China’s aluminium processing industry has reported a 9.1 per cent decline in the Purchasing Managers’ Index (PMI) for October 2023. Shanghai Metals Market survey found that the PMI for China’s aluminium processing industry stood at 47 per cent.

SMM data also found that the downstream aluminium industry experienced a downfall in production, demand, and price indices. The new order index also encountered a 26.9 per cent drop M-o-M. Except for aluminium wire and cable, new orders for aluminium foils, plate/sheet and strip, construction extrusion, and primary/secondary aluminium alloys decreased. The end-user segment also showed weaker demand, resulting in a 15.9 per cent M-o-M rise in the finished goods inventory index.

The PMI for aluminium plate/sheet and strip, aluminium foil, industrial extrusion, primary aluminium alloy, and secondary aluminium alloy fell below 50 per cent in October. The PMI for aluminium wire and cable sector also saw a drop but remained above 50 per cent. The PMI for aluminium extrusions used in construction was also recorded above 50 per cent, backed by the minor peak at the beginning of the year due to a rebound in orders for commercial public buildings in areas such as East China.

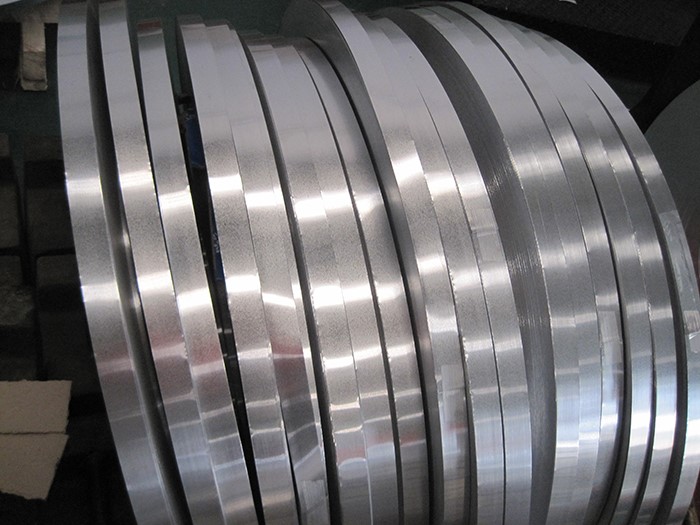

The PMI for the aluminium plate/sheet and strip was 45.1 per cent in October 2023, down 15.6 per cent M-o-M. The demand for the product was weak; hence, many small and medium-sized companies operated at a lower rate. Many companies even shut down for the National Day Holiday in October, resulting in reduced monthly production than in September. Going ahead, the demand for the aluminium plate/sheet and strip will drop further in November; therefore, the PMI is unlikely to exceed 50 per cent.

The PMI for the aluminium foil industry in October was 39.2 per cent, down 22.1 per cent from September. The first half of October saw a relatively strong demand in the aluminium foil sector, but the latter half of the month experienced a decrease in new orders and a slowdown in production pace as the traditional off-peak season approached. In November, with the off-peak season about to onset, there’s no expectation for the growth of the aluminium foil industry’s PMI.

Although the construction extrusion PMI marked above 50.20 per cent, the overall industrial aluminium extrusion industry’s PMI stood at 49.04 per cent, with production index at 48.36 per cent and new order index at 47.6 per cent. That was mainly due to a decline in downstream demand in the photovoltaic sector, which led to a decrease in order volumes and operational rates.

Primary and secondary aluminium alloy's PMI stood at 43.5 per cent and 46.1 per cent, respectively, declining by 17.6 percentage points and 11 percentage points M-o-M. Demand barely improved from September, and so new orders declined.

As November is about to enter the off-season, there is no sign of improvement in the near future. Except for aluminium cables, other aluminium processing sectors are pessimistic about production and sales in November. The domestic aluminium processing sectors are expected to remain below 50 per cent in November 2023.

Responses