India: Aluminium ADC12 alloy ingot prices inch up w-o-w on rising raw material costs

India's ADC12 non-OEM prices experienced a slight rise of INR 1,000/t ($12/t) w-o-w due to higher raw material costs. However, demand for aluminium ADC12 remained sluggish in the domestic markets of Delhi-NCR and Chennai.

{alcircleadd}

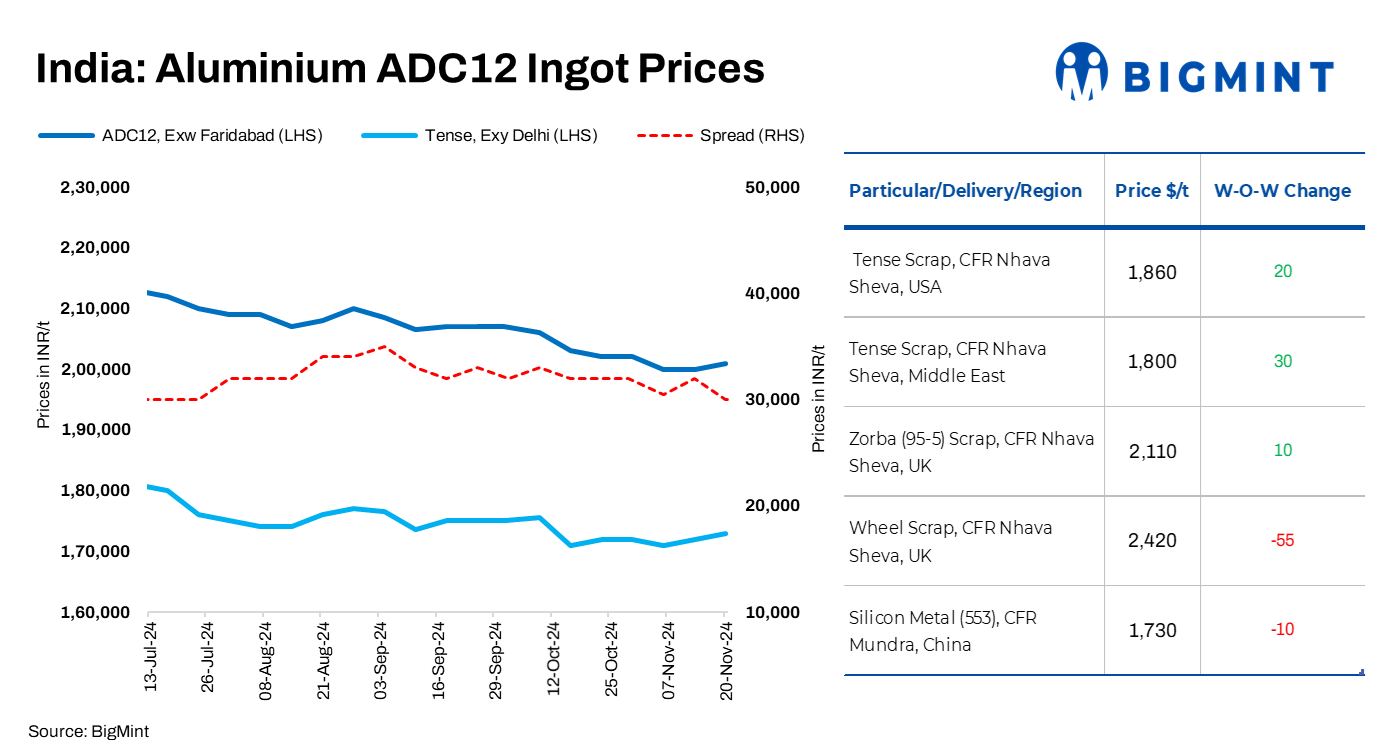

BigMint's benchmark assessments for ADC12 (non-OEM) grade stood at INR 201,000/tonne (t) in Delhi and INR 203,000/t in Chennai, up by INR 1,000/t ($12/t) w-o-w.

Meanwhile, three-month London Metal Exchange (LME) aluminium prices increased by 5 per cent w-o-w to around $2,677/t, with stocks at LME-registered warehouses declining by 1 per cent.

In line with the increase in LME aluminium prices, both imported and domestic aluminium scrap tags rose w-o-w, leading to a slight increase in ADC12 prices in the Delhi and Chennai regions.

The current scrap-to-semi-finished spread stands at INR 28,000-29,000/t, stable w-o-w.

Major automaker's Dec'24 ADC12 prices hit 9-month low

A prominent automobile manufacturer announced its ADC12 prices for December 2024 settlements at INR 209,000/t, reflecting a marginal reduction of INR 900/t from November's price of INR 209,900/t. This marks the lowest price seen in nine months, with similar levels last recorded in March 2024. The decline is primarily attributed to persistent sluggish demand in the automobile sector.

An alloy ingot manufacturer informed BigMint, "If the leading automobile manufacturer reduces prices further, it will harm alloy ingot producers, as the price gap between tense and ADC12 will narrow, putting pressure on profit margins. Many alloy manufacturers are already facing losses, and this could lead to the closure of small and medium-scale producers."

Global ADC12 market faces weak demand

The ADC12 export market has also been underperforming due to weak demand globally. However, according to market sources, China has been actively importing aluminium ADC12 ingots, especially from Thailand, due to lower prices and duty exemptions.

China's aluminium alloy production increased by 9 per cent y-o-y to 1.41 million tonnes (mnt) in October. In the first 10 months of 2024, aluminium alloy output rose 8.7 per cent y-o-y to 13.22 mnt. This growth comes amid a general rise in China's aluminium production, with primary aluminium and alumina also showing y-o-y output increases.

Imported raw material prices inch up w-o-w

Prices of the basic raw material for aluminium alloys, that is, scrap edged up, w-o-w. BigMint's assessment for tense scrap originating from the UAE was at $1,800/t CFR Nhava Sheva, up by $30/t. Meanwhile, zorba 95/5 from the UK rose by $10/t to $2,110/t, CFR west coast, India.

The price hikes follow the Chinese finance ministry's proposal of export tax rebate cuts on aluminium and copper semi-finished products. Effective December 1, 2024, the rate is expected to be cut to nil from 13 per cent. The announcement sparked a jump in aluminium prices on the LME.

Domestic scrap prices stable

In the domestic market, tense scrap prices edged up by INR 1,000/t w-o-w in both Delhi and Chennai. According to BigMint's assessment, domestic tense scrap stood at INR 173,000/t ex-Delhi NCR and INR 174,000/t ex-Chennai.

China's silicon prices remain stable

According to BigMint's assessment, prices of China's 553-grade silicon remained largely stable w-o-w at $1,730/t CFR Mundra. Meanwhile, offers from the suppliers' side were at $1,760-1,770/t. However, bids were heard lower, at $1,710-1,720/t.

Freights from China to Mundra were heard at around $2,000-2,300 per 20 ft container.

Outlook

Aluminium alloy ADC12 prices are expected to stay within a narrow range in the near term. However, price announcements from leading automobile manufacturers should be monitored for further clarity on market trends. Overseas demand for ADC12 is likely to remain slow due to the upcoming winter holidays.

Received under the content exchange agreement with BIGMINT

Top image credit: Tradekorea.com

This news is also available on our App 'AlCircle News' Android | iOS