The global demand for aluminium picked up in the first three months of 2018. RUSAL estimated that global aluminium demand increased by 6% in 2017 to 64 million tonnes amid coordinated economic growth in major regions of the world, while robust demand growth left the global aluminium market in a deficit of around 1 million tonnes.

Global primary aluminium production came in at 15.7 million tonnes in the first quarter of this year, according to World Aluminium Institute.

{alcircleadd}A global disruption in aluminium supplies and trade issues had raised the prices of aluminium in April, and hence higher profits for the company. Series of events like the United States’ tariffs on imported aluminium and steel, followed by the sanctions on Russian aluminium giant Rusal blew a storm to create price upheaval. The global primary aluminium production have not yet affected by US sanctions, but, have caused unprecedented price volatility in alumina and aluminium prices.

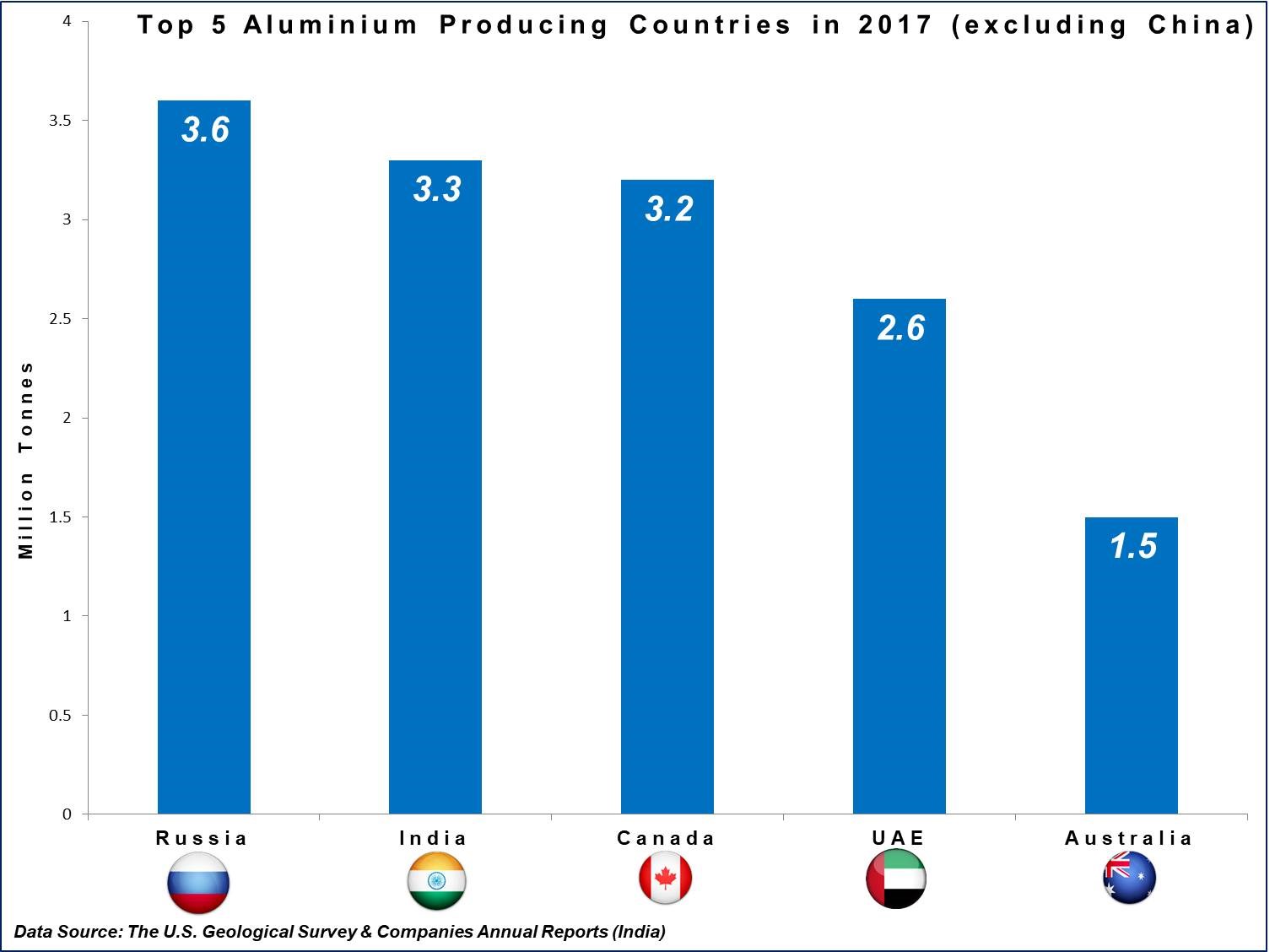

According to the US Geological Survey, world aluminium production increased in 2017 to reach 60 million tonnes compared to 58.9 million tonnes in 2016. Most of the aluminium production came from Asia in 2017.Russia continued to maintain its top position in the world outside China. Russia is followed by India and Canada.

Here is the list of top 5 primary aluminium producers of the world excluding China:

Russia ranked as the world’s largest producer of primary aluminium in 2017 outside China. The country produced 3.6 million tonnes of aluminium in 2017, the US Geological Survey reports. Leading aluminium producer RUSAL reported a total aluminium production of 3.7 million tonnes in 2017.Rusal accounts for about 6% of the global aluminium production.

India holds the second position in the list of top 5 primary aluminium producers in the world. According to the annual reports of the three major aluminium producers in India, the total aluminium production stood at 3.3 million tonnes in 2017. Aluminium production in the country is currently outpacing the demand leading to an increase in exports.

India’s aluminium production is mostly dominated by the three leading companies- Vedanta, Hindalco and Nalco. Vedanta Resources reports record aluminium annual production of 1.7 million tonnes for the full Year ended 31 March 2018, 38% higher y-o-y on account of ramp up of additional pots at the Jharsuguda-II smelter and complete ramp up of BALCO-II smelter.

