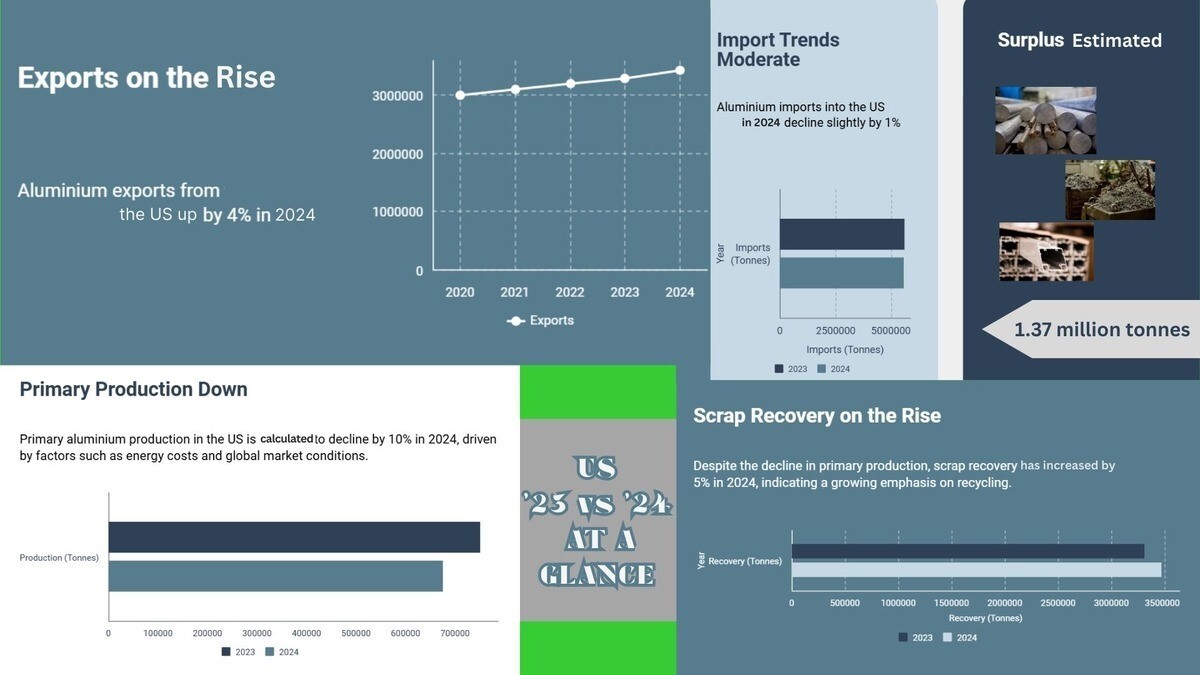

The United States’ 2024 aluminium market has further demonstrated a clear shift from primary to secondary sector, as evidenced by a Y-o-Y drop in primary metal production and a rise in scrap recovery. According to the United States Geological Survey, the country’s primary aluminium production recorded a decline of 9.92 per cent from 750,000 tonnes in 2023 to 675,600 tonnes in 2024, while its scrap recovery increase by 4.83 per cent from 3.31 million tonnes to 3.47 million tonnes.

Monthly production trend

While analysing the monthly trend this year, it is observed that the United States primary aluminium production ranged between 52,000 and 57,000 tonnes, following a peak in the first month of the year amounting to 63,000 tonnes. Similarly, scrap recovery was mostly around 292,000 to 299,000 tonnes, with a peak of 302,000 tonnes in March.

However, it is interesting to note that the United States scrap recovery in the first half of 2024 was way higher than it was in the second half. According to USGS data, the scrap recovery in H1 totalled 1.763 million tonnes compared to 1.71 million tonnes in H2 2024.

Also, the United States primary aluminium production in H1 was less than in H2. In H1, the output of primary aluminium was 339,000 tonnes versus 336,600 tonnes in H2. However, the overall decline in the United States primary aluminium production in 2024 could be attributed to electricity cost surge. As of May 2024, industrial electricity prices amounted to USD 7.95 cents per kilowatt-hour, up from USD 7.82 cents per kilowatt in the previous month, according to S&P Global.

The average daily production of primary aluminium through 2024 was 1,850 tonnes per day - 10 per cent less than in 2023 and 13 per cent less than in 2022.

Trade dynamic & metal surplus

Events

Events

e-Magazines

e-Magazines

Reports

Reports

Responses