During 2011-2018, aluminium powder market has reportedly grown at a CAGR of around 2.2 per cent, reaching a volume of 617,238 tonnes. The growth in primarily driven by the use and demand of aluminium in the form powder and flakes across various industrial sectors such as paints and sealants, sparkles and glitters, aerated autoclave concrete, reflective roof coating, and printing inks.

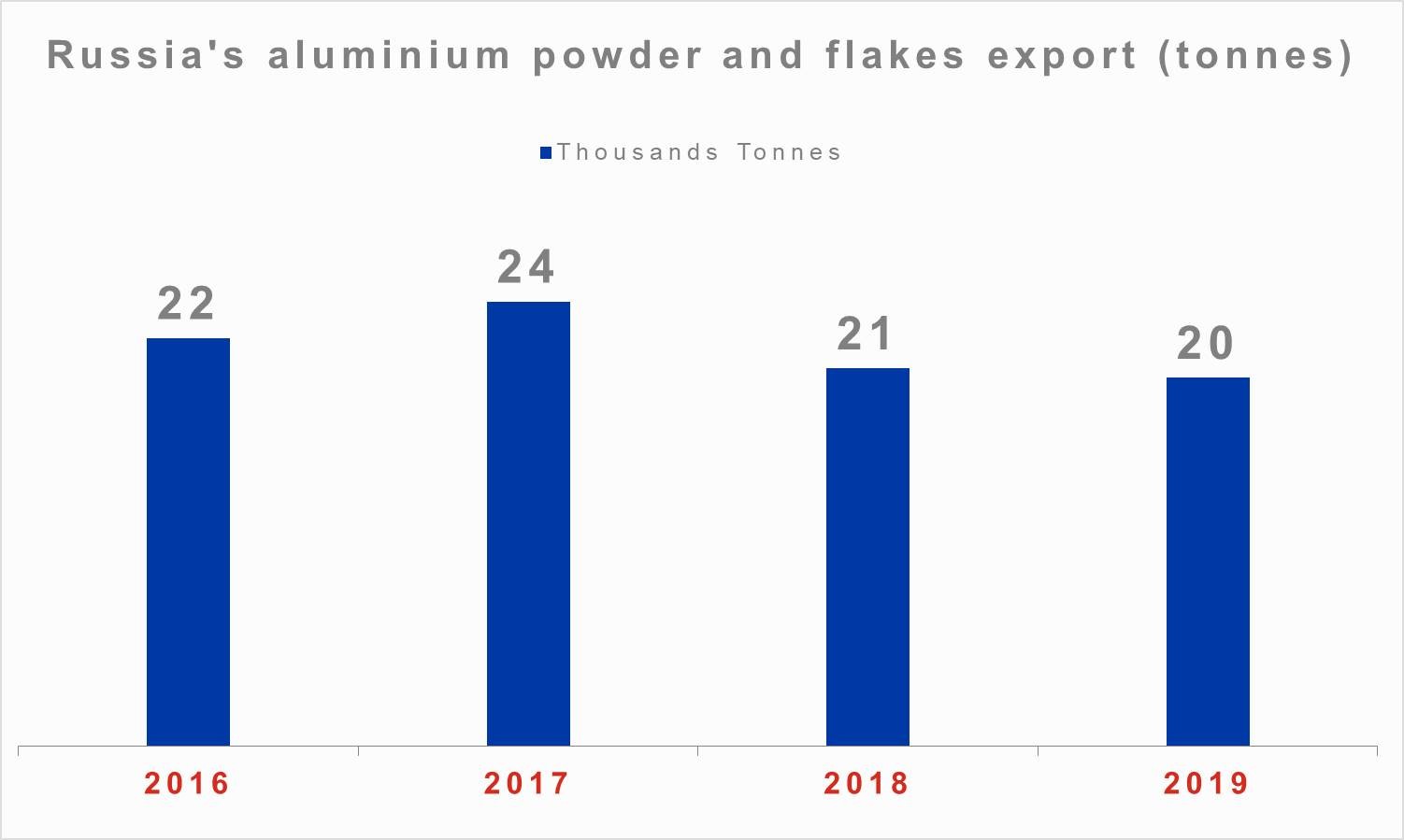

During the said period, particularly in 2016 and 2017, aluminium powder and flakes export by the Russian Federation also recorded a year-on-year growth. As the chart below shows that Russia in 2017 had exported 24,413 tonnes of powder and flakes, compared with 22,413 tonnes in 2016. Thus, its export rose 9 per cent year-on-year in 2017. However, in the year 2018, the export dropped 15 per cent to 20,750 tonnes. The reason could be the US sanctions against Russia, including the biggest aluminium giant Rusal. In 2019, the export is estimated to remain flat at 20, 231 tonnes.

