As per the reports, the global aluminium flat-rolled products market is expected to increase between 2023 and 2030. It is projected to reach a readjusted size of USD 159,230 million by 2028, with a Compound Annual Growth Rate (CAGR) of 4.8 per cent throughout the evaluation period. Based on AL Circle’s report, ‘Global Aluminium Industry- Key Trends to 2030,” extruded aluminium accounted for 32 per cent of global aluminium usage, followed by flat-rolled products at 25 per cent and castings at 23 per cent.

Flat-rolled products (FRPs) and wire rods individually accounted for 25 per cent and 8 per cent. Among the end-use sectors, transportation drove the usage by accounting for 27 per cent of the total, followed by building & construction at 23 per cent, packaging at 15 per cent, and electrical & electronics at 13 per cent.

The market size of aluminium flat rolled products was evaluated at USD 90.91 Billion in 2021 and may reach USD 166.4 Billion by 2030, with a compound annual growth rate (CAGR) of 6.95% from 2023 to 2030, as per the sources. The primary driving force behind the worldwide aluminium flat-rolled goods market is the increasing demand for these goods in the packaging and automotive sectors. Worldwide market growth is anticipated to be driven by the growing demand for aluminium flat-rolled products in the packaging industry, precisely due to the increasing use of flexible foil-based packaging in the food and beverage sector.

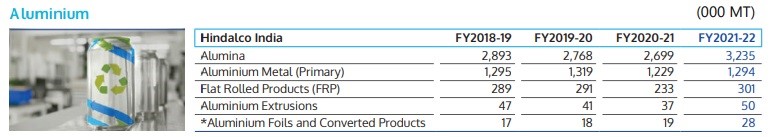

Hindalco and Novelis

Hindalco has become the world's biggest aluminium rolling manufacturer by acquiring Novelis, the worldwide leader in value-added high-end flat rolled products and recycling aluminium cans. As per the data, for the financial year FY2021-22, Hindalco produced 301,000 tonnes of aluminium flat-rolled products. On a Y-o-Y calculation, a surge of 87.09 per cent was witnessed compared to the FY2020-21. Novelis, the company's wholly-owned subsidiary, is the world's largest flat-rolled aluminium producer and recycler, with a rolling capacity of 4 million tonnes and a recycling capacity of 2.5 million tonnes.

Their aluminium sheet is made from the company's cast slabs or continuous cast coils, which are then rolled down to the desired thickness, gauge, and tolerances. Their operations are equipped with cutting-edge rolling mills and finishing equipment. The plant locations are Hirakud in Odisha, Belur in Kolkata, Mouda near Nagpur in Maharashtra, Renukoot in Uttar Pradesh, and Taloja near Mumbai in Maharashtra. Hindalco's activities in India include the whole value chain of aluminium production, including bauxite mining, alumina refining, coal mining, captive power generation, aluminium smelting, and downstream processes such as aluminium rolling, extruding, and foils of various specifications. This establishes our position as the biggest fully integrated aluminium player in India.

UACJ Corporation

The UACJ Group's overall production capacity is among the world's greatest, at over 1.5 million tonnes annually. The group's flat rolled products division includes four manufacturing sites in Japan, the United States, and Thailand, with annual output surpassing 300,000 tonnes each, enabling the UAJC to fulfil rapidly expanding demand for aluminium products. If we look at the results for FY2022, UAJC grew in its international sales volume, primarily driven by a rise in can stock sales at Tri-Arrows Aluminium Inc. and strong sales performance at UACJ (Thailand) Co., Ltd. The UACJ Group's overall volume of flat-rolled goods had a year-on-year growth.

Consequently, the sales in the Flat Rolled Products Business amounted to ¥850,918 million, reflecting a 22.0 per cent year-on-year growth. This may be attributed to the rise in the price of aluminium ingots compared to the previous year and an overall increase in sales volume. The operating income was ¥23,337 million, representing a decrease of 63.6 per cent compared to the previous year. This decline may be partly attributed to the negative effect of inventories, notwithstanding the positive impact of an increase in net sales.

On the other hand, for the second quarter ended September 30, 2023, the Group's overseas sales volume decreased year on year due to declines in can stock at Tri-Arrows Aluminium Inc. and UACJ (Thailand) Co., Ltd., resulting in a year-on-year fall in the UACJ Group's overall volume of flat-rolled goods. As a consequence of the above, revenue in the Flat Rolled Products Business was 374,265 million (down 15.8% year on year), owing to lower sales volume and lower aluminium ingot pricing. Operating income was $16,565 million, a 6.9% decrease yearly, owing to lower sales volume and the negative effect of inventories.

