The data analytics and consulting company, headquartered in London, GlobalData Plc in April’20 reported that bauxite miners generally been unaffected, with the major producing countries of Australia, Guinea and Brazil were yet to announce the closure of mines at that time and mines in China have almost resumed operations to pre-Covid-19 lockdown levels. In Australia, several states have imposed a ban on workers travelling from interstate unless they are critical, and this has led to many miners housing as many of their FIFO workers as possible onsite. In India, another major producer of bauxite kept it exempt from the country’s first phase of 21-day COVID-19 pandemic lockdown.

However, in August’20, Globadata reported that the global bauxite mine production hardly to get effected by the temporary suspension of mines due to the COVID-19 pandemic and assumed shrink by just 0.1% to 344 million tonnes in 2020. GlobalData also stated that the production in Australia is expected to rise by 1.9% to 107.2kt in 2020, accounting for almost a third of the global total.

Guinea rose to world's second-largest producer of Bauxite

Guinea, the West African nation is now the world's second-largest producer of bauxite, as per the latest World Bank ranking, Guinea is ahead of China and is now behind Australia.

The bauxite production in Guinea increased from 59.6 million tonnes in 2018 to 70.2 million tonnes in 2019. According to the analysis of data from the latest World Bank report on the outlook in the commodity market, this 18% upswing allows it to grab its place as the world's second-largest producer from China.

Indeed, China produced last year practically the same volumes as in 2018, i.e. 68.4 million tonnes of bauxite. However, the Chinese production has not increased much in recent times that of Guinea has not ceased to panic counters since 2015. The West African country will now be competing with Australia, which is by far the world leader with the production of over 105 million tonnes in 2019.

Guinea stands as the largest bauxite exporter in the world today. The metallurgical grade bauxite resources in Guinea are estimated to be about 40 billion tonnes and thus occupy the top position in the world. Guinea’s bauxite industry is blooming on the back of major miners- SMB, CBG, RUSAL, GAC/EGA, CHALCO, Alufer and scores of other bauxite exploration-mining companies.

During 2019, the country exported about 70 million tonnes of bauxite, which is expected to grow around 10%-15% during 2020.

China’s Bauxite price remained calm for the year

China’s bauxite production has been contingent on its overseas mining investments. Alumina refineries in the China pursues to rely on imported bauxite from Australia and Guinea as an alternative for China’s depleting bauxite reserves and lower quality domestic bauxite.

In 2019, China practically produced the same volumes as in 2018, i.e. 68.4 million tonnes of bauxite. However, Chinese production has not increased much in recent times. The Bauxite Shanxi price historical data shows from 1stth Jan’20 to 30th December’20, the bauxite price remained with an average of $78.97 per tonne, while from 30th December’19 to 25th March’20 the average price remained at $ 80.31 per tonne and the average price from 26th March’20 to December’20 stood at $79.12.

As per the Bauxite Henan price historical data, it demonstrates a complete motionless graph from 1st January’20 to 30th December’20, as the average price stood at $75.43 per tonne.

However, the Bauxite CIF historical data shows from 30th December’19 to 9th March’20 stood at $43 per tonne, while from 10th March’20 to 25th August’20 the price fell to $42 per tonne and from 26th August’20 to 25th September’20 the price further dropped to $41 per tonne. The price again dropped to $40 per tonne for a shorter span from 28th September’20 to 30th September’20, whereas from 9th October’20 to 26th November’20 the bauxite import price fell to $39 per tonne and in 27th November’20 the price rose to $41 per tonne and remained same as on 30th December’20.

