At the recent annual conference of the China Photovoltaic Industry Association (CPIA), a renewable energy analyst from a publicly traded securities company renowned for its excellent asset quality and innovative capabilities highlighted significant cost shifts in the solar industry. The event, held earlier this month, underscored the sector's evolving dynamics.

According to the analyst, secondary materials have significantly reshaped the cost structure of the solar panel industry this year, becoming the primary driver of production expenses.

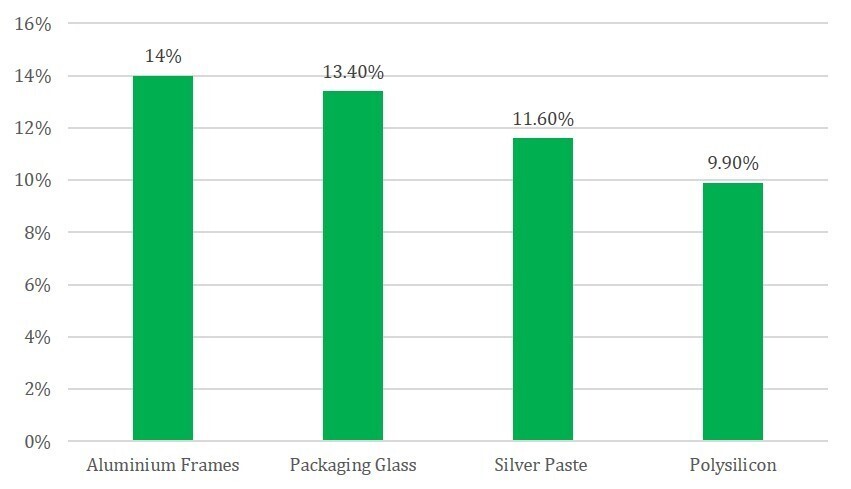

SinoLink Securities reported that by November 2024, aluminium frames had become the most expensive component in solar panel manufacturing, accounting for 14 per cent of total production costs. Packaging glass closely followed, at 13.4 per cent, while silver paste represented 11.6 per cent.

Solar panel costs, 2024 (% comparison)

Polysilicon, which historically dominated production costs, has dropped to fourth place, contributing 9.9 per cent of the total. This marks a significant shift compared to late 2023, when glass led with 16.4 per cent of production costs, followed by polysilicon at 14.1 per cent, and aluminium frames at 12 per cent.

According to the China-headquartered securities company, rising aluminium prices have significantly increased the cost of aluminium frames despite declining processing fees, driven by expanded production capacity and cost-cutting pressures.

Manufacturers are exploring alternatives to address this challenge, but concerns over the reliability of those substitutes have slowed their adoption. Efforts to standardise designs and minimise material usage offer another pathway to reducing costs in the long term.

Global solar installations are projected to grow annually by 10 per cent to 15 per cent through 2025, driving photovoltaic (PV) panel demand to an estimated 650 to 700 gigawatts peak (GWp).

Image credit: The China Project

Information credit: PV -Magazine

Responses