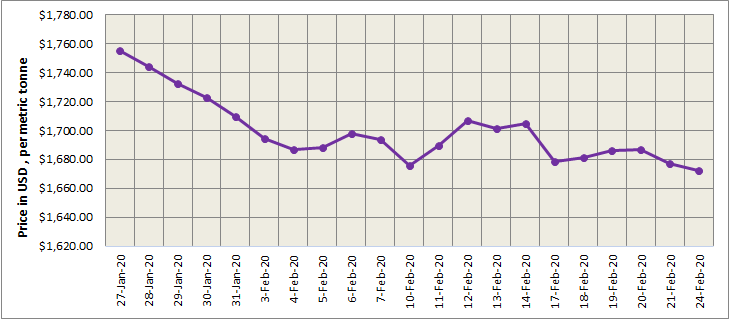

The US dollar continued to decline on Monday after a large bullish breakout last week, in a risk-off move spurred by the rise in coronavirus cases. LME base metals fell across the board last night. LME aluminium went down 0.7%.

Three-month LME aluminium slipped to a session low of US$1,690 per tonne. It then closed down 0.7% on the day at US$1,699 per tonne. The contract is likely to trade between US$1,680-1,720 per tonne.

{alcircleadd}

As on Monday February 24, LME aluminium cash (bid) price stands at US$ 1671.5 per tonne, LME official settlement price stands at US$ 1672.5 per tonne; 3-months bid price stands at US$ 1696 per tonne, 3-months offer price is US$ 1698 per tonne; Dec 21 bid price stands at US$ 1825 per tonne, and Dec 21 offer price stands at US$ 1830 per tonne.

The LME aluminium opening stock stood at 1127400 tonnes. Live Warrants totalled 799050 tonnes, and Cancelled Warrants were 328350 tonnes.

LME aluminium 3-months Asian Reference Price is hovering at US$ 1700.25 tonne.

SHFE Aluminium Price Trend

Benchmark aluminium price for SHFE decreased to US$1912 per tonne on Tuesday, 25 February 2020.

The most-active SHFE 2004 contract fell to a one-year low of RMB13,450 per tonne on Monday, before it recouped some losses to close the day 0.59% lower at RMB13,530 per tonne. Recent losses have sent the contract below all near-term moving averages, according to an SMM. The contract is likely to move within a range of RMB13,400-13,700 per tonne.

Responses