Rising alumina prices not a concern for Hindalco

The alumina price index (API) used for individual price discovery of alumina spot has been quite volatile this year. In October, the API surged to record highs driven by supply corners over curtailments in Chinese alumina refineries. The higher alumina prices, however, were not backed by a commensurate rise in aluminium prices. As a result many primary aluminium producers across the globe have felt the pangs of rising cost of production. Hindalco remains an exception among them.

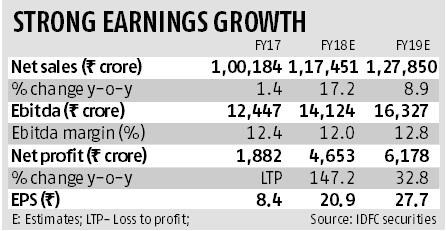

The integrated aluminium company, headquartered in India, continues to post strong earnings growth amid this volatility thanks to its diversified portfolio and Novelis’ value-added product business.

{alcircleadd}

Till September this year, spot alumina prices continued to trade higher in major markets of China in tandem with other aluminium raw material prices. It is only recently that the prices have come under pressure.

As updated by Shanghai Metals Market, the yearly aluminium price trend in China domestic market (base market) has been as follows:

Unit: RMB per tonne

Hindalco’s earnings are less sensitive to aluminium price volatility, analysts at IDFC Securities observed. UBS Global Research opines upstream aluminium is not a significant driver of earnings (25-30 per cent of Ebitda or operating earnings). Operating profit in the current escalating input cost environment also remains fairly insulated, since the company has integrated operations.

Hindalco’s convertor businesses, i.e. Novelis (55 per cent of FY19's Ebitda) and copper (10 per cent) are expected to contribute 65 per cent to FY19's estimated Ebitda), IDFC Securities says.

This news is also available on our App 'AlCircle News' Android | iOS

.png/0/0)