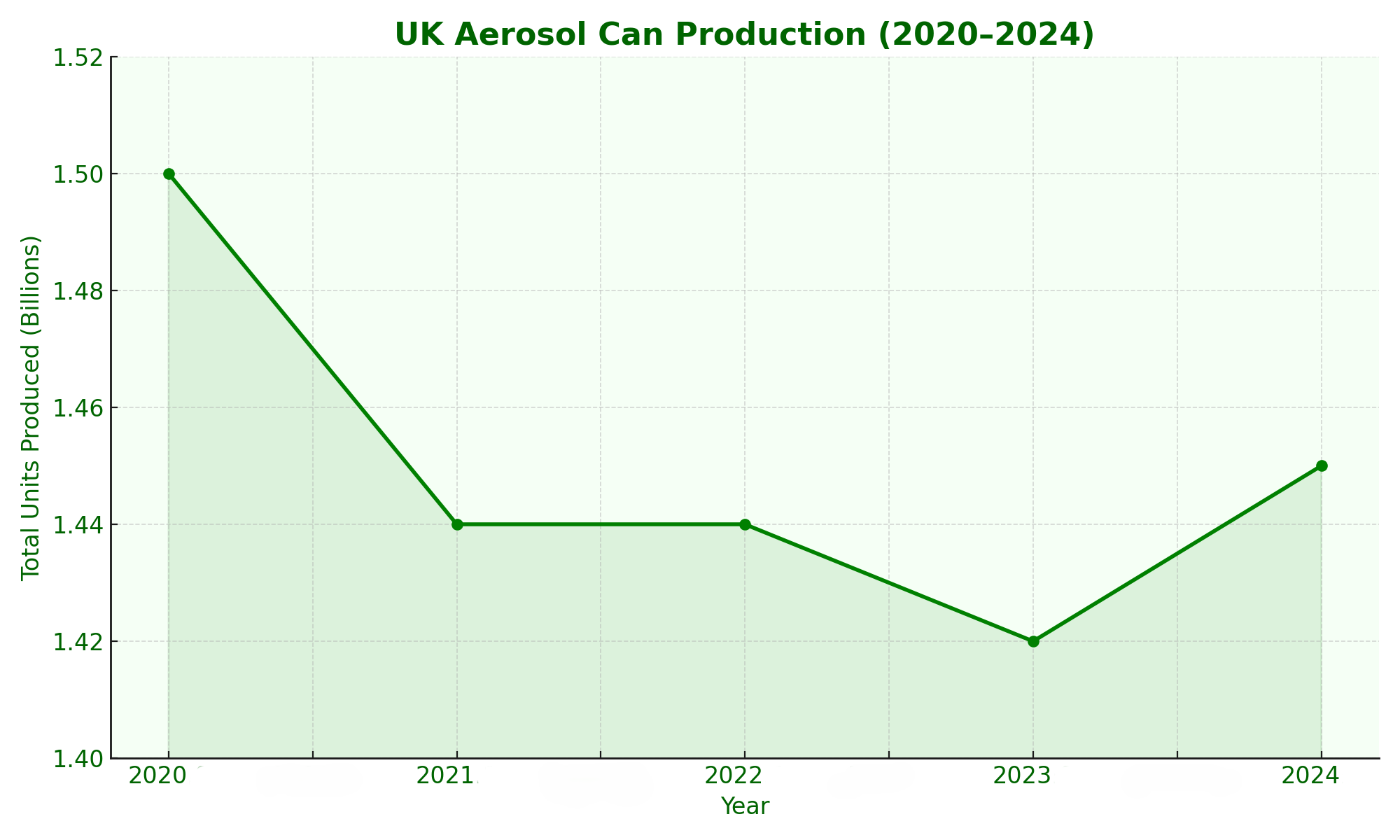

The United Kingdom aerosol industry marked a return to growth phase in 2024 after a three-years declining notion, with total production rising to 1.45 billion units, a 1.97 per cent increase over 2023. After a prolonged period of stagnation between 2021 and 2023, where production hovered around 1.44 billion units, this uptick signals renewed momentum for the sector. The figures, released by the British Aerosol Manufacturers Association (BAMA), are based on contributions from UK-based fillers and are considered a reliable snapshot of current market activity.

Alike world trend, UK’s personal care aerosols continue to dominate, accounting for approximately 75 per cent of all fillings in 2024. According to retail sales data from Kantar World Panel, this category saw a 3 per cent increase over the previous year.

Within personal care, deodorants rose by 2.9 per cent, antiperspirants by 5 per cent, and tanning and suncare aerosols surged by 22.5 per cent, the latter likely driven by rising consumer interest in skincare and outdoor leisure. For the first time in years, shaving preparations also saw growth, suggesting a shift in grooming habits and perhaps the start of a category revival.

The retail data from Kantar, which tracks aerosol sales in the UK from 2015 to 2024, reveals a gradual consumer shift from body sprays to more functional deodorants and antiperspirants. With a broader range of antiperspirants available on the market, consumers appear to be trading up for higher-performance products. This trend is mirrored in the dramatic rise in suncare aerosols, which grew from just 1,342 units in 2015 to 5,322 in 2024, reflecting increased sun safety awareness and travel activity.

Conversely, the household aerosol segment has slowed compared to 2023. A sharp drop in air freshener fillings was reported, as alternative in-home fragrance delivery formats, such as diffusers and electric devices, continue to gain favour.

Additionally, demand for furniture polish aerosols declined, a trend BAMA attributes to the rising use of manmade materials in furniture manufacturing, which typically requires less traditional care. However, some of this downturn may be statistical rather than actual, as distinct DIY and automotive aerosol products have been reclassified under different industry segments this year.

Events

Events

e-Magazines

e-Magazines

Reports

Reports

Responses