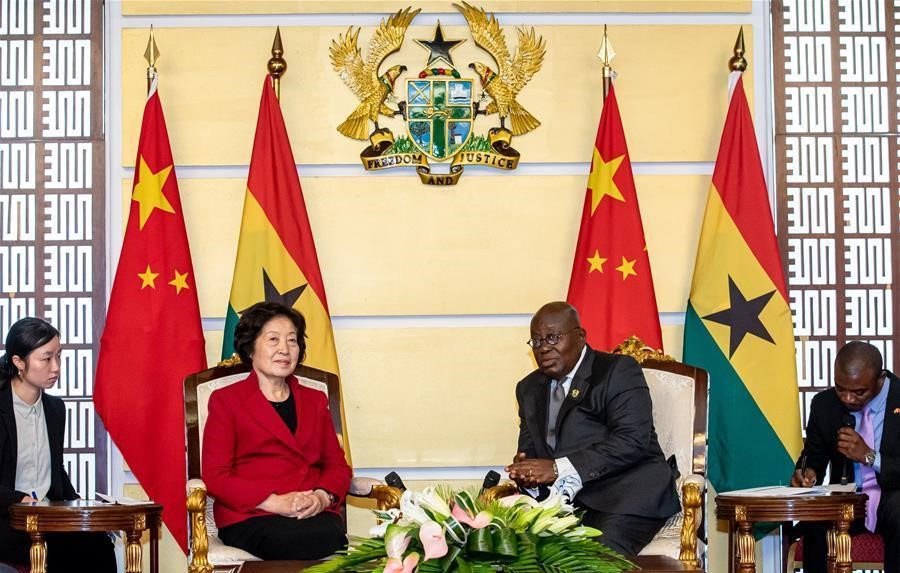

The Ghana-China Sinohydro Bauxite deal got delayed due to COVID-19

Ghana Centre for Democratic Development (CDD-Ghana) declared stated that the outbreak of COVID- 19 hit hard Ghana’s economy, as the money flow for the Sinohydro bauxite barter deal delayed.

CDD-Ghana has raised concerns regarding the need for the government to initiate socio-economic reforms to mitigate the effects of Coronavirus on the country’s economy.

However, the Akufo Addo Government commented that as a net consumer of goods and services, any disruptions in the global economy ripples down to Ghana. There were indications that the aspects of the Sinohydro Bauxite agreement got delayed due to disruptions in the Chinese economy.

The Sinohydro Bauxite Project is expected to bring some $2 billion, with about $1.5 billion being directed towards major road projects in the country.

The $2 billion bauxite-for-infrastructure deal was signed between Govt. of Ghana and the Chinese state-owned, Sinohydro Company. The government’s 2020 budget projected that some GH¢9.2 billion would be needed to finance its capital projects and due to some reason there is a delay in raising the funds, it could affect the government’s financial prospects badly for the year 2020.

Fitch Ratings pulled down Jamaica’s outlook to stable from positive due to COVID-19 impact on Bauxite exports

In April’20 Fitch Ratings, the leading provider of credit ratings, revised down its sovereign long-term foreign currency rating on Jamaica to stable from positive citing the expected negative shocks of its exports of bauxite, alumina, and remittances due to the “COVID-19” pandemic.

Jamaica has been making progress in reducing its government debt-to-gross-domestic-product levels that are still above its rating peers. The rating agency projected the economy to shrink by 4% in 2020 followed by a recovery of 2% in 2020 and thus Jamaica’s B+ rating was asserted.

The COVID-19 epidemic, emerged from the Chinese city of Wuhan, has caused a global shutdown of manufacturing as many nations and municipalities imposed stay-at-home orders or even more strict containment measures, affecting the demand for raw materials.

Fitch Ratings quoted that bauxite and alumina prices are facing downward pressures as manufacturing in China slowed down and demand weakens. Bauxite/alumina exports were 6% of GDP in 2018.

The Governor of Central Bank of Jamaica noted during an exclusive Latin Finance roundtable of central bankers that the downturn in commodity prices hit the economy and caused the closure of some of the bauxite and aluminium producing plants. However balancing against those negatives is the fall in the price of crude oil, a major import at 8% of GDP.

Hydro’s bauxite production during April-May recorded a rise of 94%

Hydro has revealed a volumetric update for its business areas for April and May’20, ahead of the complete second-quarter financial results. The company recorded with 1,760 tonnes of bauxite during April-May compared to 910 tonnes during the corresponding period last year. This means Hydro’s bauxite output in the second-quarter-to-date of 2020 increased by 94% year-on-year, owed to the rise in production at the Paragominas bauxite mine.

Hydro’s alumina production rose as well by 82% during the said period of 2020. In April and May 2019, Hydro’s alumina output was 543 tonnes, which in the year next increased to 989 tonnes, primarily as a result of higher production at Alunorte alumina refinery in Brazil.

