The German aluminium industry is navigating turbulent waters as it grapples with significant production declines across nearly all subsectors in the first quarter of 2024. This downturn exacerbates the pressure from increasing imports, posing additional challenges for domestic manufacturers, as Aluminium Deutschland released in a press release.

Aluminium Deutschland is the association of the aluminium-producing and processing industry in Germany.

The President of Aluminium Deutschland, Rob van Gils, emphasised, "High energy costs and the overall tense economic situation in Germany continue to hit manufacturers hard. Demand from important customer industries - especially from the construction industry - remains at a low level. Added to this are the weak registration figures for electric cars as a result of the federal government's overnight cancellation of funding."

The production of recycled aluminium saw a significant decline despite its critical role in Europe's decarbonisation efforts and the associated market potential. Germany produced 685,000 tonnes of secondary aluminium from January to March, marking a 7 per cent decrease.

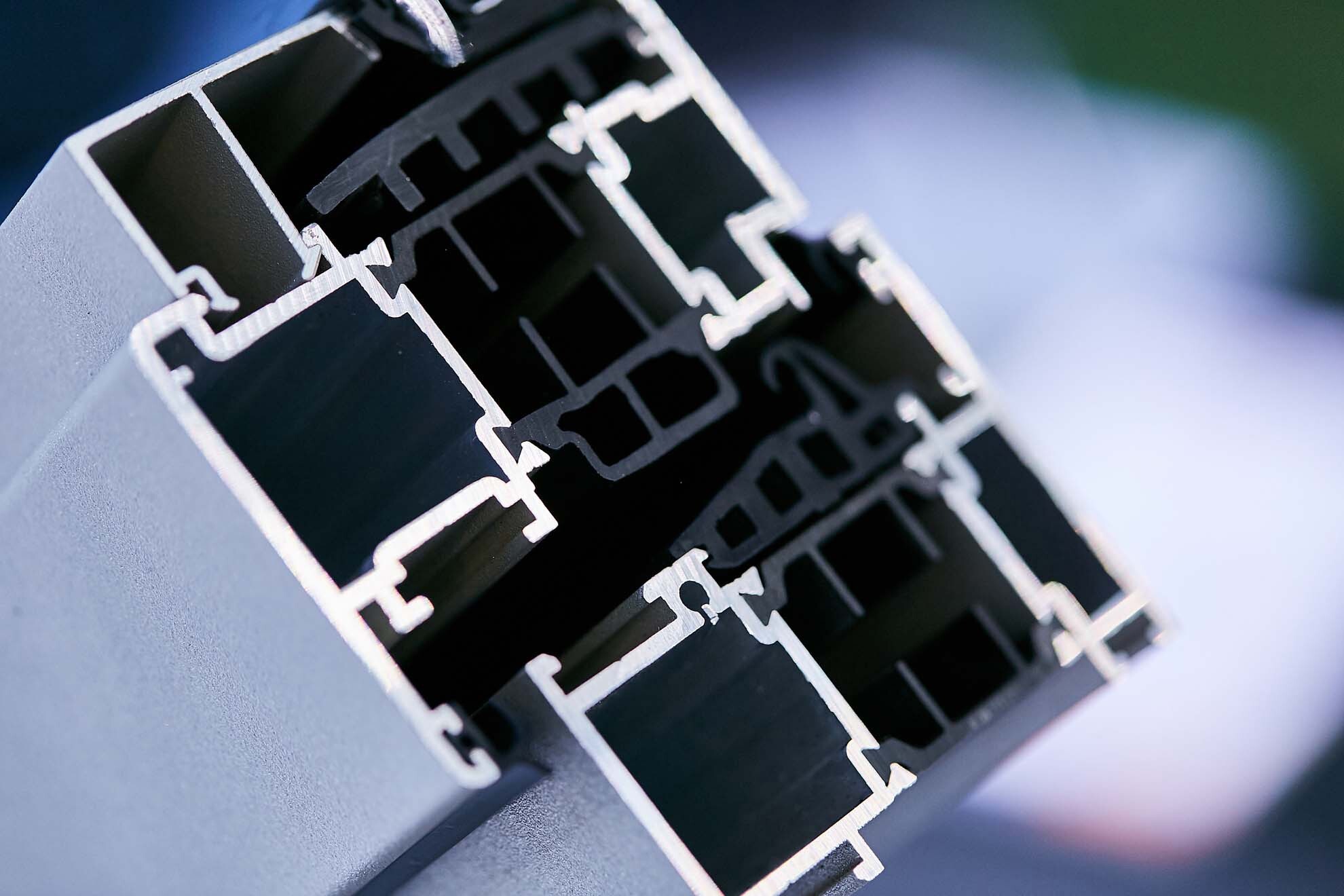

In the first three months of this year, producers of semi-finished aluminium products experienced a significant decline in volume, with some cases falling by double digits. The total production was just over 571,000 tonnes, marking a 6 per cent decrease. Among these, manufacturers of rolled products saw a relatively moderate decline of 5 per cent, producing around 448,000 tonnes. On the other hand, the production of extruded products experienced a much sharper drop, falling by 13 per cent to just under 124,000 tonnes.

German manufacturers are experiencing growing competitive pressure from third countries, particularly Turkey, in the aluminium extrusion sector. A decade ago, German manufacturers held just under half of the market share in Germany. However, by the first quarter of 2024, this share had declined to slightly more than one-third. Currently, the largest importers to Germany are Turkish manufacturers, whose market share has increased to approximately 10 per cent in recent years.

Van Gils commented, "We do not shy away from competition and are in favour of free trade. German industry depends on open markets like hardly any other. But competition must take place on fair terms. The flood of imports from Turkey at least raises questions about a level playing field. It is not without reason that the USA has initiated an anti-dumping procedure here. State interventions can affect energy supplies, financing conditions or tax breaks. In addition, Turkish extruders benefit from discounted access to Russian primary metal while we are making every effort to become independent of it - that alone is morally highly questionable."

The post-pandemic resurgence of the aluminium extrusion market has generated significant excitement and interest. Looking forward, the demand for aluminium extrusions is expected to increase further. For comprehensive insights into the European aluminium extrusion sector, as well as the global market, access AL Circle's latest industry-focused report, "The World of Aluminium Extrusions - Industry Forecast to 2030."

Responses