On April 18, at the AICE 2025 SMM (20th) Aluminum Industry Conference and Aluminum Industry Expo - Industrial Aluminium Extrusion Forum, Yao Kexin, senior analyst of aluminium products at SMM, analysed the Chinese industrial aluminium extrusion market. According to him, China's aluminium extrusion supply and demand situation has experienced rapid development over the past decade, with promising prospects for lightweight extrusions required by NEVs and aluminium extrusions for PV applications.

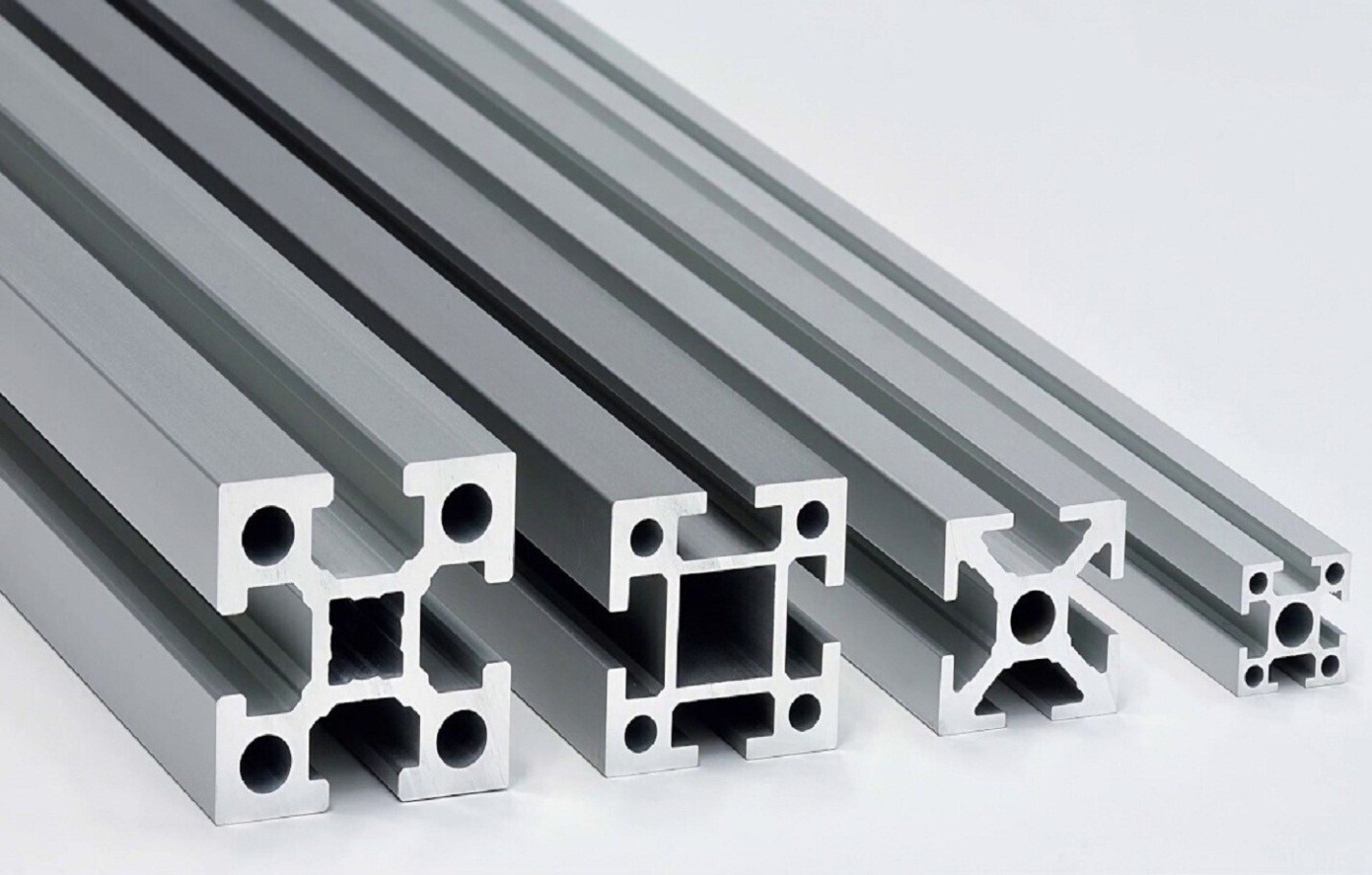

Image source: New Construction Aluminium

In the future, the demand for construction extrusions is expected to decline as the real estate sector slows down, while the demand for industrial extrusions will increase, with aluminium usage in PV, automotive, machinery equipment, and durable goods sectors growing year by year.