NALCO sets record of all-time high production of Bauxite amid COVID-19 pandemic

National Aluminium Company Limited (NALCO), on 01st April’20, declared in a statement that it has recorded a three-sixty degree success in bauxite productions in the fiscal year 2019-20.

The company has utilized its full capacity at Panchpatmali mines and achieved bauxite production of 7.30 million tonnes. This is the highest ever production since the journey of Nalco started. The bauxite transportation of the company has increased to an all-time high of 7.30 million tonnes.

Nalco Chief credited the record performance to the teamwork and dedication of the employees and also added that despite a sluggish metal market, the company tided over the downturn through a continuous focus on bauxite mining and alumina refining arm, coupled with several cost reduction measures.

Amid COVID-19 crisis, all Nalco units remained operational, though with reduced manpower and contributing to the national economy.

Metro Mining remained focused on the market for Bauxite Hills Mine expansion stage-2

Metro Mining kept a close watch towards the market situations in regards to formally proceed with stage-2 expansion at the Bauxite Hills Mine in Far North Queensland in Australia.

In April’20, the company was instructed by the Queensland Treasury that the Queensland State Government would not exercise its veto right regarding the Metro Mining Bauxite Hills Mine expansion proposal and supported its progression to the loan documentation stage.

This had been one of the last key milestones for the facility and Metro is now well advanced in satisfying all remaining CPs and reaching the financial close of the facility. The timing for the formal commitment to stage-2 is being influenced by the uncertainty over the outlook for global growth and associated weakness in aluminium and alumina prices due to COVID-19 epidemic.

Despite, with funding now secured and key supply contracts negotiated, Metro will continue to monitor market conditions before deciding to formally proceed, as completion of stage-2 is not expected to occur before the second half of 2021.

As per the expectation of Metro Mining, production next year will likely be 4-5 million wet metric tonnes depending on the specific timing of commitment to stage-2.

Rio Tinto’s Bauxite production in Q1’20 records a YoY growth of 8%, Q o Q revealed a 9% drop

Rio Tinto, the world's second-largest metals and mining corporations posted its operational results for the first quarter of 2020, where it was spotlighted that its bauxite production has increased year-on-year by about 8% to stand at 13.8 million tonnes. But when compared to the previous quarter, the output has been found decreased by 9%.

The growth in the year-on-year production of Rio’s bauxite followed the successful ramp-up of its Amrun mine in 2019 and the 7% increase in third-party shipments to 9.5 million tonnes in the first quarter.

Canyon Resources progress remained on course for Minim Martap Bauxite project amid COVID-19

Canyon Resources Ltd remained persistent of development at its 100% owned Minim Martap Bauxite Project in central Cameroon, Africa, with the conveyance of the Pre-Feasibility Study (PFS) on course.

The study of the maiden ore reserve for the project was delivered in the second quarter of 2020.

Managing Director Phillip Gallagher stated it was known to them that they are in unprecedented times and that everyone is in some way affected, however, as a business company is in a strong position to continue to deliver on the project.

The PFS is reinforced by Minim Martap’s portrayed mineral resource of 892 million tonnes at 45.1% aluminium oxide, 2.8% silicon dioxide.

The organization at that time already executed a COVID-19 management plan for its head office and project team which authorizes Canyon to pursue on-site pursuit.

Canyon Resources applied sensible methods in place to restrict the risk of any team members being affected by COVID-19. The company sustained to implement full effort and executed its work plan at Minim Martap.

The Canyon’s project in Cameroon has all the technical and operation team members from in-country, so there is no effect of travel restrictions and fully supported by the local community.

Ivory Coast’s port of Abidjan floated its first shipment of Bauxite

On 29th May’20, Ivory Coast witnessed the launch of the first shipment of 20,000 tonnes of Bauxite, at the bulk terminal of Abidjan port. It is the first in-country. The aluminium ore was one of the products exported from the port.

The cargo bound for China and it comes from mines operated by the company Lagune Exploitation Bongouanou (LEB). The second shipment of 50,000 tonnes will be shipped very soon, while annual production is estimated at 750,000 tonnes.

For the first official of the Autonomous Port of Abidjan, the exploitation of bauxite in Côte d'Ivoire will not only contribute to increasing traffic in the port of Abidjan but will also bring added value to the Ivorian economy.

