Chinese tech giant Xiaomi has officially entered the electric vehicle (EV) market by introducing its first electric car, the SU7.

The highly anticipated sedan is expected to leverage Xiaomi's popular phone operating system, marking a significant step toward the company's ambitious goal of becoming one of the world's top five automakers.

While outlining the company's big ambitions, Xiaomi CEO Lei Jun expressed the desire to create "a dream car comparable to Porsche and Tesla." Despite the challenges posed by a capacity glut and slowing demand in the global auto market, Xiaomi is determined to make a mark in the industry. The autonomous driving capabilities of Xiaomi cars are touted to be at the forefront of the automotive industry, promising a unique and advanced driving experience.

The SU7 will be manufactured by a unit of the state-owned BAIC Group in a Beijing factory with an annual capacity of 200,000 vehicles. Xiaomi's foray into electric vehicles is part of its broader strategy to diversify beyond smartphones, with a $10 billion investment earmarked for the automotive sector over the next decade.

As the electric vehicle market experiences rapid growth, Xiaomi is positioning itself as a key player, offering consumers a compelling alternative in the ever-evolving landscape of sustainable transportation.

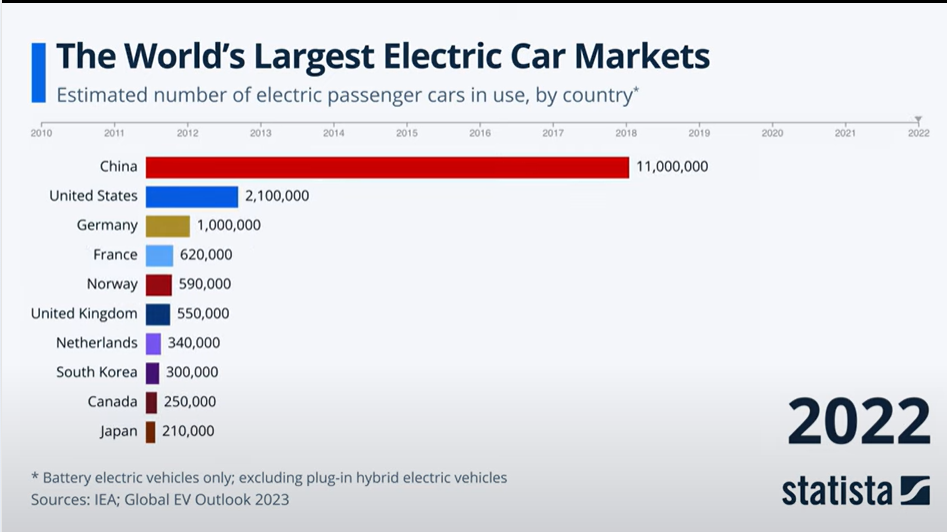

According to the graph below, China, the USA and Europe are the top producers of EVs. Let's take a look at their regional market scenarios.

China’s EV market trend:

China, standing tall as a frontrunner in the EV realm, has significantly broadened its global market presence, catapulting from under 30 per cent in 2019 to an impressive 41.5 per cent in 2022. Solidifying its position as the primary hub for EV production, China accounted for a robust 70 per cent of the global total in 2022, producing a staggering 7.1 million units.

The electric vehicle landscape has witnessed a remarkable ascent on the domestic front. EV sales in China surged from constituting 16 per cent of the domestic car market in 2021 to a substantial 29 per cent in 2022, amounting to a formidable 6.9 million vehicles.

This thriving market is categorised into battery-electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). Notably, BEVs dominated the scene, comprising nearly 77.9 per cent of total sales in 2022. Adding to the momentum, plug-in hybrid EV (PHEV) sales experienced an extraordinary year-on-year surge, registering an impressive 151.9 per cent increase.

China's EV landscape is expanding its global footprint and witnessing dynamic shifts in consumer preferences and the adoption of diverse electric vehicle technologies.

The USA EV market trends:

A recent survey by Ducker Carlisle predicts a surge in aluminium demand as EVs gain momentum. The report highlights the following key trends:

European EV trends:

A study commissioned by European Aluminium and Ducker Carlisle also indicates a notable increase in the average amount of aluminium used in European cars, rising from 174 kg in 2019 to 205 kg in 2022. Projections suggest a continuous upward trend, reaching 237 kg by 2026 and 256 kg per vehicle by 2030. This trend aligns with the broader industry push towards lightweight vehicles for improved efficiency and range.

The weighty impact of aluminium in EVs

Shifting gears to the automotive industry's materials evolution, aluminium has emerged as a star player. From its modest use of around 35 kg per car in the 1970s, today's vehicles boast almost 150 kg of aluminium. According to Frost & Sullivan, the average aluminium content in vehicles is projected to surge to 250 kg over the next five years, emphasising the material's increasing significance.

Research suggests that for every kilogram of aluminium used in a car, its overall weight is reduced by 1 kg. This weight reduction substantially impacts electric vehicles, translating into a potential 10-15 per cent increase in range for every 100 kg saved. This attribute significantly contributes to the broader goal of driving higher EV adoption among consumers.

Xiaomi's entry into the EV market and the concurrent surge in aluminium usage signal a transformative period in the automotive industry. As technological advancements and sustainability goals converge, the stage is set for a future where electric vehicles, coupled with innovative materials like aluminium, lead the way to a more eco-friendly and efficient transportation landscape.

Responses