According to the Shanghai Metals Market, China’s domestic average alumina spot price has further increased for the fourth consecutive day towards the RMB 4,000 per tonne level. As of September 13, the price stands at RMB 3,968 per tonne, accumulating RMB 11 per tonne overnight and marking week-on-week increase of RMB 30 per tonne from RMB 3,938 per tonne.

Analysis of the market and unprecedented price rise

Over a month, the price has escalated by RMB 64 per tonne, and that over a year heightened by RMB 1,035 per tonne, breaking all the previous records. This unprecedented growth in China’s domestic alumina price could be attributed to the surging demand for alumina to support the ever growing capacity of primary aluminium reaching 43.49 million tonnes by the end of August. The rise in alumina price is further fueled by increased production costs due to tight availability of bauxite. China is already a home to more than 80 million tonnes of alumina capacity, leading to a struggle to source adequate bauxite to satisfy demand.

Among the major alumina markets, Henan and Shanxi have witnessed alumina price rise of RMB 20 per tonne. With the latest hike, alumina price in Shanxi has touched the level of RMB 4,000 per tonne, while the price in Henan is slightly away from the milestone, standing at RMB 3,975 per tonne.

The Australian alumina FOB price has also increased on September 13 by RMB 6 per tonne to US$ 545 per tonne, marking a record high.

Effect on A00 aluminium ingot price

The relentless increase in alumina spot price has recently stirred the market dynamics for primary aluminium prices. Over the past one month, China’s domestic A00 aluminium ingot price has been demonstrating a volatile trend, rising significantly by RMB 770 per tonne from RMB 18,990 per tonne on August 13 to RMB 19,760 per tonne on September 13. Today, the prices are expected to range between RMB 19,740-19,780 per tonne, with spot contract to be traded at a discount price of RMB 10 per tonne and a premium price of RMB 30 per tonne.

Among the Chinese provinces, Wuxi and Hangzhou have witnessed a hike of RMB 170 per tonne to RMB 19,750 per tonne and RMB 19,760 per tonne, respectively. Foshan has seen an increase of RMB 160 per tonne to RMB 19,660 per tonne, while Chongqing and Tianjin have experienced a growth of RMB 150 per tonne to RMB 19,710 per tonne.

China’s low-carbon aluminium price has expanded by RMB 162 per tonne to close the week at RMB 20,595 per tonne, reflecting a staggering W-o-W rise of RMB 513 per tonne. High purity aluminium (99.99% and 99.96%) prices have increased by RMB 200 per tonne, reaching RMB 26,800 per tonne and RMB 27,800 per tonne.

According to the Trafigura Group, a key player in the commodity market, has cautioned that the unprecedented surge in alumina price is altering the outlook for primary aluminium prices. According to their obeervation, the alumina price has skyrocketed by 50 per cent in 2024, reaching its highest level since March 2022. This escalated cost of alumina is placing significant financial pressure on smelters that don't have their own supply, potentially straining the broader industry. As a result, this trend is causing many aluminum smelters to be concerned about the long-term stability of production costs.

Other input costs

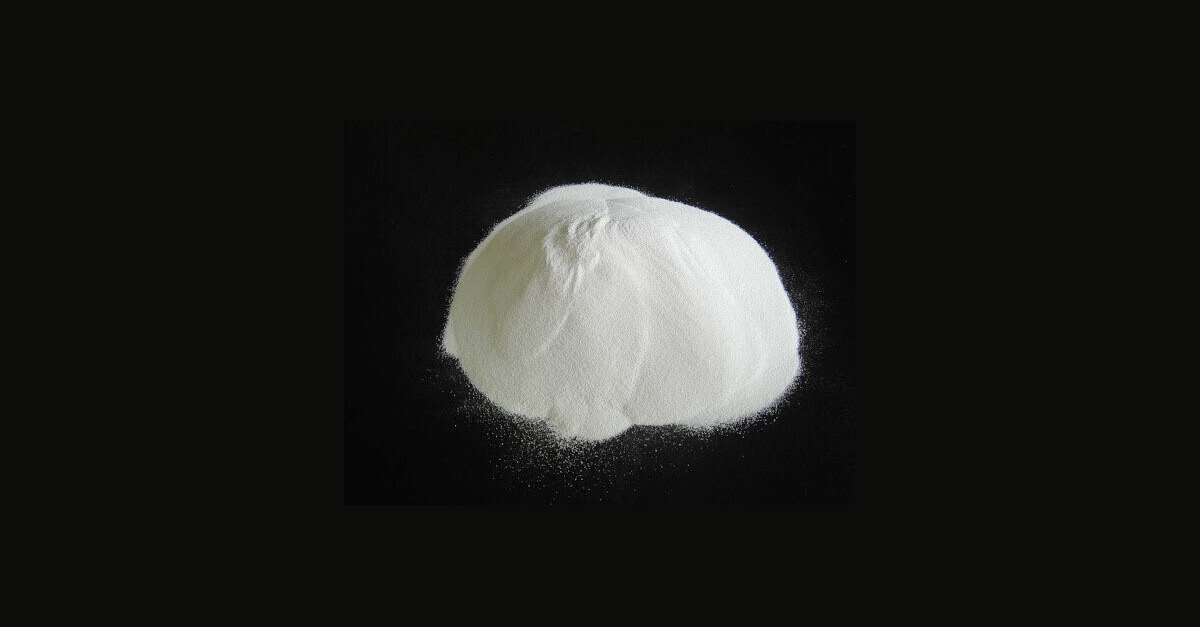

Among other primary aluminium raw materials, aluminium powder price has inched up by RMB 0.2 per kg to stand at RMB 22.4 per kg, with average prices to range between RMB 22.3-22.5 per kg, found SMM.

Responses