Constellium

Headquartered in Amsterdam, Constellium is a key player in the aluminium rolling industry, specialising in high-value-added aluminium products and solutions mainly for aerospace, automotive, and packaging applications. The company's sophisticated aluminium solutions assist worldwide automobile manufacturers in producing lighter, safer, and more fuel-efficient cars while saving money for aerospace firms of all sizes. Constellium, on the other hand, is the name that dominates the European market, from beverage cans and food cans to luxury packaging.

As per the data, the company's value-added revenue (VAR) saw a 5 per cent Y-o-Y rise to €704 million during Q3 2023, driven by improved price and product mix. From January to September 2023, it closed at €2,243 million, up by 11 per cent from €2,029 million. Constellium shipped 261,000 tonnes of packaging and automotive rolled goods in the third quarter of 2023, a 2 per cent decrease from the previous year. Shipments have totalled 792,000 tonnes this year, a 5 per cent decrease from 835,000 tonnes during the same time the previous year. Revenue fell 16 per cent in the third quarter to €954 million and 17 per cent in the first nine months to €3,033 million.

Assan Alüminyum

One of the world's leading manufacturers in the flat-rolled aluminium (FRP) industry, Assan Alüminyum has been producing coil & sheet, foil, and pre-painted aluminium products, supplying a wide range of industries including packaging, distribution, construction, consumer durables, automotive, and HVAC. Assan Alüminyum, a Kibar Holding subsidiary, has an installed yearly capacity of up to 360 thousand tonnes at its manufacturing facilities in Istanbul and Kocaeli, Turkey. With a manufacturing capacity of up to 130 thousand tonnes, the firm is now one of Europe's two biggest aluminium foil producers.

Assan Alüminyum, in collaboration with its business partners, creates the future. The firm offers customised solutions to its clients based on its fundamental principles of dependability, adaptability, innovation, and sustainability. Assan Alüminyum aims to create long-term value by becoming more sustainable regarding the environment, governance, and social aspects.

At its renewable energy production plant in Manavgat, the firm generates clean energy at a rate equal to its manufacturing facilities' yearly electrical energy consumption. With its renewable energy output, Assan Alüminyum has obtained I-RECs (International Renewable Energy Certificates), allowing it to offset its scope 2 emissions entirely. The company's carbon footprint is reduced by recycling 100 per cent of indefinitely recyclable aluminium at its integrated recycling plant.

Assan Alüminyum aspires to become more sustainable and have the greatest continuous casting capacity in Europe and America by continuing expenditures costing over 100 million US dollars, which is expected to be completed in 2024.

Amag

Amag (Austria Metall AG) is the biggest name in the Austrian aluminium industry, whose product portfolio ranges from cast products to flat-rolled aluminium. The company provides strips, sheets, and panels to the aerospace, automobile, and construction industries and tailored solutions for purposes particular to each industry. These items are utilised in various sectors, including aerospace, automotive, mechanical engineering, packaging, electrical, sports industries, consumer goods, and architecture. AMAG Austria Metall AG, in collaboration with AMAG Rolling, runs the most advanced rolling mill in the Western world, producing products that match the highest standards. AMAG can respond swiftly and flexibly to client needs due to our closeness to customers via our sales firms or agents. The company is also known for producing more than 200 different alloys from all alloy families (1xxx to 8xxx).

In the first three quarters of 2023, AMAG Group's sales decisively surpassed the EUR 1 billion mark, totalling EUR 1,142.8 million (Q1-Q3/2022: EUR 1,353.9 million). Compared to the previous year, the reduced aluminium price and, in particular, the decrease in exports of aluminium rolled goods had a significant influence. Total sales by AMAG Group were 327,700 tonnes (Q1-Q3/2022: 341,500 tonnes).

Overall, current forecasts of demand patterns indicate medium and long-term increase in demand for aluminium goods. With the exception of the transportation industry, demand for aluminium-rolled goods will fall in the near future (2023). The Casting Division is likewise forecast to achieve high capacity utilisation and, as a result, good profit performance for the rest of 2023. So far, the Rolling Division has effectively engaged in growing aircraft construction rates and consistent demand for automotive goods. The sluggish market is having a particularly profound influence on industrial applications and the sports and architectural industries.

Conclusion

The global aluminium rolling industry is dynamic and competitive, with several key players standing out for their exceptional performance and contributions to the market. As we explored the top 5 aluminium rolling companies, it is evident that each has unique strengths, technological advancements, and strategic approaches that have propelled them to the forefront of the industry.

These companies have demonstrated a commitment to innovation, sustainability, and customer satisfaction, significantly shaping the aluminium rolling landscape. As the industry evolves, witnessing how these companies adapt to emerging trends, challenges, and opportunities will be fascinating.

Responses