Downstream sector of aluminium has seen an event full 2018, again marked by continuous expansions around the world. Demand remained strong in North America, Japan and Europe. China had a lacklustre year as for downstream growth is concerned. Restrictive trade policies by the U.S. president Trump have affected international trade to a certain extent. 10% import tariffs on aluminium and punitive sanctions on Rusal by the U.S. have also affected the market dynamics. Growing demand for aluminium moved the market in 2018 despite all trade disruptions and auto industry shaped the uptrend.

Policy Changes, Import Tariff and Investigations

2018 saw continuation of the protective trade policies of Trump that was announced during the President’s election campaign. On 9th March 2018, Trump imposed 10% tariffs on all aluminium (aluminium and aluminium semi-finished products) imported from all countries including China, Canada, EU and Mexico being the most talked about regions.

The administration exempted EU, Argentina, Australia, Brazil, Canada, Mexico and South Korea for a period of two months for further negotiations on the tariffs. Finally, from June 1 the Trump administration granted indefinite aluminium tariff exemptions to Argentina, Australia and Brazil. South Korea also received a permanent exemption from steel tariffs. This led to a trade war mainly between China and the U.S the two biggest economies. Other countries followed with retaliatory tariffs leading to a steep hike in price and disruptions in international trade. This was further fuelled by investigations and extra tariffs on Chinese aluminium product imports.

However, aluminium associations from all major countries including European Aluminium, Aluminum Association, Aluminium Association of Canada and Aluminium Association of Mexico have urged for permanent, quota-free exemptions from imported aluminium tariff under administration’s section 232 for all responsible trading partner countries.

Market Developments

Growing aluminium demand and semi-finished exports from China constituted two significant sides of the downstream market in 2018. The market dynamics were influenced by the tariffs and counter tariffs.

According to the latest report from Aluminum Association, aluminium demand in the United States and Canada totalled an estimated 10.7 million tonnes in the period from January to October 2018, up 3.4 per cent over the same period of 2017. Demand for semi-finished or mill products totalled 7.7 million tonnes, up 3.3 per cent.

Apparent consumption from January to October (demand minus exports) in domestic markets stood an estimated 9.4 million tonnes, up 1.8 per cent from the same period of 2017.

The tariffs on aluminium import have discouraged import while encouraging domestic products to produce and ship more. Total aluminium exports (ingot and mill products) from the U.S. and Canada (excluding cross-border trade) totalled 1.3 million tonnes through October 2018, up 16.3 per cent from the same period of 2017. Total aluminium imports were off 5.6 per cent to 3.6 million tonnes.

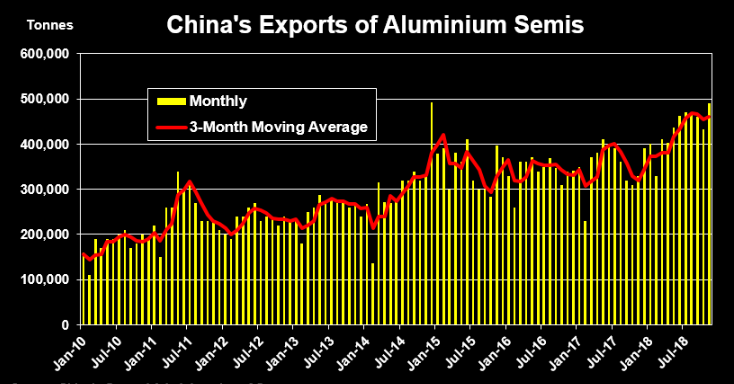

The fact is that despite U.S. tariffs on aluminium import and AD and CVD on foils and sheets, China’s exports of aluminium products are still growing, with outbound flows on track to set a new record this year. U.S. trade measures have not been able to solve what the rest of the world regards as the core problem facing the aluminium sector.

China’s exports of aluminium in all forms grew by 21 per cent to 5.8 million tonnes from January to December 2018. This is the preliminary figure released by China’s customs department on the export of primary metal, aluminium alloy and semi-finished products.

For a break-up, available till October, exports of primary metal remain negligible, coming in at under 30,000 tonnes in January-October. Exports of unwrought alloy were larger over the same period at around 410,000 tonnes, but were down 10 per cent YoY. Minus these two, the export of semi-finished aluminium products stood at 4.3 million tonnes in the first 10 months of this year, more than the total export for 2017.

China’s export to the US has seen a decline in 2018 after the implementation of the tariffs. The total Chinese export to the U.S. from January to October 2018 stood at 235,000 tonnes, a drop of 40 per cent from 393,000 tonnes in the same period of 2017.

While China’s semi-finished exports to the U.S. have lessened due to tariffs, the surplus metal, minimally transformed to exploit China’s export tax differentials, has been showing up in other Asian countries. South Korean and Vietnamese aluminium producers recently expressed their concern that cheap aluminium products imported from China would make their domestic products un-competitive. Indian aluminium producers expressed concern over the growing import of semi-finished aluminium and scraps to the country. While scrap aluminium imports from US have increased 144 per cent, overall imports have risen 32 per cent in July-September period, creating a concern for the domestic aluminium producers. This was mainly driven by the 10% tariffs the U.S, imposed on imports.

Looking at the surge in imports, India’s metals and mining conglomerate Vedanta Ltd has strategized a plan to raise its downstream products output by 25 per cent in the October-March period.

US companies have paid tariff duties of US$ 6.2 billion in October. The October tariff collections registered a 104% jump YoY from October 2017 amount of US$3.1 million and up from US$ 4.4 billion in September 2018, mostly driven by President Trump’s tariffs on steel, aluminium, and Chinese goods. Trump has cheered billions “pouring into the coffers of the USA,” while the costs are adding huge to the operational costs.

In November Japanese aluminium company UACJ has removed Rusal from a list of its suppliers for next year due to uncertainty over U.S. sanction against the Russian aluminium giant, according to news published by Reuters.

“Given uncertainty over (the U.S. sanctions against) Rusal, we are removing Rusal for now from the list of suppliers from which we plan to procure aluminium ingots next year,” UACJ President Miyuki Ishihara said.”

(To be continued in Part II)

Responses