Guinea Govt. approved Lindian Resources for the acquisition of Lelouma Bauxite project

Lindian Resources, the Australian Securities Exchange-listed West African Bauxite mining company received approval from the Ministry of Mines, Govt. of Guinea towards the conclusion of the acquisition of the massive, undeveloped Lelouma bauxite project in Guinea.

The Perth-based mining firm is set to assume the 75% stake in Lelouma’s underlying ownership in Sarmin Bauxite, and take over operational control of the project, pending one final condition.

In October’20, it reported significant development in the mineral resource estimate for Lelouma to an imposing 900 million tonnes grading 45% aluminium oxide.

According to Lindian, more than US$10 million of previous exploration expenditure has been sunk into Lelouma by previous owner Mitsubishi Corporation as well as Sarmin.

According to the US Geological Society, Guinea hosts the largest bauxite reserves in the world and accounts for approximately 95% of bauxite exports out of Africa.

Red Mud Utilization

HINDALCO: World’s first company ever to achieve 100% red mud utilization

Hindalco Industries Ltd. signed a Memorandum of Understanding with UltraTech Cement Ltd., part of the same group and India’s largest manufacturer of cement and concrete, to deliver 1.2 million tonnes of red mud (also known as bauxite residue) annually to UltraTech’s 14 plants located across 7 states in India. Hindalco now stands as the world’s first company to achieve 100% red mud utilisation across three of its refineries.

Red mud generated in the alumina manufacturing process is rich in iron oxides, along with alumina, silica and alkali. The cement industry has developed the capability to process red mud as a replacement for mined minerals such as laterite and lithomarge in its process. Hindalco is supplying red mud to UltraTech Cement plants where it has proved to be an effective substitute for mined materials, successfully replacing up to 3% of clinker raw mix volume. Use of red mud reduces the cement industry’s dependence on natural resources and promotes a circular economy.

Hindalco’s alumina refineries are currently supplying 250,000 tonnes of bauxite residue to 40 cement companies every month, making Hindalco the world’s first company to have enabled such large scale commercial application of bauxite residue. In 2020, Hindalco focused to achieve 2.5 million tonnes of bauxite residue utilisation, which will be another global milestone.

Globally, 160 million metric tonnes of red mud is produced annually and stored in large tracts of land which is a serious industry challenge. To find a sustainable solution, Hindalco has invested in infrastructure and collaborated with cement companies, with UltraTech Cement being a key partner.

In 2019, UltraTech consumed about 15.73 million tonnes of industrial waste as alternative raw material and about 300,000 metric tonnes as an alternative fuel in its kilns.

The MoU represents a significant sustainability initiative for both Hindalco and UltraTech. Waste of one industry being used as an input material in another is more than an example of a circular economy; it exemplifies Hindalco’s sustainability-first approach to business.

In response, to the announcement, Miles Prosser, Secretary-General for the International Aluminium Institute (IAI), said: “For successfully exploring new uses for Bauxite Residue in the cement industry, I’d like to congratulate IAI member Hindalco and UltraTech Cement for this fantastic achievement. If aluminium by-products can also deliver environmental benefits in another industry, such as cement, then we are making great progress towards a sustainable circular economy. Hindalco has contributed immensely to our work on Bauxite Residue in cement production and we’re looking forward to learning from them and hope to replicate their success across the industry. Our long term goal is to find uses for the industry’s by-products to ensure the least possible environmental disruption.”

Noranda Alumina to sell Bauxite residue for cement production

New Day Aluminum Holdings LLC, through its subsidiary Noranda Alumina, has executed a Letter of Intent with Cemtech Materials Corporation to sell 60,000 tonnes of bauxite residue starting from the Q4 of 2020. This bauxite residue will be used in the cement production process as the raw material for iron (Fe), replacing other current iron-bearing raw materials.

_0_0.png)

This agreement was preceded by a beneficial use approval from the Louisiana Department of Environmental Quality for Noranda Alumina to supply bauxite residue into the cement industry.

Noranda remained focused towards continuously improving the sustainability of the business and reducing their environmental footprint on the path to a zero residue refinery in Gramercy. The approval from the LDEQ coupled with their agreement with Cemtech is another step forward in that endeavour.

Responses