The Natural Resource Governance Institute (NRGI), an independent non-profit organization dedicated towards improving countries' governance over their natural resources to promote sustainable and inclusive development, publicizes that “Natural resource-backed loans are loans surrounded by secrecy”. These loans are contributing to the debt levels profuse in Africa.

NRGI defined it, "a natural resource-backed loan is a mechanism by which a country can access funds in exchange for future flows of income from its natural resources, such as oil or minerals, or in exchange for repayment guarantees made up of these resources”.

NRGI investigated 52 natural resources backed-loans made during 2004-2018, amounted to $164 billion.

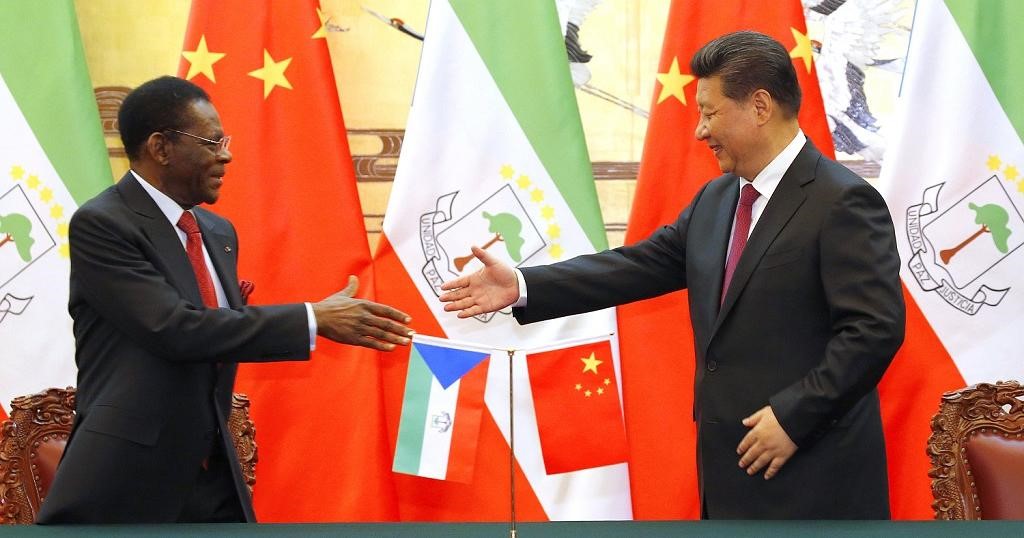

The sub-Saharan African country, Guinea in 2017, concluded a $ 20 billion bauxite barter deal with China. The deal states that China will build multi-sector infrastructure, road networks, sanitation, and a university building.

In repayment, the consortium of Chinese companies: China Henan International Cooperation Group, Chalco, China Power Investment Corp has obtained mining licenses and agreements.

The production mining by the Chinese companies has already been started as repayment of the loan.

Evelyne Tsague, Africa co-director of NRGI said: "African leaders have often contracted these loans to contribute to their short-term political ambitions, their countries finding themselves consequently heavily indebted and facing the risk of losing collateral worth more than the value of the loan itself.”

She also added: "They must avoid such risky deals, usually negotiated by mismanaged public enterprises that often bypass national parliaments and budgets.”

Responses