{alcircleadd}

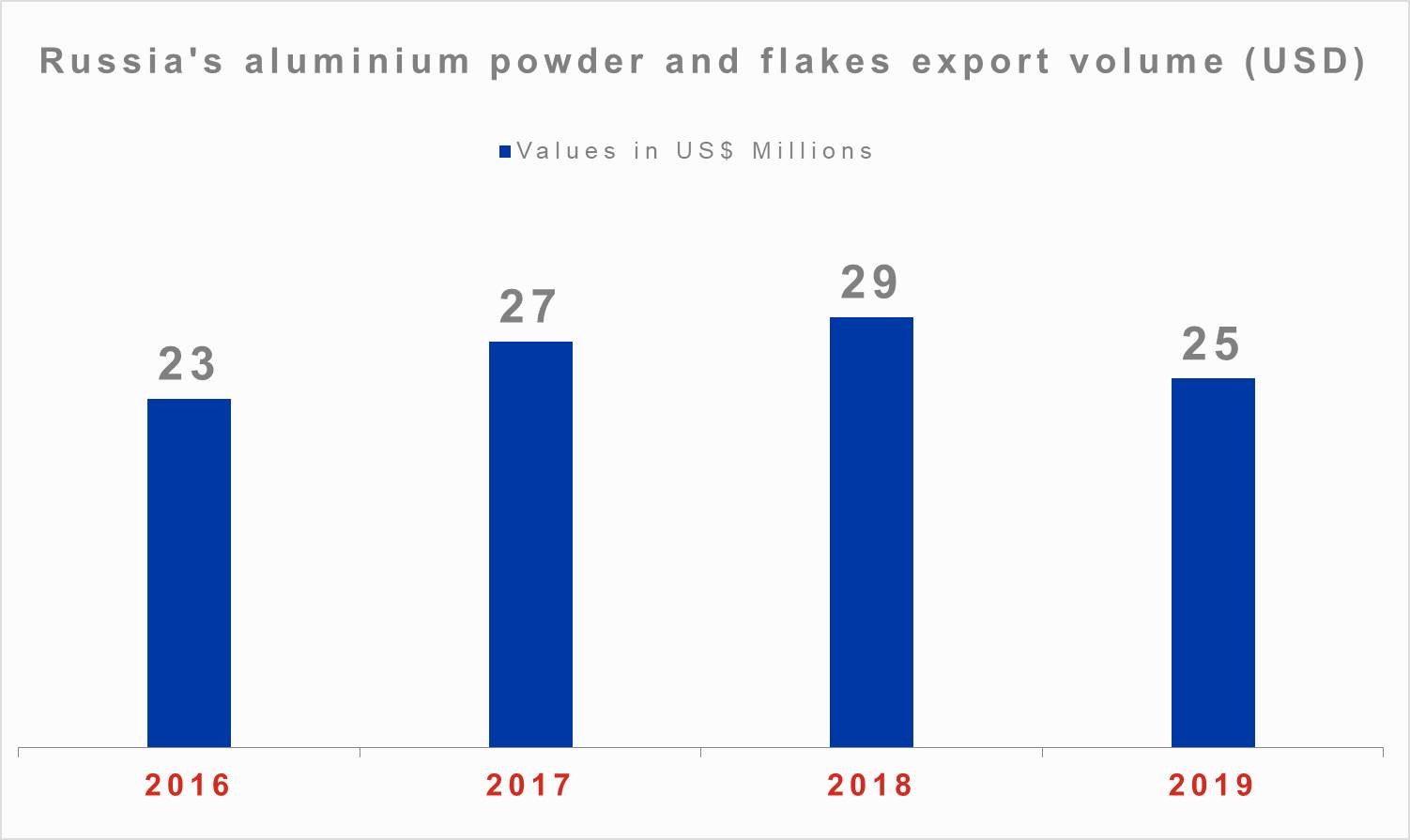

But despite the export volume being projected to remain flat, the value is likely to see a decline from US$29 million in 2018 to US$25 million this year, according to our third-party data. On the other hand, while the aluminium powder and flakes export by Russia had recorded a drop last year in terms of volume, its revenue had pegged higher at US$29 million in compare with US$27 million in 2017.

However, in 2017, the revenue had increased by 17 per cent from US$23 million in 2016, in tandem with the rise in volume.

Germany is estimated to continue to be the top importer from Russia this year. According to the data, the country is likely to import 11,786 tonnes of aluminium powder and flakes from Russia, which is almost flat compared to 11,728 tonnes in 2018. In 2017, Russia’s export to Germany was at 13,590 tonnes while that in 2016 at 12,262 tonnes.

Responses