On April 2, the Ministry of Commerce of the People’s Republic of China issued a announcing that the 25 per cent tariff on aluminium scrap imported from the United States would take effect immediately. China immediately imposed tariffs on all 128 products, citing public comments expressing support for the measures.

On March 23 Chinese Ministry of Commerce issued a notice soliciting public opinions and invited comments to be submitted by March 31. The ministry said, during the comment period, a large number of people expressed their support for measures and product lists. And the tariffs were implemented only after evaluating the feedback.

{alcircleadd}

Ministry of Commerce states, “In view of the lack of agreement between the parties, on March 29, China notified the WTO of the suspension of the concession list and decided to impose tariffs on certain products imported from the United States in order to balance the loss of profits caused by the U.S. 232 measures against the Chinese side.”

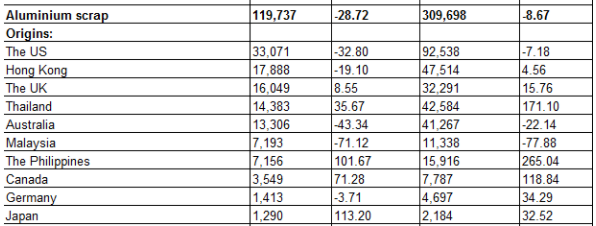

According to a Resource Recycling report, China is the single largest recipient of scrap aluminium exported from U.S. shores. Last year, the U.S. sent China nearly 820,000 tonnes of scrap aluminium and about 54 per cent of total U.S. scrap aluminium exports, valued at $1.17 billion. We see the import of aluminium scrap falling in February after the revised scrap policies in China:

A Recycling Today source said aluminium scrap buyers in China had been clearing shipments of zorba, twitch and other types of aluminium scrap during the brief comment period. The source also said some buyers were already considering purchases of scrap from Europe and other parts of the world.

According to statistics by Institute of Scrap Recycling Industries (ISRI), China’s scrap came from several nations, but considering the U.S. has been the world’s leading aluminium scrap exporter each year since at least 2005, a large percentage of China’s imports each year come from the U.S.

ISRI also said that Chinese tariffs on aluminium could apply to cargo that is already en route, although the organization has not received confirmation from the Chinese government. According to an update from Shanghai Metals Exchange, on April 3, 2018, 100 tonnes of aluminium scrap imports from the US for recycling was rejected at the Yangshan customs in Shanghai, only due to the fact that it requires paying 25 per cent import tariffs.

This is indicating how China's tariffs on aluminium could be especially damaging for the U.S. Despite a large domestic capacity for aluminium recycling and recovery of aluminium from scrap, the U.S. exported more than $1 billion-worth of aluminium scrap to China in 2017. With the imposition of 25% tariffs on imported aluminium, it is expected that Chinese buyers will be looking for other sources to buy scrap.

There is hardly any positive signal that the trade situations between the countries will improve any sooner. Analysts feel U.S. recyclers should turn to domestic markets , improve their scrap quality and look for alternative markets to export their scrap.

An update from Platts says the trade of secondary aluminium ADC12 alloy, used for automotive components, has not been affected by China imposing a 25% tariff on US scrap imports. Major Chinese ADC12 producers can still import US scrap for processing trade operation without paying the tariff. China's processing trade system, designed to promote export of value added products, allows Chinese companies to import raw materials from overseas without any tax, as long as the raw material is processed in China and exported.

Responses