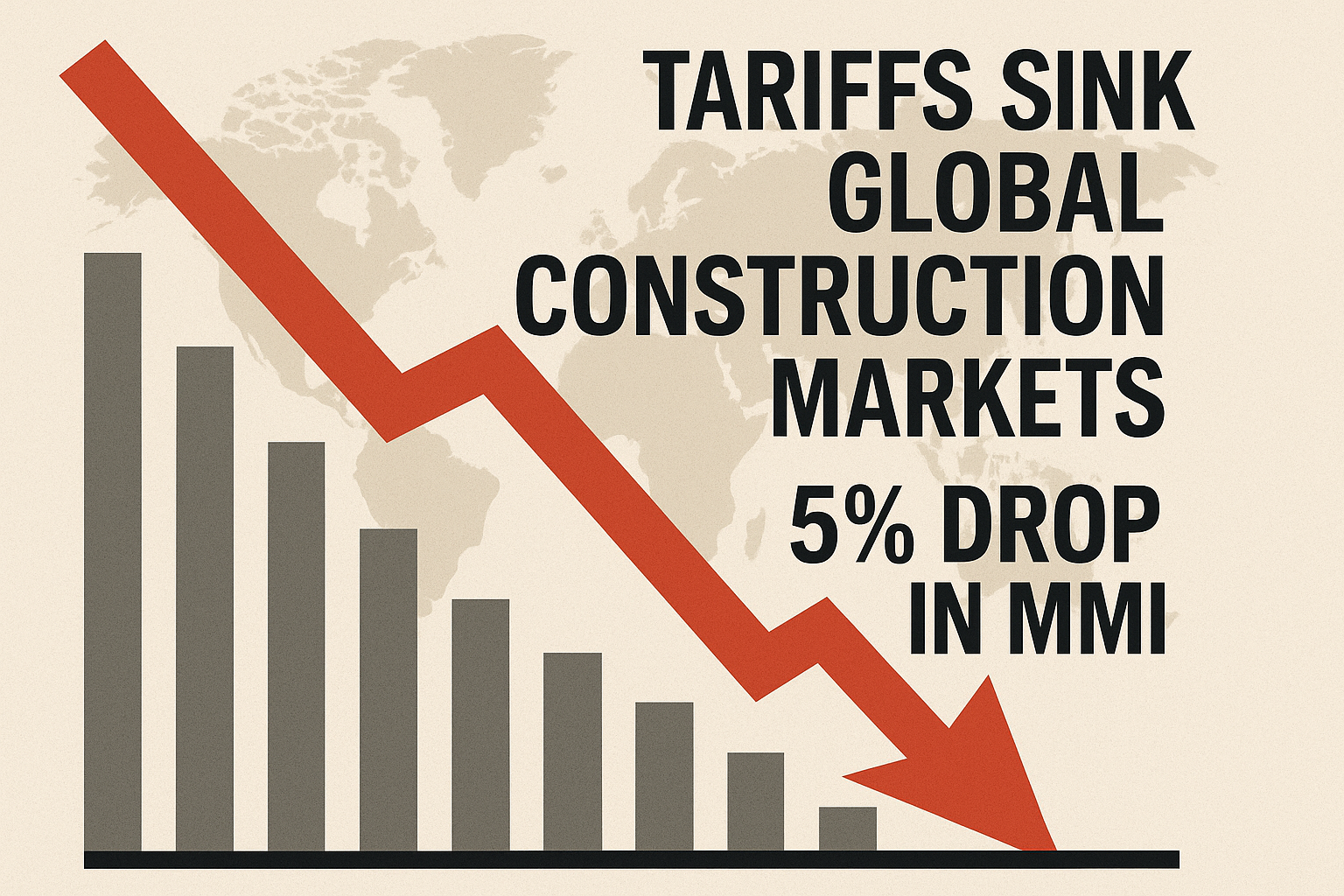

US President Donald Trump announced on April 16 a tariff escalation from the previously announced 145 per cent to a whopping 245 per cent that has evidently caught the global construction industry off-guard and, in turn, caused a ruffle in sourcing downstream (semi-finished) metals from the world’s largest aluminium-producing nation, China. Transnational builders are now in a rat race with the sudden slap of cost surges, which has reflected in a 5.41 per cent plunge according to MetalMiner’s April Construction Monthly Metals Index, tracking everything from H-beam steel to rebar.

This AI-generated image is for referential purposes only

Economists warn that the true sting lies in the unpredictability of the regime, deterring investment and complicating procurement strategies. Despite Treasury Secretary Scott Bessent branding the levels ‘unsustainable’ and market whispers of possible rollback talk, contractors remain on tenterhooks over erratic price swings that threaten project timelines and margins.

A sudden tariff tsunami

In February 2025, the administration imposed a 10 per cent blanket levy on all imports (excluding Canada and Mexico), immediately followed by targeted hikes under Section 232 that raised aluminium duties from 10 per cent to 25 per cent and reinforced 25 per cent steel tariffs. China struck back, triggering reciprocal measures, and by early April, Chinese-sourced construction metals faced a punitive 54 per cent duty — only to see US rates climb further to 145 per cent in a matter of weeks. The upshot is that the essential construction inputs from structural beams to finished fasteners now carry a hefty surcharge, which procurement teams had little time to budget for.

Metal prices have roared back to the forefront of contractors’ risk registers, wherein April’s MetalMiner index broke out of a six-month lull, with a signal to the renewed volatility for H-beam steel and rebar purchasers. Simultaneously, the US Producer Price Index flagged a sharp rise in industrial metals costs after just one month of tariff implementation. The Federal Reserve’s Beige Book underscores these trends, noting that builders from California to New York are reporting material price uncertainty and margin squeeze.

Procurement headaches run deeper than sticker shock. Swiss chemicals group Sika reported that mixed trade-policy signals have unsettled US building clients, with some projects deferred or shelved altogether as stakeholders await clarity. The Beige Book further warns of firms delaying capital investments and postponing small-scale projects amid the tariff rollercoaster. Even the trucking sector, pivotal for material logistics, forecasts flat volumes and rising spot rates as shippers rush to stockpile inventory ahead of potential further hikes.

Events

Events

e-Magazines

e-Magazines

Reports

Reports

Responses