Hindalco Industries Ltd posted 2% increase in aluminium production in FY2018 as compared to the previous year. The company achieved record production of aluminium at 1.2 million tonnes

Nalco’s aluminium production has consistently been increasing over the last 5 years and achieved highest cast metal production of 0.426 million tonnes in FY 2017-18, registering a growth of 10% over last year.

Aluminium production in Canada remained unchanged from 2016 to 2017; in both years, the country’s aluminium production was 3.21 million tonnes in 2017. Rio Tinto Alcan, Alcoa and Alouette are the three primary producers in Canada. Québec is home to eight smelters with a combined production capacity of 2.9 million tonnes of primary aluminium, representing 90% of Canada's production. Kitimat aluminium smelter in British Columbia operated by Rio Tinto is one of the largest manufacturing complexes in the province.

United Arab Emirates, the fourth largest aluminium producing country in the world, produced 2.6 million tonnes of aluminium in 2017, from 2.5 million tonnes in 2016.

Emirates Global Aluminium, one of the world’s five largest primary aluminium producers and is the largest aluminium producer in the Middle East, achieved record production of 2.6 million tonnes of primary aluminium. EGA operates aluminium smelters in Abu Dhabi and Dubai. The company’s Jebel Ali smelter has seven potlines and a nameplate production capacity of over 1 million tonnes of aluminium per year.

Australia, the world’s 5th largest aluminium producing country, produced 1.49 million tonnes of aluminium in 2017, down from 1.63 million tonnes in 2016.

Rio Tinto’s Boyne Smelters Limited is the largest aluminium smelter in Australia. The smelter produces in excess of 570,000 tonnes of aluminium annually. Last year, the company reduced production at its smelter due to higher power prices in Queensland.

The tariffs and sanctions imposed by the USA are expected to have no major impact on the global aluminium production in 2018. In fact, the global aluminium production is projected to increase this year.

Hydro’s President and CEO Svein Richard Brandtzæg expects a balanced market outlook for primary aluminium in 2018, and a 2018 global demand growth outlook of 4-5%, driven by solid demand for aluminium from automotive and construction market.

Responses