Even the significant investments by the Biden administration in revitalizing domestic critical minerals supply chains have yet to be able to rescue the industry. Primary aluminium, crucial for both national defence and the transition to clean energy, has unfortunately slipped through the cracks of policy initiatives.

The impact of Trump's tariffs, aimed at revitalising the declining U.S. primary aluminium sector, has proven limited in its sustained effects. Efforts to revive the Intalco smelter in Washington lost momentum last year, leading to Alcoa announcing its permanent closure in March. Meanwhile, Century Aluminium fully idled its Hawesville smelter in Kentucky in July 2022.

Source: Reuters

Although Century continues to produce primary metal at its Sebree and Mt Holly smelters, the latter is operating at reduced capacity. Alcoa is managing the remaining two plants, with the Massena facility in New York, the world's oldest continuously operating aluminium smelter, running at its total 130,000 tonnes annual capacity. The Warrick plant in Indiana, originally designed for a capacity of 269,000 tonnes, has been operating only two production lines since mid-2022.

National primary metal production experienced a short-term upturn in 2018-2019 due to the restart of New Madrid but has steadily declined each year since. Last year's output amounted to 785,000 tonnes, compared to 740,000 tonnes in 2017, the year preceding the implementation of import tariffs. The closure of the 263,000-tonne-per-year New Madrid smelter is anticipated to result in national run rates reaching a new historic low.

Explore AL Circle's industry-focused report, "Global Aluminium Industry Outlook 2024," to gain a comprehensive understanding of the performance of the world's primary aluminium production and the entire upstream segment. This report provides valuable insights into the industry's outlook for 2024.

Responses