(Continued from Part I)

Growing demand for automotive sector has moved the market and boosted investments and expansions in 2018. Trump’s aluminium tariffs also encouraged opening of a number of small and medium size aluminium plants in the U.S. and expansion of many plants, as tariffs boosted domestic purchasing. It is interesting to observe that decisions on most of the expansions and new projects were made keeping in mind the growing automotive demand.

{alcircleadd}

Below are a few key developments in 2018, which would also have an impact on the downstream industry in next few years:

Mergers & Acquisitions

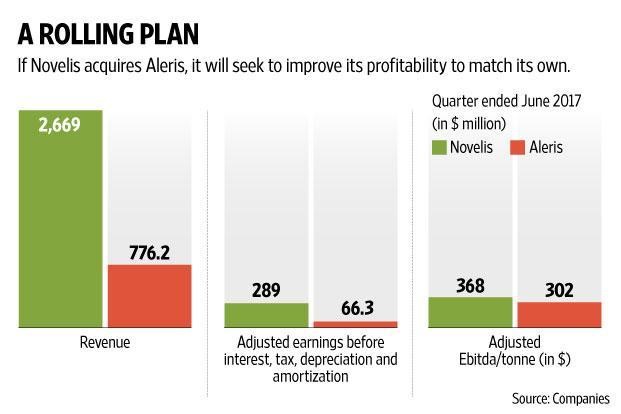

In July 2018, Novelis, the US-based rolling and recycling arm of India’s largest aluminium producer Hindalco Industries has closed on a US$2.3-2.5 billion acquisition deal of Aleris Corp. The acquisition is expected to establish a more diverse product portfolio for Novelis, including aerospace, beverage can, automotive, building and construction, commercial transportation and specialty products. This is also expected to broaden Novelis' automotive business to meet growing demand and diversify its global footprint. The acquisition is subject to customary closing conditions and regulatory approvals and is expected to close in 9-15 months.

In April, Norsk Hydro completed acquisition of Arconic’s two extrusion plants in Brazil on April 2, 2018, strengthening Hydro’s downstream position in Brazil and creating a solid platform for further growth. The two extrusion plants at Utinga and Tubarão in southern Brazil that belonged to Arconic have one casthouse, seven extrusion presses and value-added capabilities.

In March, Constellium announced that it signed a binding agreement with Novelis to sell the North Building Assets of its Sierre plant in Switzerland to Novelis who was operating the plant on lease.

Constellium N.V. announced in December that it signed an agreement with UACJ Corporation and its U.S. subsidiary, Tri-Arrows Aluminum Holding Inc. (TAAH), to acquire TAAH’s 49% stake in Constellium-UACJ ABS, LLC (CUA). CUA operates the Bowling Green Aluminium Auto Body Sheet Plant.

Investments & Expansions

In May, Novelis broke ground on its $300 million automotive aluminium sheet manufacturing facility in Guthrie, Kentucky. The 400,000 square foot facility will create approximately 125 jobs and produce annual nameplate capacity of 200 thousand tons.

In Nov Novelis Inc. has invested US$175 million for the expansion of its Pindamonhangaba plant, in Brazil which will add 100 thousand tonnes of rolling capacity and 60 thousand tonnes of recycling capacity. Novelis also broke ground on the expansion of its automotive aluminium manufacturing facility in Changzhou, China to meet the growing demand for automotive aluminium sheet in Asia.

In January 2018 Braidy Industries purchased 204 acres of land for the construction of $1.3 billion aluminium rolling mill in northeastern Kentucky. The construction of new aluminium rolling mill has already started and the Braidy Industries expects the production at the mill to roll out in 2021.

In January 2018 Sanjeev Gupta led GFG Alliance has won Highland Council’s permission for a new aluminium alloy wheel factory in Fort William, UK. The plant, which will come up next to its Liberty British Aluminium Smelter, will be the first large-scale alloy wheel plant of UK and requires an initial investment of 120 million Pound.

In March Constellium also announced the grand opening of its new Automotive Structures plant in San Luis Potosí, Mexico, to supply aluminium Crash Management Systems and structural components to automakers in Mexico. In September Constellium, announced that it expanded its operations in Dahenfeld, Germany to increase the supply of aluminium automotive structures.

In March Nalco has firmed up plans to form a joint venture and Ontario (Canada) based Almex at the upcoming Angul Aluminium Park in Odisha for the production of auto-grade aluminium. The unit with INR 25 billion investment will be set up on 50 acres at the park.

In Oct, Norsk Hydro declared to expand its automotive aluminium production at a plant in Cressonia, Pennsylvania that will provide new manufacturing capabilities needed to compete in the automotive market.

Taweelah Aluminium Extrusion Company (Talex) was inaugurated at the Kizad Industrial City in Abu Dhabi in May 2018, with an estimated annual production capacity of 50,000 tonnes of aluminium profiles and 45,000 tonnes of aluminium billets.

In June, 2018 JW Aluminum, a manufacturer of flat-rolled aluminium products announced that it will invest $255 million in an expansion of its Mount Holly flat rolled aluminium plant in Goose Creek, South Carolina.

