Aluminium downstream operating rate continued to rise W-o-W; March peak season yet to be verified

This week, the operating rate of leading enterprises in China's downstream aluminium processing sector continued its mild post-holiday recovery, up 1.1 percentage points W-o-W to 59.8 per cent. By segment, the operating rate of primary aluminium alloy slightly increased WoW, with production momentum constrained by aluminium price corrections and inventory pressure.

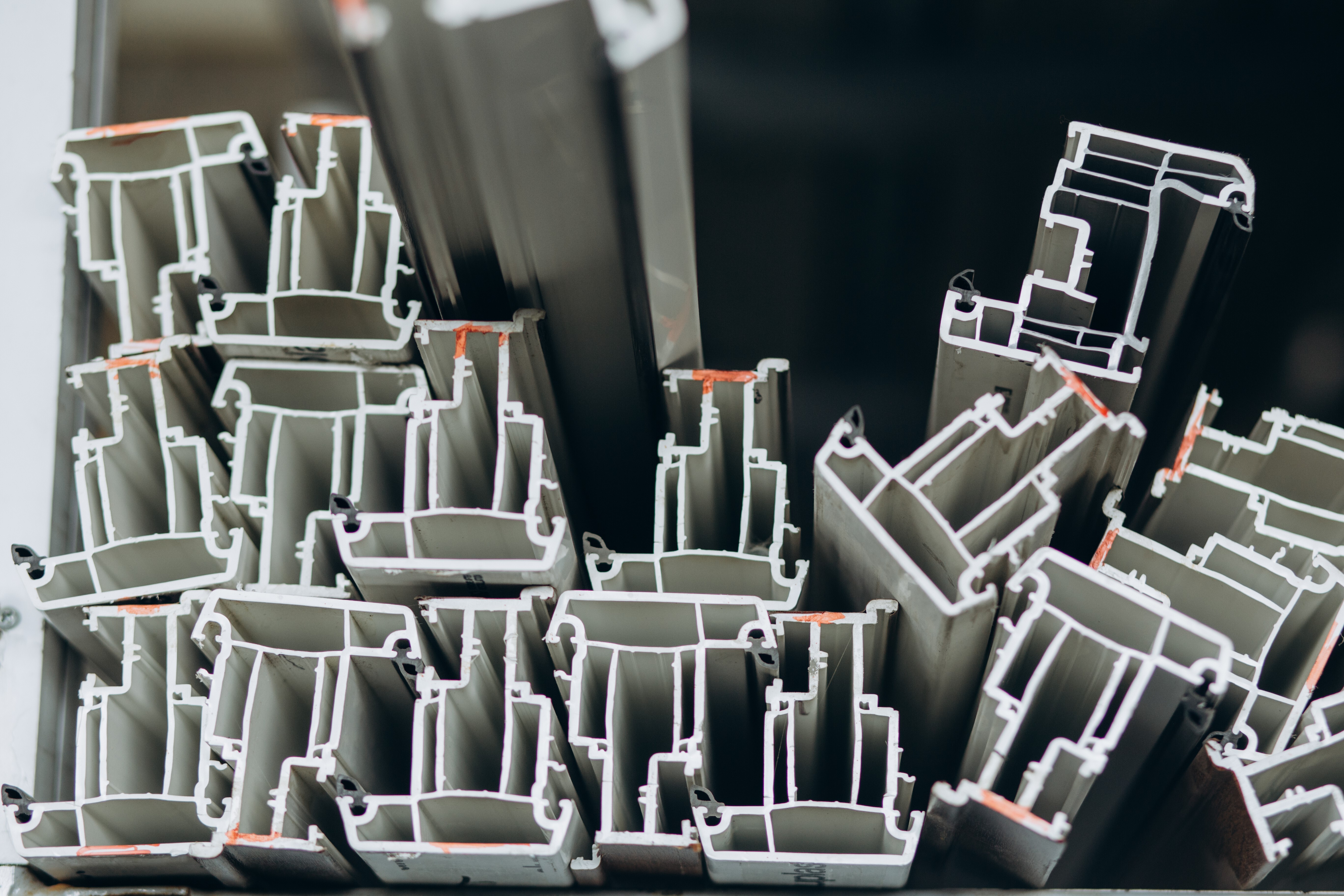

Aluminium plate/sheet and strip benefited from a rebound in automotive and battery demand, pushing the operating rate to 68.6 per cent, with further improvement expected under peak season expectations. The operating rate of aluminium wire and cable continued to rebound, supported by restocking demand, but struggled to rebound due to insufficient new orders. Aluminium extrusion saw a slight increase in operating rate, with industrial extrusion maintaining high prosperity, while leading enterprises in architectural extrusion resumed production quickly with quality orders, and small and medium-sized enterprises remained under pressure.

Aluminium foil operating rates improved, driven by increased orders for air-conditioner foil and battery foil. The operating rate of secondary aluminium alloy remained stable, with weak downstream demand leading to inventory accumulation and resistance to further increases.

