The US dollar on Wednesday fell against a basket its rivals, easing off one-month highs. LME base metals, except for lead, closed lower across the board on Wednesday. LME aluminium declined 1% and SHFE aluminium traded higher.

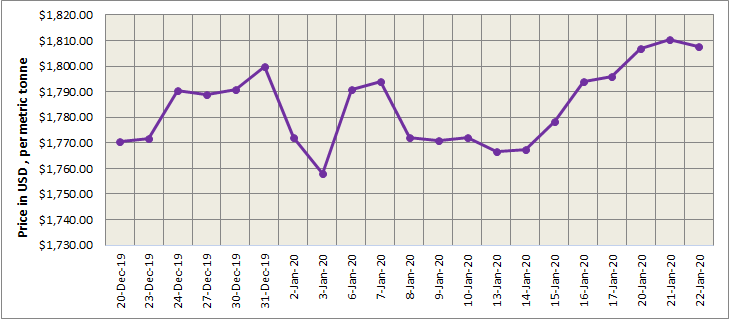

LME aluminium closed Wednesday’s trading at US$ 1807.5 per tonne, down from US$ 1810.5 per tonne. Three-month LME aluminium climbed to its highest in more than two weeks at US$1,834 per tonne on Wednesday, before it eased to end down 0.96% at US$1,809.5 per tonne.

{alcircleadd}

As on Wednesday January 22, LME aluminium cash (bid) price stands at US$ 1807 per tonne, LME official settlement price stands at US$ 1807.5 per tonne; 3-months bid price stands at US$ 1817 per tonne, 3-months offer price is US$ 1819 per tonne; Dec 20 bid price stands at US$ 1945 per tonne, and Dec 20 offer price stands at US$ 1950 per tonne.

The LME aluminium opening stock dropped to 1292500 tonnes. Live Warrants totalled 669275 tonnes, and Cancelled Warrants were 623225 tonnes.

LME aluminium 3-months Asian Reference Price is hovering at US$ 1823.06 per tonne.

SHFE Aluminium Price Trend

Benchmark aluminium price for SHFE (Shanghai Future Exchange) decreased to US$2052 per tonne on Thursday, 23 January 2020.

The most traded SHFE 2003 contract closed the day a tad lower at RMB14,165 per tonne. SHFE aluminium remains above the 10-day moving average, but its upside potential is limited by stagnated consumption ahead of the Chinese New Year holiday, Shanghai Metals Market reported. The most traded SHFE 2003 contract rebounded 0.35% overnight.

Responses