Tariffs on aluminium extrusions dismissed: US ITC's decision brings reimbursement for importers

In a rare move, the United States International Trade Commission (ITC) denied countervailing and anti-dumping duties on aluminium extrusion imports from 14 countries, including China, India, Mexico, and the United Arab Emirates. This ruling effectively halts cases aimed at imposing tariffs on aluminium extrusions, a material vital to numerous industries, including residential construction, HVAC, and furniture manufacturing.

The decision ends countervailing and anti-dumping investigations and mandates that all duties previously collected by U.S. Customs and Border Protection will be refunded to importers. This outcome marks a significant win for American businesses, especially in the construction sector, as the absence of tariffs helps keep costs down for aluminium-dependent products such as windows, doors, and refrigeration systems.

The ITC’s ruling came after opposition from a coalition, which included the National Association of Home Builders (NAHB), urging the commission to reconsider the sweeping scope of tariffs that could raise costs for U.S. businesses and consumers. Tariffs, essentially taxes on imports, typically lead to higher domestic prices as businesses pass on additional costs to consumers.

The ITC rarely issues a negative determination once tariffs are in place, signalling that the commission did not find evidence that these imports harmed United States aluminium extrusion producers. While the ITC has yet to release a detailed report explaining the basis of its decision, the ruling stands as a reminder of the far-reaching effects of tariffs on the broader economy.

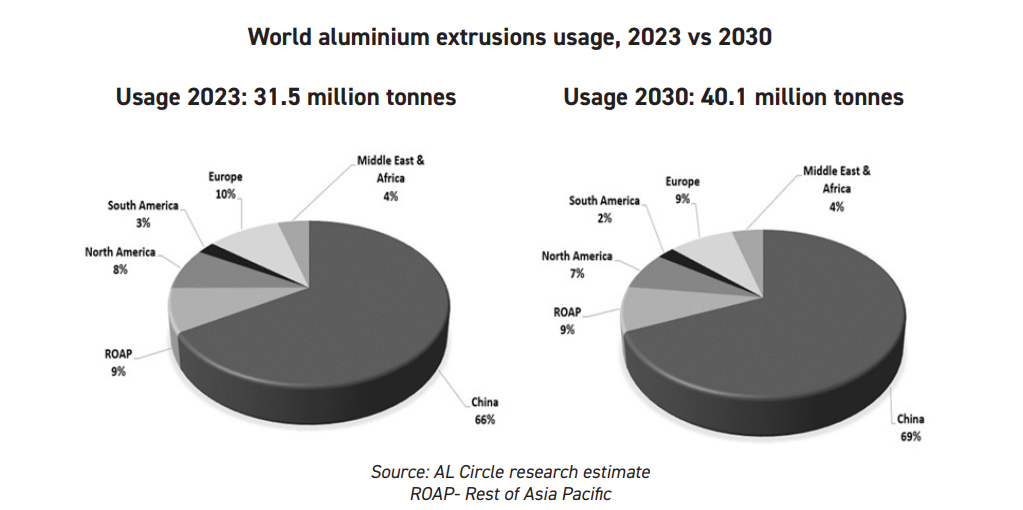

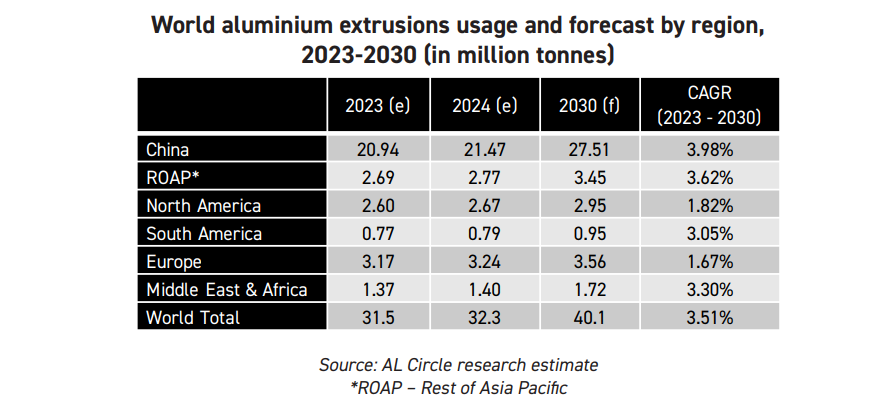

AL Circle’s latest industry-focused report, “Global Aluminium Extrusion—Market Analysis & Forecast to 2030,” revealed that North America currently commands approximately 8 per cent of the market share of aluminium extrusion usage, while Europe holds 10 per cent. The rest of the Asia Pacific region (excluding China) accounts for approximately 9 per cent, and China holds around 66 per cent.

Projections indicate an anticipated decline in market share for North America and Europe, whereas the Rest of the Asia Pacific region is poised for marginal growth over the forecast period. Factors such as construction initiatives in developing nations, the rapid expansion of the electric vehicle market, and the burgeoning renewable energy sector are expected to significantly contribute to the advancement of the extrusions market in the forthcoming years.

In 2023, North America’s usage of aluminium extrusion reached an estimated 2.60 million tonnes. This figure aligns with the region’s extrusion production capacity, which ranges between 3 and 3.2 million tonnes. In 2022, North America’s usage of aluminium extrusion was approximately 2.65 million tonnes. You can gain in-depth insights into aluminium extrusion usage across North America and other regions by obtaining a copy of the comprehensive report today.

However, coming back to the aluminium extrusion import tariff issue, the investigation, initially requested by the United States Aluminium Extruders Coalition and the United Steel Workers Union (USW) on October 4, 2023, concluded with the U.S. Department of Commerce announcing its findings on September 27, 2024.

The group stated in a press release, “The United States Aluminium Extruders Coalition and the USW are surprised and disappointed by the split negative vote by the Commission and the surprising recusal of one of the Commissioners. The domestic industry has been and continues to be injured by unfairly traded imports and will evaluate all possible means at its disposal to address this injury.”

As United States manufacturers and consumers await further details, the decision brings immediate financial relief. It supports competitive pricing across a range of industries that rely on imported aluminium extrusion products.

Top image credit: Aluminium Extruders Council (AEC)

This news is also available on our App 'AlCircle News' Android | iOS

.gif/0/0)