SMM analysis: China's aluminium extrusion industry has shown rapid growth over the past decade, and it is expected to rise slightly from 2024 to 2028. By sector, construction extrusions are projected to decrease slightly. Since 2022, the real estate industry has faced a severe downturn, with many domestic real estate companies experiencing credit contraction from multiple creditors, frequent project delays, and declining consumer confidence in home purchases, leading to a sharp drop in construction extrusion production.

Under recent macro policy adjustments in the real estate sector, downstream demand is expected to remain weak. Looking ahead, SMM predicts that construction extrusion production will show a slight downward trend, decreasing from 10.96 million tonnes in 2023 to 8.69 million tonnes in 2028, with an annual compound growth rate of -4.5 per cent. The PV industry has a bright future. After 2018, with the significant increase in aluminium usage in automotive, PV, and rail transportation sectors, many outdated capacities actively transitioned to industrial extrusions, revitalising the aluminium extrusion industry. From 2023 to 2028, SMM expects industrial extrusion production to rise significantly, from 9.88 million tonnes to 15.91 million tonnes, with an annual compound growth rate of 10 per cent.

China's aluminium extrusion demand analysis: The overall trend of China's aluminium extrusion downstream demand is upward. In the future, the demand for construction extrusions will decline as the real estate sector slows down, while the demand for industrial extrusions will increase, with aluminium usage in PV, automotive, machinery equipment, and durable goods sectors growing year-on-year.

Particularly for construction extrusions, demand was dragged down by the real estate sector, but the next two years will still be in a recovery and repair process. The usage of construction extrusions may continue to decline, although many construction extrusion companies are expanding high-value-added orders related to system doors and windows, the overall proportion is relatively small. Although there is some potential in niche markets, the overall demand for construction extrusions will be limited. In the future, as the construction extrusion industry clears out, many small enterprises will reduce or stop production, and new capacity investments will decrease.

On the other hand, industrial extrusions, PV extrusions, and transportation extrusions are the main demand areas, while general industrial demand will maintain slow growth. Since the domestic "carbon peak and carbon neutrality" goals were proposed, the PV industry has entered a policy environment of strong support and long-term friendliness. In the coming years, both domestic and overseas PV demand will be robust. With the urgent need for environmental protection and energy efficiency, internal combustion engine vehicles need to reduce fuel consumption and emissions to improve efficiency, while NEVs need to reduce weight and power consumption to increase driving range and competitiveness. Due to their high specific strength, high weight reduction rate, and excellent corrosion resistance, aluminium alloy extrusions are increasingly used in automobiles. The demand growth for general industrial extrusions will slow down in the coming years. General industrial extrusion products are relatively scattered, involving various fields. High-end sectors such as aerospace and military have higher requirements for alloy raw materials and extrusion processes, creating certain technical barriers. There are few domestic producers, and a small portion of demand still relies on imports, resulting in a tight supply-demand situation.

New energy-related demand remains the main growth driver transformation of China's aluminium extrusion enterprises dragged down by the real estate sector, some extrusion companies originally focused on construction materials are attempting to transition to industrial extrusions, with PV extrusions becoming the first choice. Recently, due to the slowdown in PV growth, some companies have adopted new CNC and extrusion equipment and engaged with end customers to attempt a transition to other industrial extrusion directions.

SMM Analysis: Considering the downturn in the construction industry, some extrusion manufacturers have started to transition to industrial extrusions in recent years. Due to the low technical barriers in PV extrusion production, it has become the first choice for many manufacturers. However, with the slowdown in the PV industry, many extrusion companies face the challenge of transitioning again to other industrial extrusions, such as automotive, ESS, and military sectors. In terms of equipment, some transitioning extrusion companies have added CNC machining centers and industrial extrusion machines. In terms of customers, extrusion manufacturers with transition intentions have also established connections with automakers, but becoming a supplier to automakers requires a lengthy certification process, which takes a long time. A typical example is Huajian Aluminum, which has expanded into the automotive extrusion market while cooperating with wind power companies to produce wind turbine component housings and operation platforms.

Note: This article has been issued by SMM and has been published by AL Circle with its original information without any modifications or edits to the core subject/data.

Responses