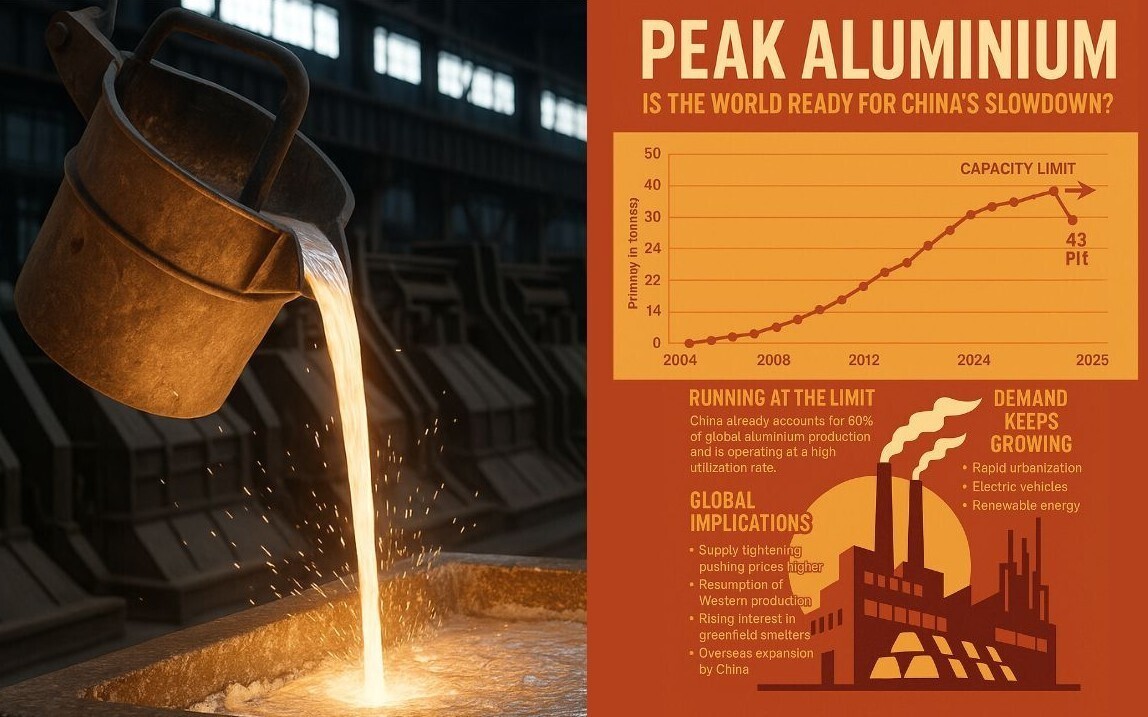

For the past two decades, China has dominated the global aluminium landscape with unparalleled force. From producing just 4 million tonnes in 2004, the country now commands a staggering 43 million tonnes of primary aluminium smelting capacity, accounting for 60 per cent of the world’s total. But now, in 2025, the dragon appears to be nearing its limits. As China approaches its government-imposed production ceiling with a 2.6 per cent growth rate during the first quarter of the calendar year, a monumental shift is on the horizon — one that could recalibrate global supply chains, trade dynamics, and pricing structures.

Image for representational purposes

If China’s aluminium production growth rate progresses in a similar pattern, the national production will reach 44 million tonnes, just one million tonnes away from the set cap. Thus, the aluminium world rightfully asks: What happens when China peaks?

The concept of ‘peak production’ isn’t new. Borrowed from the world of oil economics, it describes the point at which production hits its maximum before an inevitable plateau or decline sets in, not due to lack of demand, but due to constraints like raw material availability, cost pressures, or environmental regulations. For China, all three are now converging.

The country’s bauxite reserves, the cornerstone of aluminium production, are running low. At current rates, domestic resources might only last another 11 years. Compounding this, since 2017, the Chinese government has enforced a hard cap of 45 million tonnes of annual aluminium production to combat overcapacity and reduce the sector’s higher carbon footprint.

Adding to the pressure are rising input costs. Prices for energy and alumina, the key intermediate product, have spiked, with alumina contracts on the Shanghai Stock Exchange recording sharp increases in late 2024. Meanwhile, technological innovation, while ongoing, hasn’t advanced quickly enough to counteract these structural challenges.

Running at the limit

China’s aluminium industry is already operating near full throttle. By February 2025, its smelting capacity had hit 45.81 million tonnes, with operating output at 43.64 million tonnes — a utilisation rate of over 95 per cent. With little room left to grow, analysts now believe the industry is brushing up against its absolute limits.

Events

Events

e-Magazines

e-Magazines

Reports

Reports

Responses