Overall, downstream aluminium consumption showed slight divergence, with strong demand in industrial extrusion and plate/sheet, strip and foil, while architectural extrusion, aluminium wire and cable, and aluminium alloy faced weak recovery momentum due to insufficient end-user orders and inventory pressure.

Looking ahead to March, with the traditional peak season approaching, aluminium consumption is expected to continue recovering, and downstream operating rates are likely to maintain an upward trend, though the strength of the peak season remains to be seen. According to SMM forecasts, the operating rate of leading downstream aluminium processing enterprises in China is expected to rise by 0.7 percentage points WoW to 60.5 per cent next week.

Primary aluminium alloy: This week, the operating rate of leading primary aluminium alloy enterprises in China recorded 54.2 per cent, up 1.2 per cent W-o-W. Aluminium prices corrected from high levels this week, and primary aluminium alloy enterprises continued their steady recovery in operating rates. However, feedback among enterprises was mixed.

Over half of the enterprises reported stable production and normal output, with market demand improving compared to the first half of the month, though inventory digestion remained the primary focus. Some enterprises began executing March liquid aluminium volumes this week, leading to increased operating rates.

However, a few enterprises preliminarily predicted that early March would still be in the off-season, with high production uncertainty as post-holiday demand fell short of expectations, requiring further observation of downstream customers' plans at the beginning of the month.

By late March, the operating rate of downstream primary aluminium alloy enterprises is expected to continue its weak recovery trend, but inventory pressure at manufacturers persists. If demand fails to reach peak season levels, the industry's momentum for further production increases will remain insufficient. SMM expects the operating rate of primary aluminium alloy enterprises to continue a slow upward trend next week.

Aluminium plate/sheet and strip: This week, the operating rate of leading aluminium plate/sheet and strip enterprises rose slightly by 2.2 percentage points to 68.6 per cent. With the arrival of the peak season, demand for automotive and battery-related products showed relatively significant improvement, driving further increases in operating rates for some enterprises.

As the traditional peak season officially begins next week, attention should focus on whether end-use consumption can sustain this momentum. The operating rate of the aluminium plate/sheet and strip sector is expected to continue warming up WoW.

Aluminium wire and cable: This week, the operating rate of leading aluminium wire and cable enterprises in China reached 53 per cent, up 2 per cent WoW, with a steady pace of recovery. Downstream operations have largely resumed, and while there is post-holiday restocking demand, the industry's delivery cycle remains relatively relaxed, preventing a significant rebound in operating rates.

Notably, this week saw the official announcement of the winning candidate for the Qinghai agreement inventory, while other provincial grid orders have yet to be significantly disclosed. Following the tender for ultra-high voltage transmission and transformation orders, new orders in the industry have shown no substantial improvement. In the short term, the aluminium wire and cable industry remain weak, with a lack of momentum for operating rate increases. Attention should be paid to changes in the delivery schedule of State Grid orders.

Aluminium extrusion: This week, the operating rate of the aluminium extrusion sector in China recorded 52.5 per cent, up 1 percentage point WoW, continuing its mild post-holiday recovery. In the industrial extrusion segment, high prosperity persisted, with leading enterprises maintaining operating rates above 75 per cent.

The trend of automotive light weighing boosted extrusion demand, and new capacity ramp-ups in Jiangsu and Guangdong progressed smoothly. PV extrusion benefited from dual policy and market advantages, with leading enterprises reporting increased orders, according to SMM. Architectural extrusion showed clear stratification: top-tier enterprises quickly resumed production with quality orders from rail transit and municipal projects, achieving relatively saturated orders, while small and medium-sized enterprises focused on short-term projects such as residential renovations and stock project completions, maintaining low operating rates.

Notably, architectural extrusion enterprises are accelerating their transformation, with some shifting capacity to high-end sectors such as NEVs and 3C electronics, according to SMM statistics. With the advancement of "trade-in" policies and increased investment in new energy infrastructure, the share of industrial extrusion is expected to rise further. SMM will continue to monitor inventory trends, downstream demand changes, and the impact of industry and regional policies.

Aluminium foil: This week, the operating rate of leading aluminium foil enterprises rose slightly by 0.9 percentage points to 74.3 per cent. By product, air-conditioner foil, which is highly seasonal, showed the most significant recovery in orders as the peak season approached. Battery foil orders also saw substantial YoY growth, while packaging foil and other aluminium foil products remained relatively stable. Entering March, the operating rate of the aluminium foil sector is expected to continue rising.

Secondary aluminium alloy: This week, the operating rate of leading secondary aluminium enterprises remained flat WoW at 56.3 per cent. Operating rates at secondary aluminium plants have largely returned to normal levels, with stable operations throughout the week. However, the resumption pace of downstream die-casting enterprises fell short of expectations, with slow order recovery and downstream procurement focused on just-in-time restocking, leading to overall weak market transactions. On the supply side, while output increased significantly, insufficient downstream order follow-up resulted in continued accumulation of social and production site inventory. With the traditional consumption peak season approaching, caution is needed as the industry's operating rate may face downward pressure if end-use consumption recovery falls short of expectations.

Source: SM

This news is also available on our App 'AlCircle News' Android | iOS

.jpg/0/0)