In September, 2018, Hindalco Industries Ltd, signed a memorandum of understanding (MoU) with Gujarat government on Friday September 14 to set up India’s biggest aluminium extrusion and recycling plant in Gujarat with an investment of INR 3,500 crore.

In December, Kobelco Aluminum Products & Extrusions Inc. which opened an extrusion plant for the automotive sector in Bowling Green, Kentucky in February 2017 announced it will expand the plant with a US$42 million investment.

Product Performance: Rolling Product has seen solid growth in 2018 and will continue the trend in 2018

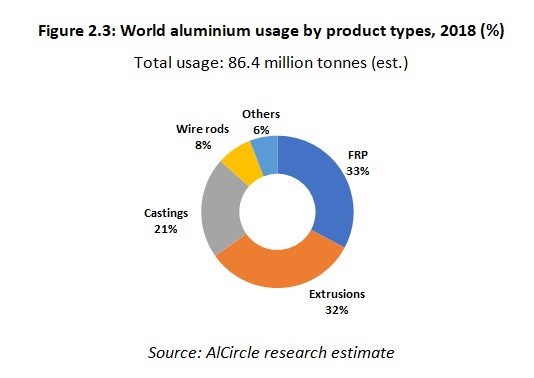

In 2018, aluminium FRP is estimated to account for about 33% of the total aluminium usage, followed by extrusions and castings at 32% and 21% respectively.

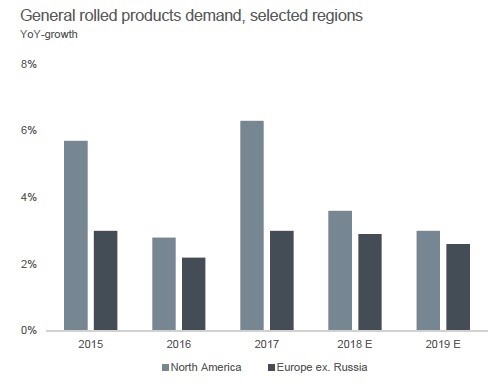

Substitution trend in automotive continued progressing through 2018, driving aluminium rolled product demand. Growth in packaging sector was driven by can stock and foil in emerging markets. In 2017, about 50% of the global rolled product demand came from the packaging sector and about 17% from transport sector. For North America, it was the automotive sector that drove the demand in 2017 and 2018.

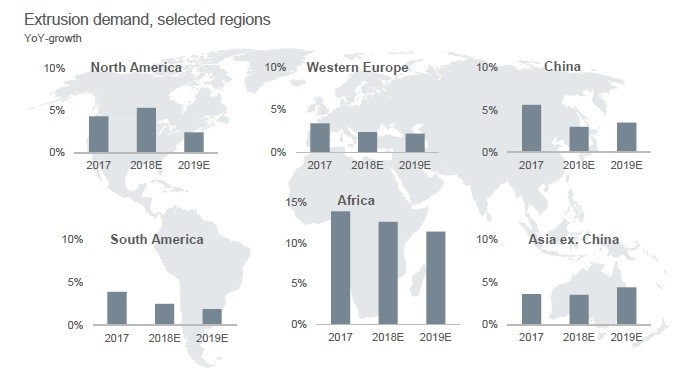

Image: Hydro Analysis

Extrusion segment growth was driven by the Building & Construction sector. Extrusion growth will still be driven by B&C sector (44%). Its automotive share is expected to stay flat. Moderating extrusion demand growth was seen in Western Europe and North America, while it is improving in Asia due to the growth in urbanization.

The demand for casting products was mainly driven by the automotive sector. However, the growth is getting slower as automakers are shifting towards aluminium body sheets mainly for lightweighting purpose. Replacing small steel or cast iron car parts with aluminium castings in big vehicles with larger footprints barely makes any significant weight difference. This rationale has paved the way for increased consumption of aluminium rolled products for Body-in-White (BiW) applications in vehicles, and rolling will soon overtake aluminium casting consumption in the years to follow.

China and India accounted for about 65% of the global aluminium wire rod usage in 2018. Wire rod demand is driven by B&C sector mostly as the wire rods are used in the electrical & electronics applications in those areas.

Conclusion

Rolling product manufacturers have seen a bullish year in 2018. Companies like Novelis and Constellium said their businesses were not much affected by U.S. import tariffs on aluminium as they supply specialty products for which the demand is strong and their consumers did not mind paying the tariffs. Quarterly and annual results of most of the rolling product manufacturers were driven by growing automotive shipments.

China's aluminium semis exports will continue to play a significant role in 2019 aluminium market. This will further be impacted by how the tariff war moves forward after the three months truce in the trade war between the U.S. and China. The export to the U.S. from China will continue to drop and this might further affect the market of the rest of the Asian countries as there is little chance that China will squeeze its production. Demand will continue to be strong, led by transport sector. More expansions will be on the card with addition of new rolling and extrusion capacities.

Responses