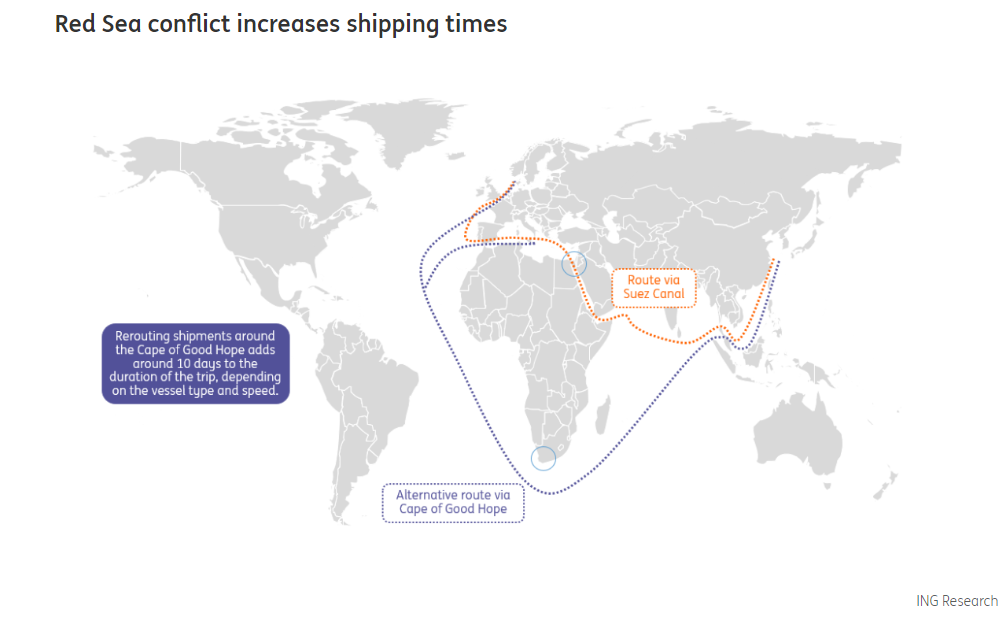

Terrorist group attacks on commercial vessels navigating through the Red Sea have prompted some shipowners to opt for the longer and costlier route via Southern Africa instead of the Suez Canal and the Red Sea. The recent intensification of these attacks has heightened concerns, with tensions showing no signs of abating.

This reluctance among shipowners has disrupted the flow of steel and aluminium into Europe, typically transiting through the Suez Canal, by 775,000 tonnes per month, equivalent to 9.3 million tons per year, as reported in some industry data.

Let’s check from Maersk

The Danish shipping and integrated logistics company Maersk has recently announced that the Red Sea crisis may endure until the latter half of 2024, and they are advising customers to make necessary preparations for this potentiality.

Charles van der Steene, the President of Maersk North America, said, "Unfortunately, we now believe that the situation in the Red Sea will not change quickly, and diversions could continue into the second or third quarter. We advise customers to adapt their supply chains to longer transit times."

According to van der Steene, US companies are currently grappling with three major challenges in their supply chains:

Shippers actively seek alternative routes to tackle these issues and mitigate the increasing transit time and costs.

van der Steene highlighted the ports in Mexico, the Pacific Northwest, as well as Los Angeles and Long Beach, are expected to handle a portion of the freight destined for the East Coast. He emphasised Mexico as a particularly promising opportunity, attributing this to the trend of nearshoring, where products once manufactured in China are now being produced closer to home. Recent trade figures from the U.S. government indicate a significant shift, with Mexico surpassing China as the nation's largest trade partner for the first time in decades.

Maersk has recently announced an acceleration in freight flow for East Coast trade originating from Oceania (Australia and New Zealand) by opting to transport containers via rail instead of waiting for passage through the Panama Canal. This decision comes amidst drought restrictions that have limited the number of vessels permitted for daily transit through the canal, prompting Maersk to seek alternative routes for efficient cargo movement.

van der Steene added, “The concern of Panama hasn’t gone away. It has stabilized in the sense that people know what to expect, but we don’t know if this might potentially be recurring on an ongoing basis in the future. As a result, we’re actively looking to potentially have a better West Coast approach that would somehow mitigate the risk of the throughput being reduced on an ongoing basis.”

What Hapag-Lloyd stated

Rolf Habben Jansen, the CEO of Hapag-Lloyd, has expressed that the ongoing Red Sea crisis shows no signs of swift resolution, compelling shipping companies to continue avoiding routes through the Suez Canal.

He suggested that a political accord and establishing a mission to safeguard cargo vessels could lead to a resolution within six months. Jansen underscored its importance by emphasising the significance of the EU's active endorsement of a multinational naval coalition to safeguard commercial traffic in the area.

Jansen highlighted that rerouting ships around Africa adds an extra two to three weeks to their journey, decreasing the volume of twenty-foot equivalent units (TEU) transported. To address this transportation time issue, options such as acquiring more containers to enhance TEU capacity and increasing ship speed with additional fuel expenditure could be considered, albeit at the expense of higher customer costs.

EU’s Red Sea protective mission

The European Council has initiated a mission aimed at ensuring the preservation of freedom of navigation in the Red Sea and the Gulf region. This safeguarding effort extends to critical maritime routes such as those passing through the Baab al-Mandab Strait and the Strait of Hormuz, as well as international waters in the Red Sea, the Gulf of Aden, the Arabian Sea, the Gulf of Oman, and the Gulf.

Paolo Gentilloni, the EU Economy Commissioner, noted that as a consequence of the crisis in the Red Sea, delivery timelines between Asia and the EU have been extended by 10 to 15 days, resulting in a staggering 400 per cent increase in costs.

Responses